The global economy is entering a phase of inflationary risk, the IMF warned on Tuesday, as it called on central banks to be “very, very vigilant” and take early action to tighten monetary policy should price pressures prove persistent.

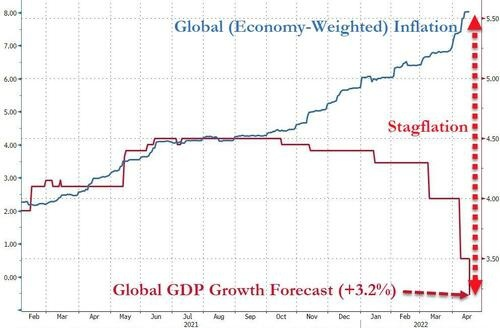

It can be recalled that, over the last couple of days both the IMF and World Bank have heavily downgraded global economic growth forecasts whilst both acknowledging and, ironically proposing to fuel more inflation with more stimulation. Hello stagflation…

Initially The World Bank slashed its 2022 global growth by 22% from 4.1% to 3.2% (for context 2021 saw 5.7%). President David Malpass proposed a $170 billion, 15 months long ‘crisis response package’, with nearly a third of that deployed in just the next 3 months.

“”This is a continued, massive crisis response given the continuation of the crisis,“ he said, adding that the new initiative will exceed the $157 billion mobilized for the initial phase of the Covid-19 pandemic.”

Let us remind you of the inflation such reckless money pumping as already unleashed and the stagflationary alligator trap is presents.

According to the statement released by IMF saying In the matter of a few weeks, the world has yet again experienced a major, transformative shock,‘’ IMF chief economist Pierre-Olivier Gourinchas wrote in the foreword to the funds World Economic Outlook report. He continued

“Just as a durable recovery from the pandemic-induced global economic collapse appeared in sight, the war has created the very real prospect that a large part of the recent gains will be erased.”

Similar to The World Bank they revised their projection for global growth downwards to 3.6% for both 2022 and 2023, down from the 4.4% growth it had expected for 2022 just 3 months ago.

And they proceed to warn that“The effects of the war will propagate far and wide, adding to price pressures and exacerbating significant policy challenges.”

“the risk is rising that inflation expectations drift away from central bank inflation targets, prompting a more aggressive tightening response from policymakers. Furthermore, increases in food and fuel prices may also significantly increase the prospect of social unrest in poorer countries.”

And possibly most concerningly the warn the war “increases the risk of a more permanent fragmentation of the world economy into geopolitical blocks with distinct technology standards, cross-border payment systems, and reserve currencies. Such a tectonic shift would cause long-run efficiency losses, increase volatility and represent a major challenge to the rules-based framework that has governed international and economic relations for the last 75 years.”

There is one monetary asset that has survived, and indeed thrived in, the test of time amid such monetary and geopolitical tectonic upheavals.

Leave a Reply