Depending on what went wrong, different measures can be followed when a broker loses their license. The brokerage firm could be promptly dissolved if the broker is charged with fraud or guilty of scamming its clients. Depending on the country where the broker is located, the government may offer insurance to protect the cash stored by the brokerage and enable reimbursement for harmed clients. In certain situations, another financial institution might occasionally agree to purchase those assets and move customer accounts to the new business without much disruption.

While a brokerage may stop operating after losing its licence, this is not the sole option. If a broker loses its licence in one jurisdiction, it can continue to operate as an unlicensed offshore firm or apply for a new licence in another. In 2022, Union Standard International lost its FCA licence but continued to operate from a St. Vincent and the Grenadines-registered office under the terms of an offshore licence.

You might only be aware if an online broker chooses to continue operating under an offshore licence after losing its licence. Keep an eye on WikiFX as we timely update the profiles of forex brokers. We also regularly reveal brokers that claim licenses which they do not have anymore.

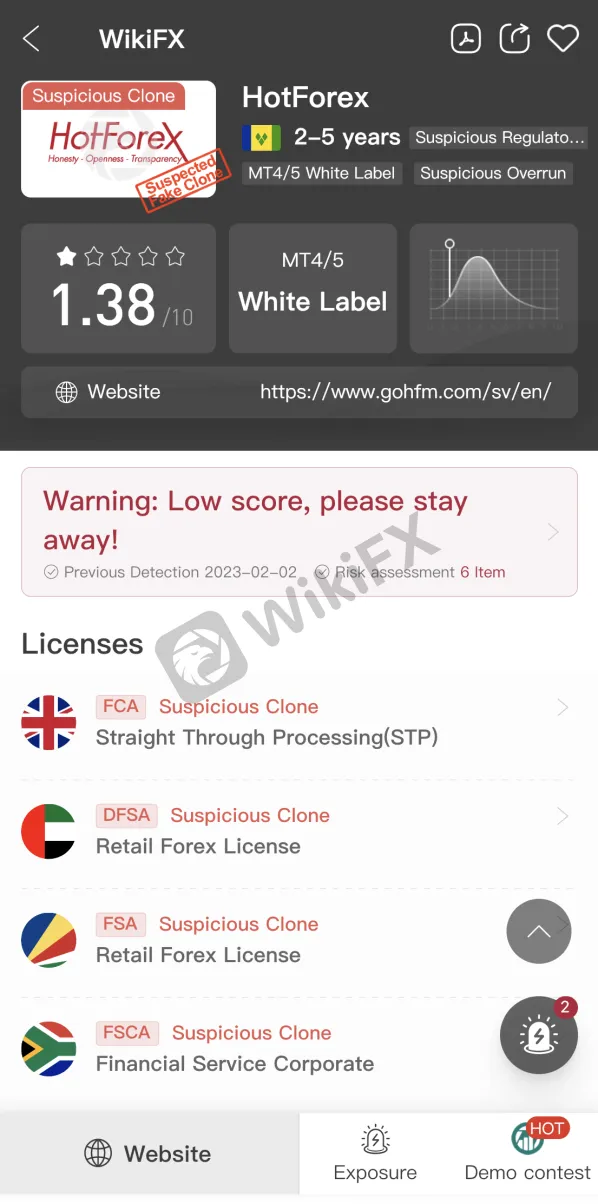

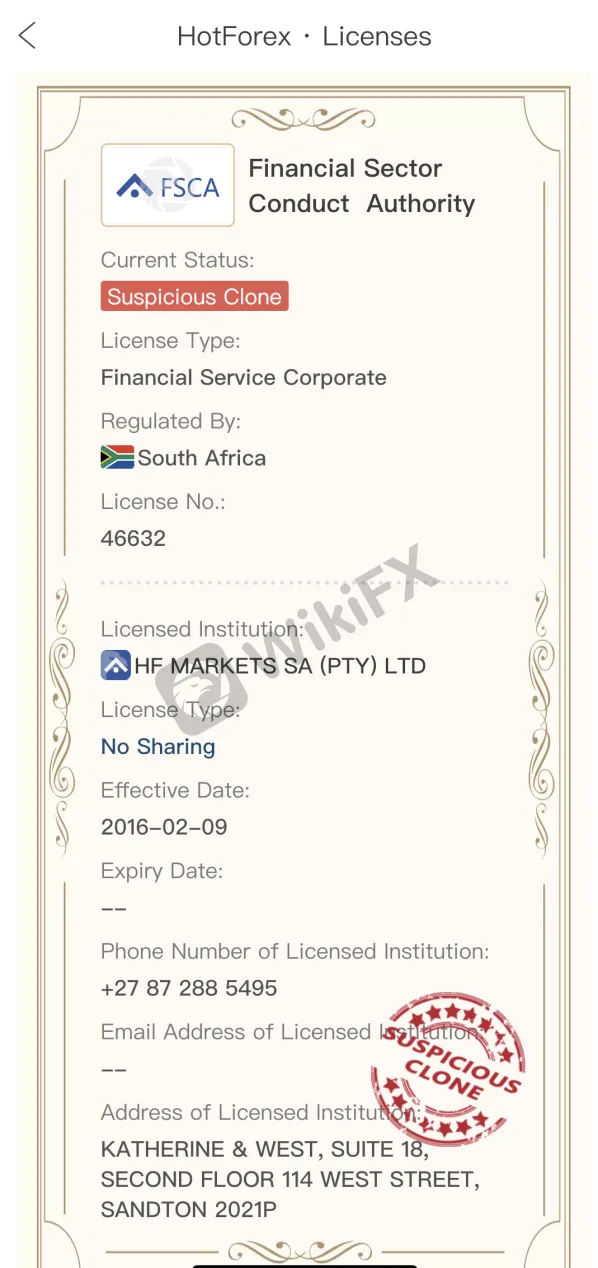

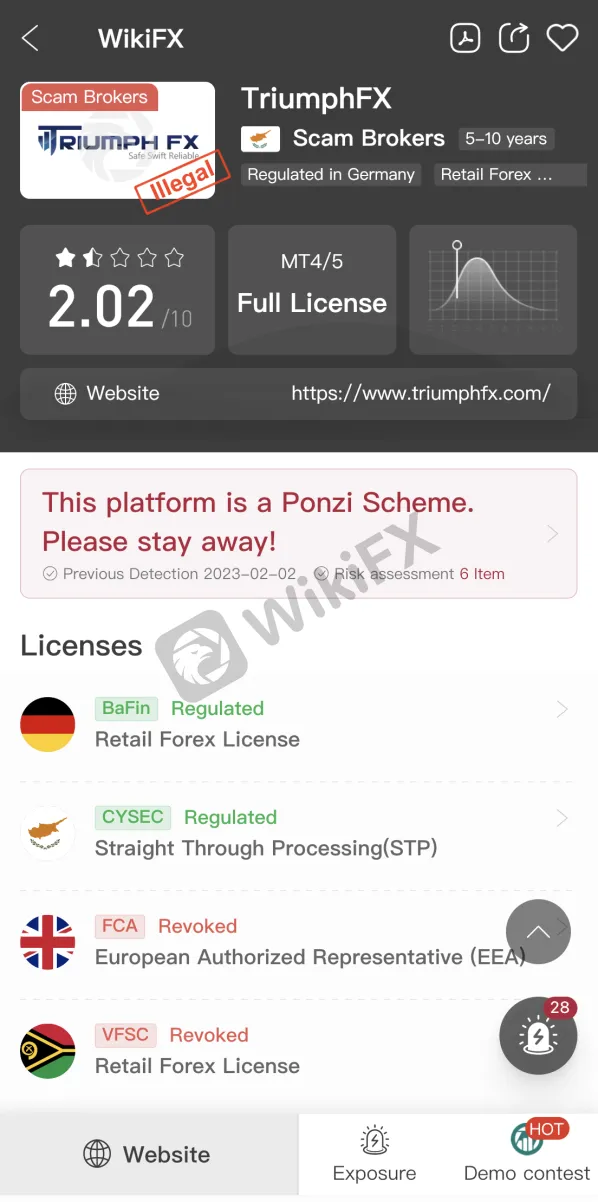

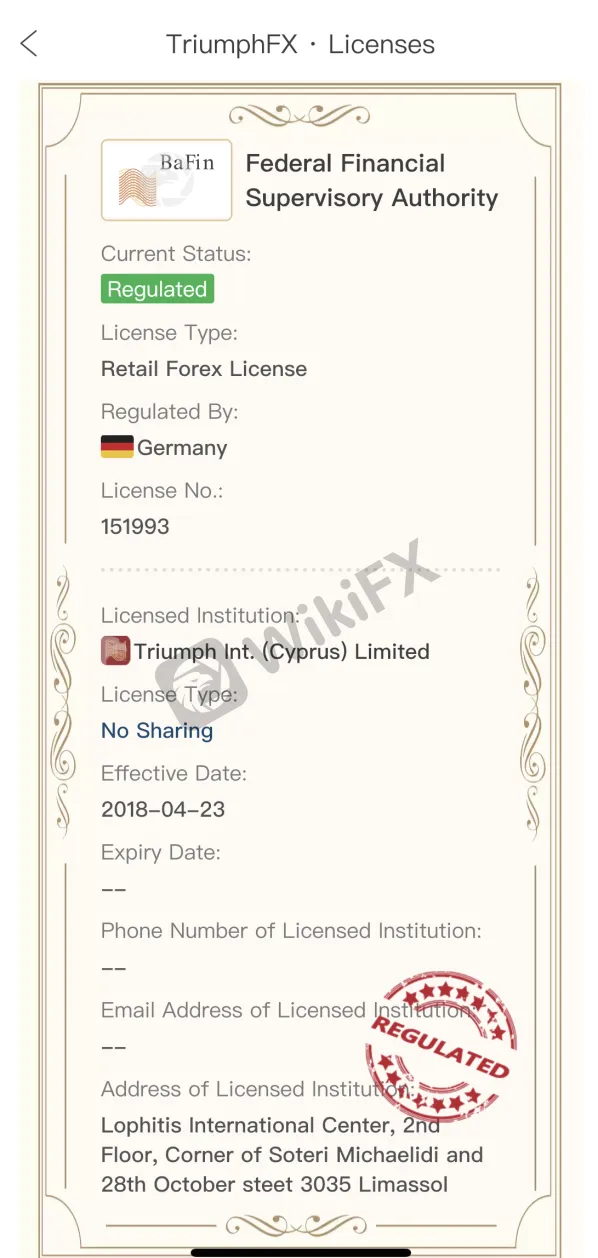

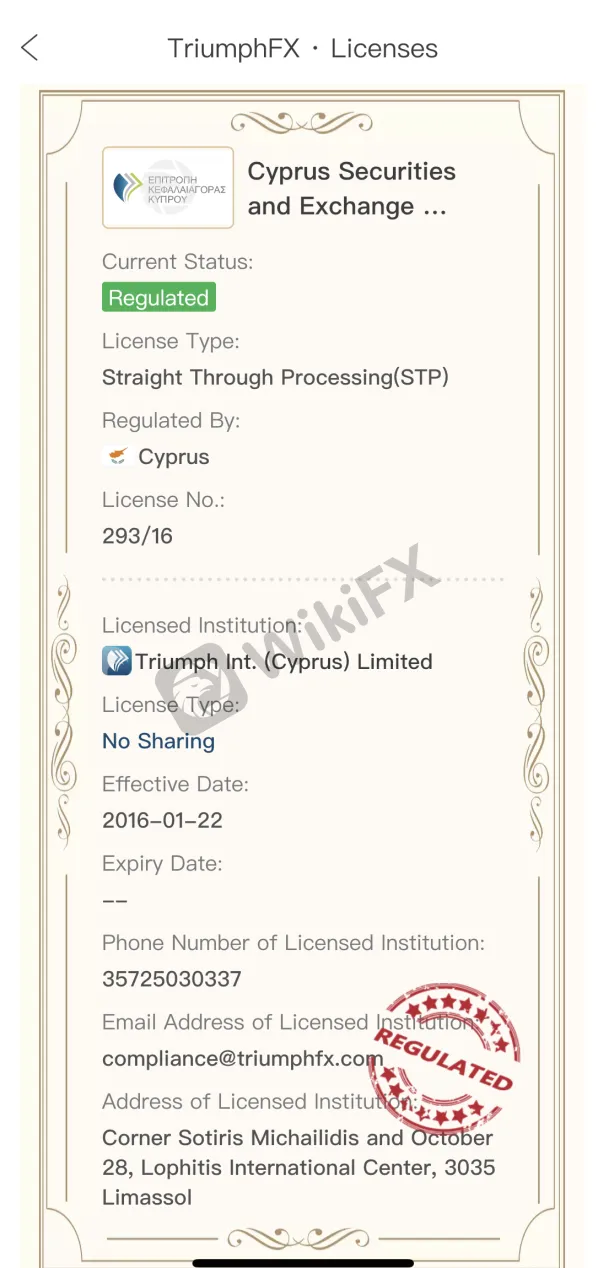

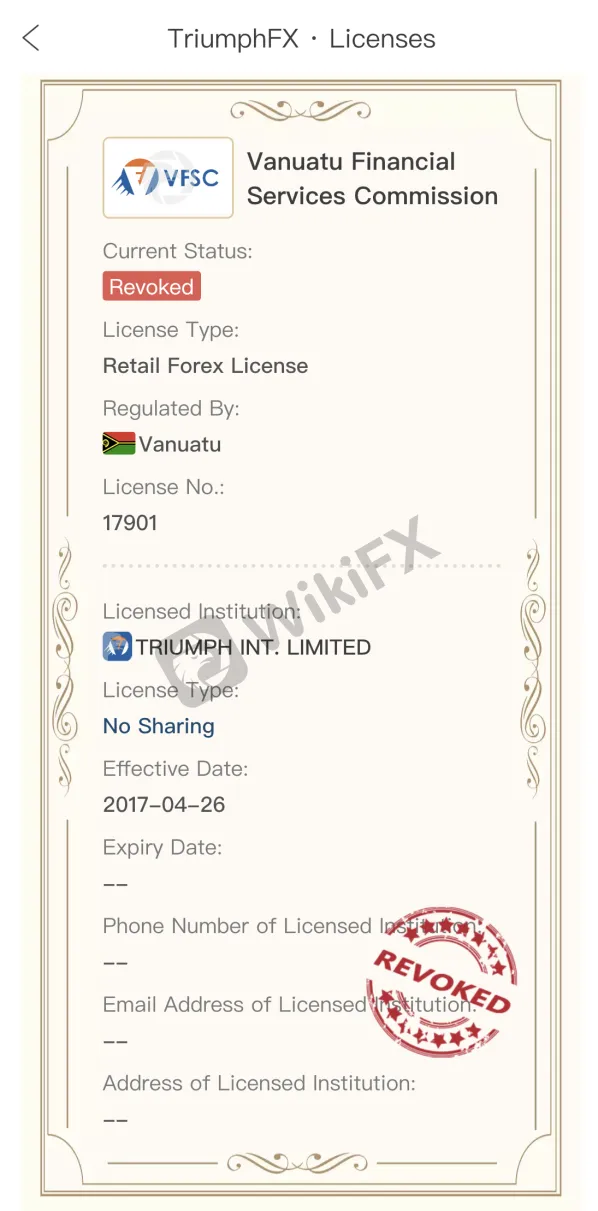

To illustrate how self-explanatory the WikiFX app is, here are 3 forex broker profiles and their respective licenses:

Broker 1:

Broker 2:

Broker 3:

Why Are Brokers' Licenses Taken Away?

Each regulated forex broker must abide by a set of rules set by its regulatory body. Additionally, they must consent to yearly evaluations and audits of their business practices to ensure continued compliance with all applicable laws and standards. As part of their onboarding procedures, forex brokers must abide by the contracts they enter into with each trading client. The revocation of a licence is possible if any rules or regulations are broken.

Brokers must abide by the laws and regulations of the nation in which they are based and the guidelines established by the national regulator issuing a licence. Even if a broker initially establishes itself as adhering to all applicable laws, if it later ceases to do so, its licence may be cancelled. Therefore, to ensure that the businesses to whom they issue licences are still compliant, national authorities should regularly monitor them.

Laws have certain similarities, even though they differ from nation to nation. Forex brokers' requirement to maintain sufficient liquidity to cover client investments is a fundamental aspect of forex regulation in several jurisdictions. In accordance with fair representation laws, all forex brokers must disclose all potential risks associated with forex trading. They cannot promise or guarantee that traders will make a profit or receive a specific rate of return on their investment.

Due to safety reasons, it is imperative that you only deal with authorised brokers. Always confirm the regulatory status of the broker you're using before signing up with them, and keep an eye on the situation to ensure nothing changes.

Leave a Reply