Crude oil prices typically fluctuate based on seasonal demand and supply. Most recently, the COVID-19 pandemic caused crude price changes through a drop in demand. While economic recovery is underway, oil prices continue to be affected by global uncertainties.

There are two grades of crude oil used as benchmarks for other oil prices: the West Texas Intermediate (WTI) at Cushing and North Sea Brent. WTI at Cushing comes from the U.S. and is the benchmark for U.S. oil prices. North Sea Brent oil comes from Northwest Europe and is the benchmark for international oil prices. Oil prices fall on news that OPEC may cut Russia out of the output alliance amid an EU ban on Russias 90% exports, which could cause Russia to substantially reduce its oil production.

According to Financial Times, Saudi Arabia indicated raising output to compensate supply shortage in Russia. The OPEC + will meet later today to discuss the joint output plan for next month. Traders took profit on the recent price rally and expect a potential material impact on the oil markets if the alliance confirms an output increase.

Chart 1 – Crude Oil Texas – Cash, Daily (CMC Markets NG)

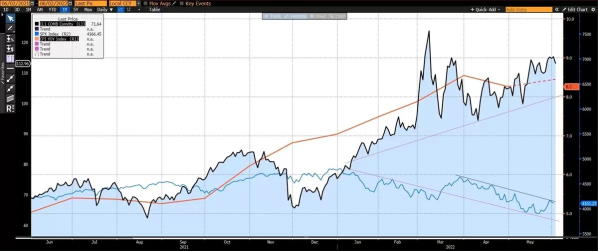

Looking at the above chart, oil retreated from the recent high at above 120, falling off the channel resistance, and heading to the 20-day MA at around 110.40 -111.36. The bearish fundamental factor may continue to send the oil price even lower to test further pivotal support at 107.17, the 50-day MA, also the long-term ascending trendline support. The short-term day resistance is at the 10-day MA, around 114.50. But we cannot confirm a major bearish breakout to the long-term descending trendline just yet, it all depends on how the macro picture plays out.

Chart -2 COMB WTI Futures (Black line) vs. SPX Index (Blue Line) vs. US CPI YOY Index (Red Line) 1 year

Leave a Reply