If you want to know whether Admiral Markets is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of Admiral Markets based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 34,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether Admiral Markets is a scammer or not, we evaluated this broker from different aspects, such as regulatory status, exposure, etc.

Table of Contents

1. Evaluate the reliability of Admiral Markets based on its general information and regulatory status.

A. General Information of Admiral Markets

B. Regulatory Status

2. The feedback from Twitter

3. Exposure related to Admiral Markets on WikiFX

4. Special survey about Admiral Markets from WikiFX

A. Scoring Criteria

B. Field Investigation

C. WikiFX Alert

5. Conclusion

1. Evaluate the reliability of Admiral Markets based on its general information and regulatory status

To understand Admiral Markets better, we explore Admiral Markets by analyzing three main perspectives:

A. General Info of Admiral Markets

B. Regulatory Status

C. Fund Security

A. General Info of Admiral Markets

Admiral Markets general info has been shown below:

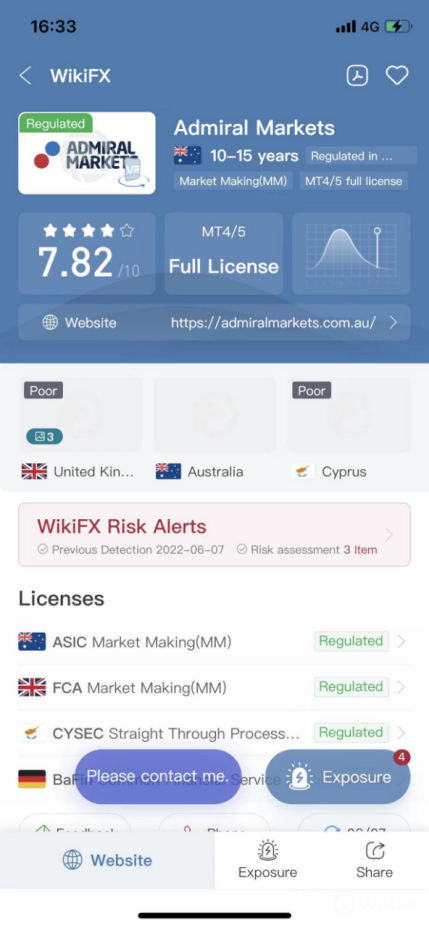

(source: WikiFX)

About Admiral Markets

Founded in 2001, Admiral Markets, also called Admirals, is an online forex brokerage company offering financial services to its clients across the globe. Admiral Markets offers a large range of market instruments, including Forex, Commodities, Indices, Stocks, ETFs, Bonds, Cryptocurrencies, etc.

Trading Platform

This broker uses the MT4 and the MT5 as the main trading platforms. Admiral Markets offers a flexible trading leverage mechanism. Retail traders only can choose pretty conservative leverage ratio, from 1:20 to 1:30, while wholesale clients can enjoy a significant increase in leverage ratio, which is up to 1:500. Please keep in mind that leverage can amplify returns but also risks.

Spread & Commissions

Trade MT5 account spreads start at 0.5, handling fees for single stocks and ETF CFDs-starting at $0.01 per share, no commission; Zero MT5 account spreads starting at 0, forex and precious metals-$1.8 to $3.0 per 1.0 lot, cash index-0.05 per 1.0 lot To $3.0, energy-$1 per 1.0 lot. Trade.MT4 spreads from 0.5, single stocks and ETF CFDs-from 0.01 USD per share, no commission; Zero.MT4 spreads from 0, forex and precious metals-1.8 to 3.0 USD per 1.0 lot, cash index-0.05 to 3.0 per 1.0 lot USD, energy-1 USD per 1.0 lot.

Trading Hours

Admiral Markets follow standard market trading hours. Specific opening and closing hours depend on the instrument traded but usually run from Monday to Friday, although cryptocurrency is traded in decent volumes over the weekend. The Admiral Markets Group does run a reduced schedule during certain bank holidays. Changes to trading hours, including respective time zones, are published on the brokers website.

B. Regulatory Status

What is Legitimate License?

-

The legitimate license is the business license issued by the financial regulatory institution of each country/region.

-

Holding a license means that the broker is recognized and regulated by the regulatory authority, therefore your money is under the protection to some extent.

-

Whether a forex brokerage firm holds a legitimate license or not is one of the important factors to evaluate the reliability of forex brokers.

-

The content of the regulation and the difficulty of obtaining a license vary with the country and agency issuing the license.

The legitimate license of Admiral Markets

Admiral Markets is a regulated broker. It was regulated by ASIC with license number: 410681 and FCA with license number: 595450. It was also regulated by CySEC with license number: 201/13.

