Speaking of TriumphFX, as a foreign exchange fund certified by SkyEye, it is naturally updated every month. However, as a common problem for fund users, as long as the foreign exchange plate does not crash and run away, they will not give up actively. The same is true for users of TriumphFX. Recently, there have been more “rumors” about TriumphFX Dehui, and the hearts of platform users have begun to shake. Today, Tianyan will interpret the “TriumphFX Dehui” in detail, and explain why the platform of TriumphFX cannot be selected. !

Supervise full license?

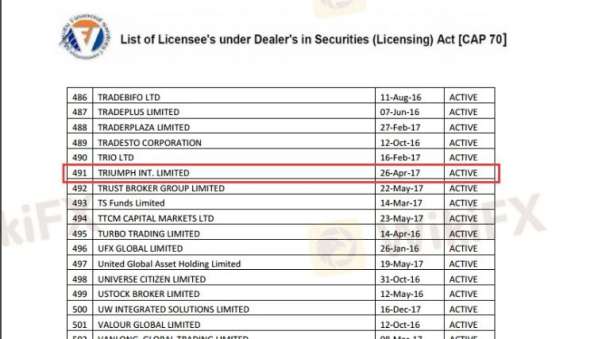

TriumphFX has always claimed to be a fully licensed foreign exchange main standard dealer. It has a British FCA license, a Cyprus direct license, a German retail foreign exchange license and a Vanuatu retail foreign exchange license. First, check TriumphFX on the Forex Eye, and claim that it holds four licenses, of which the FCA EU license and Vanuatu retail foreign exchange license have been revoked.

The German retail foreign exchange licenses and Cyprus direct licenses that are still under supervision, through the supervision of the official website, the licensees are Triumph Int. (Cyprus) Limited.

Before Tianyanjun said that you must open an account and register under the name of a company that holds a license in order to be protected by a license. And is Triumph FX's domestic user account opened under Triumph Int. (Cyprus) Limited? Obviously not. According to the display at the bottom of the official website of Dehui, all accounts opened at Triumph Int. Limited.

However, Triumph Int. Limited only has the retail foreign exchange license of Vanuatu. Unfortunately, it has been revoked, and it is still on the warning list of the regulator, which is a real fraud!

If you still don't believe that you can directly look at the Dehui MT4 server, you can directly see that it is Triumph Int. Limited, not Triumph Int. (Cyprus) Limited, which means that Dehui does have a Cyprus and German license, but the account you open an account is Under Triumph Int. Limited, a company that is not regulated, it is also not protected by regulation.

What is even more embarrassing is that Dehui has been promoting Triumph Int. Limited, a company registered in Vanuatu, that has been shown to be dissolved , and the dissolution time is May 21, 2021, but the Chinese official website of Dehui is still normal. State of operation!

Why is the Vanuatu company registered by Dehui for domestic users cancelled, but the user's business is not affected? This is mainly attributable to the fact that there are two Triumph Int. Limited in Dehui. At the bottom of its official website , it has been stated that one is registered in the British Virgin Islands and the other is Vanuatu.

Now the Vanuatu company has been cancelled, and users have not been affected. It is conceivable that they opened an account in Triumph Int. Limited in the British Virgin Islands, and this company is indeed without any supervision!

Especially on August 5th, the Financial Supervisory Authority of Singapore issued an “Investor Warning List” on TriumphFX, indicating that the content updated on its official website (English address website) was wrong-TriumphFX did not receive MAS at all. Supervision.

Today, Dehui has become the target of warnings from many regulatory agencies. Even if it still holds several regulatory licenses, but does not have a company that opens accounts for domestic users under its supervision, Sima Zhao's heart can be seen!

No brokerage platform?

A closer look at the promotional materials of TriumphFX, and you can find that there is no brokerage firm with TriumphFX at all. This means that TriumphFX is its own custodian and brokerage platform. In the foreign exchange industry, it is originally stipulated that the foreign exchange broker and the custodian cannot be the same company. If they are the same company, it means that the entire transaction process is determined by Dehui. If you do something in it, the user does not know at all. It's like the Putun foreign exchange before, but it's such a routine!

Furthermore, referring to the regulatory licenses that Dehuis claims to hold, the regulators of these licenses have long made it clear that platforms cannot access user funds by themselves, let alone provide trading guidance or trading, but Dehuis dare to do so. This shows What happened? It shows that Dehui's regulatory license does not work on it at all! Fearless!

6%-15% trading income?

Presumably, it is this attractive trading income that is attracted by Dehui. Dehui claims that the user's monthly income can reach 6% to 15%, and taking 1,000 warehouses as an example, the average monthly income can reach 8%, which is simply Even lying at home can make a lot of money. Although there is indeed a certain possibility of “getting rich” in foreign exchange, this is where foreign exchange attracts investors, but it must be down-to-earth and choose a reliable and safe formal platform to complete it. This way, the high returns of unregulated black platforms can only be achieved. It's a blinding trick that draws you into the trap.

Let's talk about why Dehui is called a capital market, because Dehui has a multi-level pulling head model. Through direct deposits, you can get spread commissions and profit dividends. The more recommended people, the more generous the rewards. A typical MLM model.

The foreign exchange fund plate always packs itself with a gorgeous appearance. In the early stage, it uses various regulatory licenses, a tall company environment or a professional trading environment, but the essence of MLM begins to be exposed in the later stage, and by this time you dare to enter the market. Funding, that can only be a sad “receiver”!

Leave a Reply