Veteran forex broker Alpari UK was hit by the serious impact of the CHF abolition and went bankrupt in January 2015, resulting in a large number of customer accounts suffering from huge losses when the company finally filed for bankruptcy. Its liquidation team KPMG took more than 2 years to finally release the last batch of customer compensation funds in recent days. Customers were compensated with funds at a rate of 82 cents per dollar restored.

There are 2 main reasons for foreign exchange brokers to file for bankruptcy.

1) The company's necessary capital shortage

Foreign exchange brokers must be regulated by the local and operating markets, and the premise of the license is that its operating capital must meet regulatory requirements. Each regulatory jurisdiction has different minimum capital requirements, which are mainly used to demonstrate the broker's ability to maintain long-term operations. In addition, this capital protects the broker from going out of business if it faces significant losses.

For example, the minimum regulatory capital requirement is $20 million in the United States and no less than 1 million AUD in Australia. However, one sudden and sharp fluctuation in the foreign exchange market can cause a broker to suffer a huge loss. In addition, margin calls from liquidity providers can result in brokers being forced to file for bankruptcy as their funds are quickly withdrawn.

2) Brokers being slapped with lawsuits

Forex brokers could be sued by their clients for a few reasons. The two most common situations are when forex brokers engaged in fraudulent practices and account managers perform acts that are not in the interests of their clients.

When a forex broker files for bankruptcy and goes bust, their assets become untouchable. No liquidity providers nor clients can claim their money anymore. Most traders trading capital would be stuck in their accounts because they were not allowed to make any withdrawals until the final settlement. Some brokers may eventually return the funds but some brokers just disappear into thin air, especially the ones that do not have a credible setup, to begin with – that is unregulated, unlicensed with no official business premises.