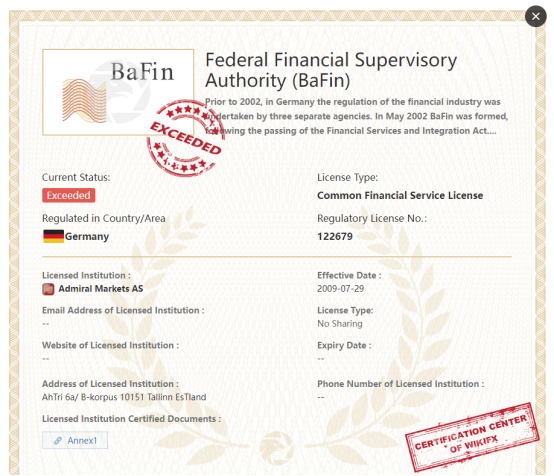

However, Admiral Markets exceeds the business scope regulated by Germany BaFin(license number: 122679)

(source : WikiFX)

2. The feedback from Twitter

To figure out whether Admiral Markets is a scam or not, we did a survey about this broker on Twitter.

Reviews on Twitter:

-

Admiral Markets used to have an official account on Twitter. But now it is unavailable.

-

It is hard to find negative feedback related to this broker on Twitter.

3. Exposure related to Admiral Markets on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

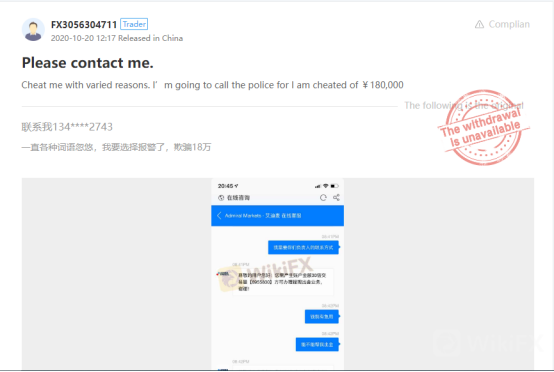

This trader claimed that Admiral Markets was a scam. He/she lost a lot of money by investing in this broker.

(source:WikiFX)

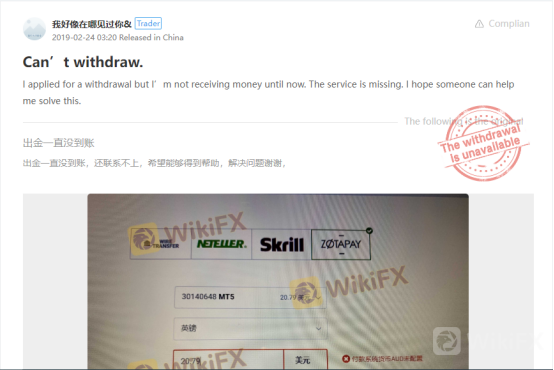

This trader applied for the withdrawal but he/she did not receive a refund. This trader is seeking WikiFX for help.

4. Special survey about Admiral Markets from WikiFX

A. Scoring Criteria

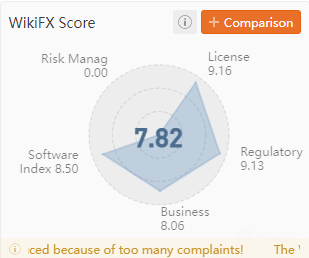

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments etc |

| Risk Management index: the degree of asset security |

Admiral Markets has been given by WikiFX a decent rating of 7.82/10.

(source:WikiFX)

According to the above, it seems that Admiral Markets is very poor at risk management. Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events. Admiral Markets seems not to have enough capital and good strategies to secure clients assets in the unstable market.

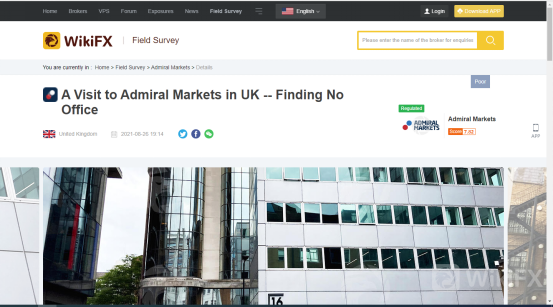

B. Field Investigation

-

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

-

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

-

WikiFX did make an on-site survey on Admiral Markets in August 2021 and successfully found their office.

(source:WikiFX)

C. WikiFX Alerts

(source:WikiFX)

5. Conclusion:

It is no doubt that Admiral Markets is a solid and regulated broker. In general, its fantastic all-around experience contributes to its unshakable status. However, the score of this broker on WikiFX has been reduced due to too many complaints. We advise you to be aware of the potential risks. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself. If you have any problems with this broker, please do not hesitate to contact WikiFX. The global customer service of WikiFX is +234-706 777 7762 on WhatsApp. Or you can call +65-31290538. We are willing and ready to help you out.

Click on Admiral Markets' WikiFX page for details

Leave a Reply