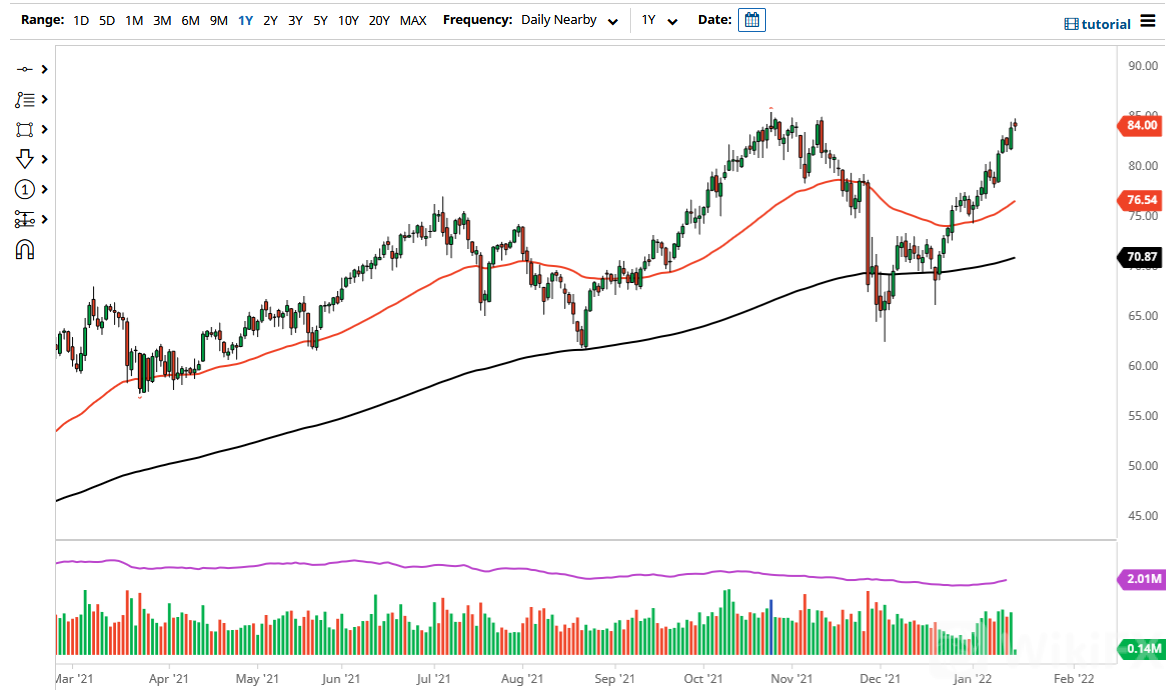

The West Texas Intermediate Crude Oil market initially gapped higher on Monday, which was Martin Luther King Jr. Day in the United States. This is a market that continues to see a lot of bullish pressure and I simply just do not see that changing anytime soon. That being said, the market is very likely to continue to see plenty of buyers underneath and I think that continues to be the main theme here.

Underneath, I see the $80 level underneath offering quite a bit of support, as it has been important multiple times in the past and is a large, round, psychologically significant figure. I think that pullbacks at this point will continue to be thought of as a value proposition in what has been a very strong market, and perhaps even a little overbought. I do believe that we will break the highs above the $85 level and continue to go much higher. I have no interest in shorting because I believe that the crude oil market will continue to be lifted by OPEC+ not been able to pump out what it had suggested it was going to. Not only that, we have to take a look at the world reopening after the coronavirus scare of the omicron variant has come and gone.

Even if we do get a significant breakdown, the reality is that the 50 day EMA down at the $76.42 level is starting to curl higher and will offer dynamic support. Hedge funds are piling into the crude oil markets, so I think we will continue to see a lot of that behavior going forward, simply because one of the few things that will perform in an inflationary environment is energy. With that in mind, keep in mind that there is a lot of “groupthink” on Wall Street so that should continue to push this market higher. That does not necessarily mean that we will take off right away, and we are her stretched at the moment, so looking for value makes sense. Having said that, if we were to take off and break out to the upside, one would have to think this is more of a “buy-and-hold” type of situation.

Leave a Reply