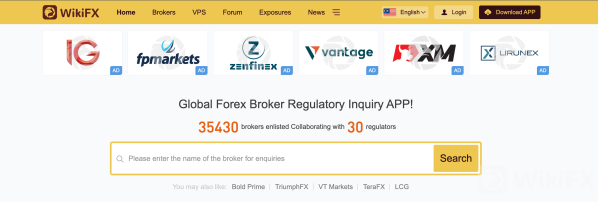

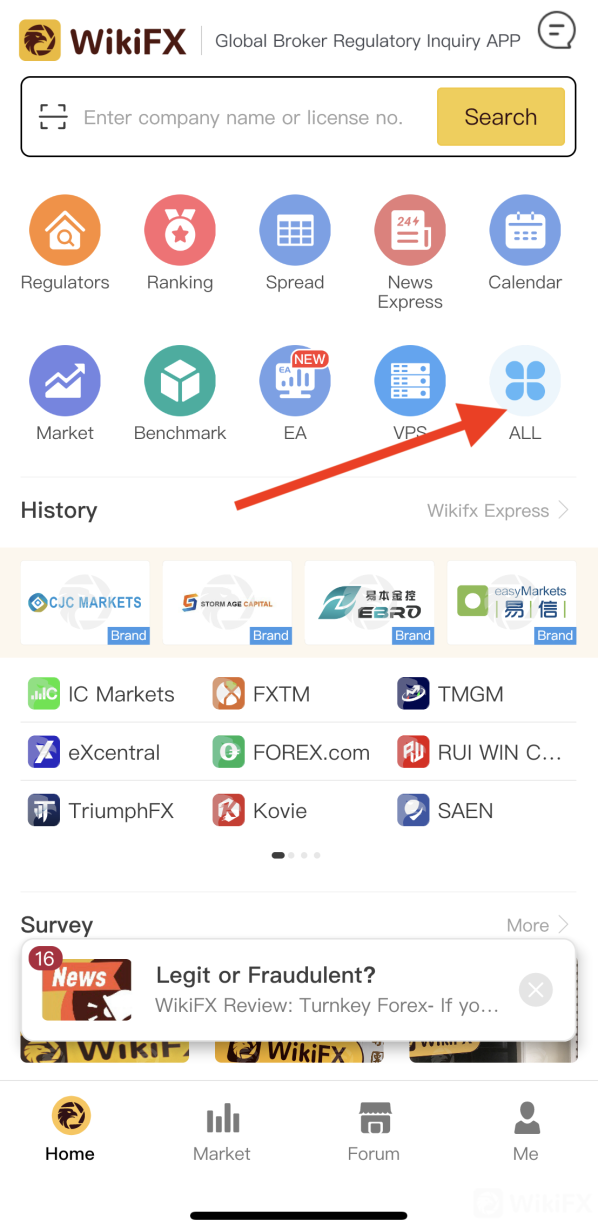

WikiFX is a global broker regulatory inquiry app that holds information of over 35,000 forex brokers in collaboration with 30 national regulators. Here, traders can find verified details of a certain forex broker before engaging with them. Visit WikiFX's official website at www.wikifx.com.

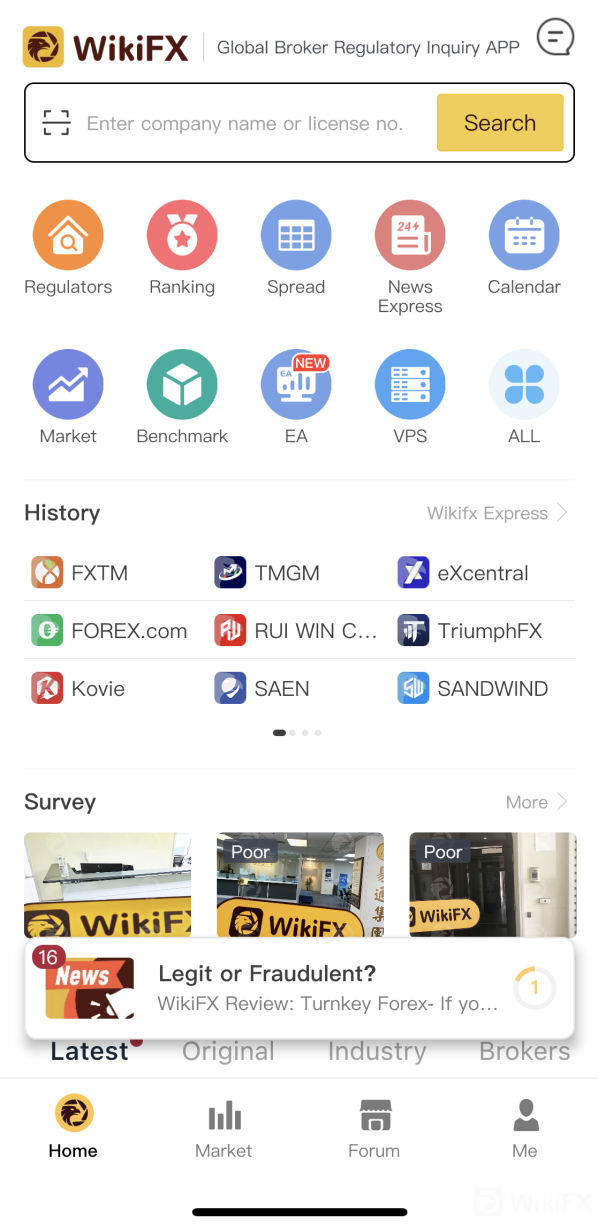

Alternatively, download the free WikiFX app on Google Play/App Store.

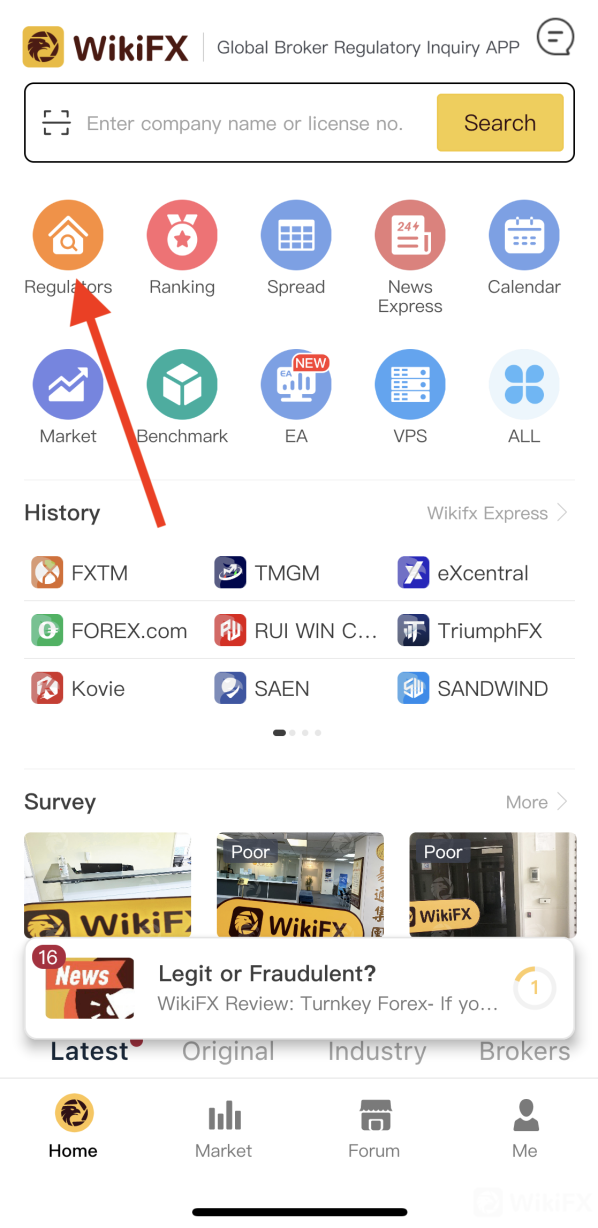

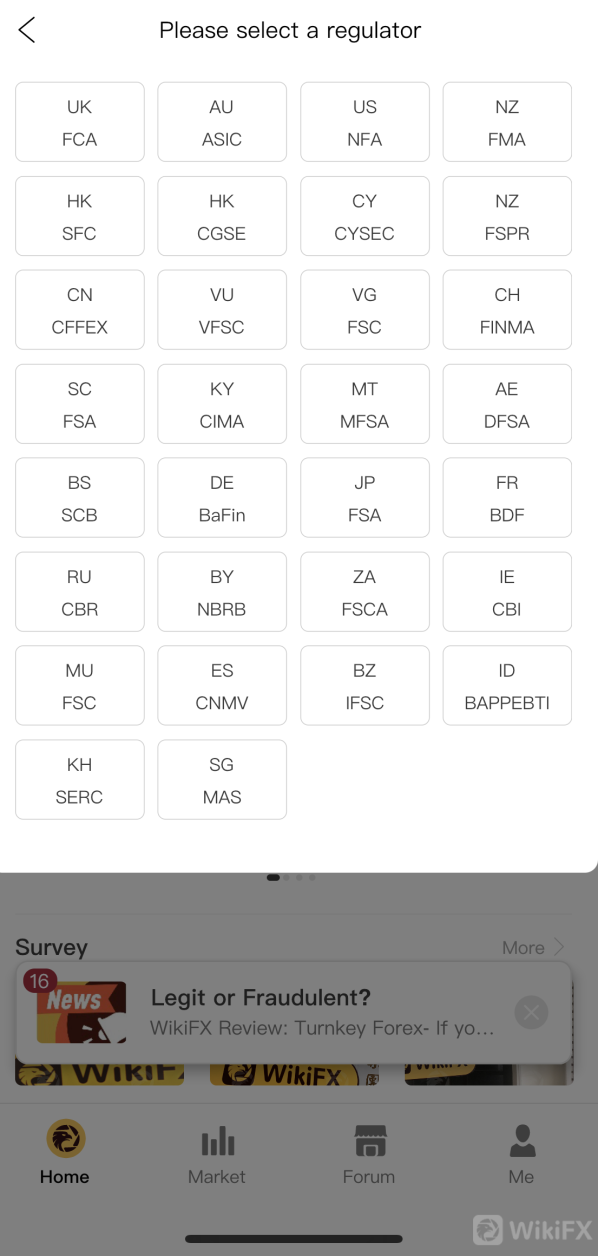

Click on “Regulators” in the mobile app.

Here is a comprehensive list of regulators categorized according to respective countries.

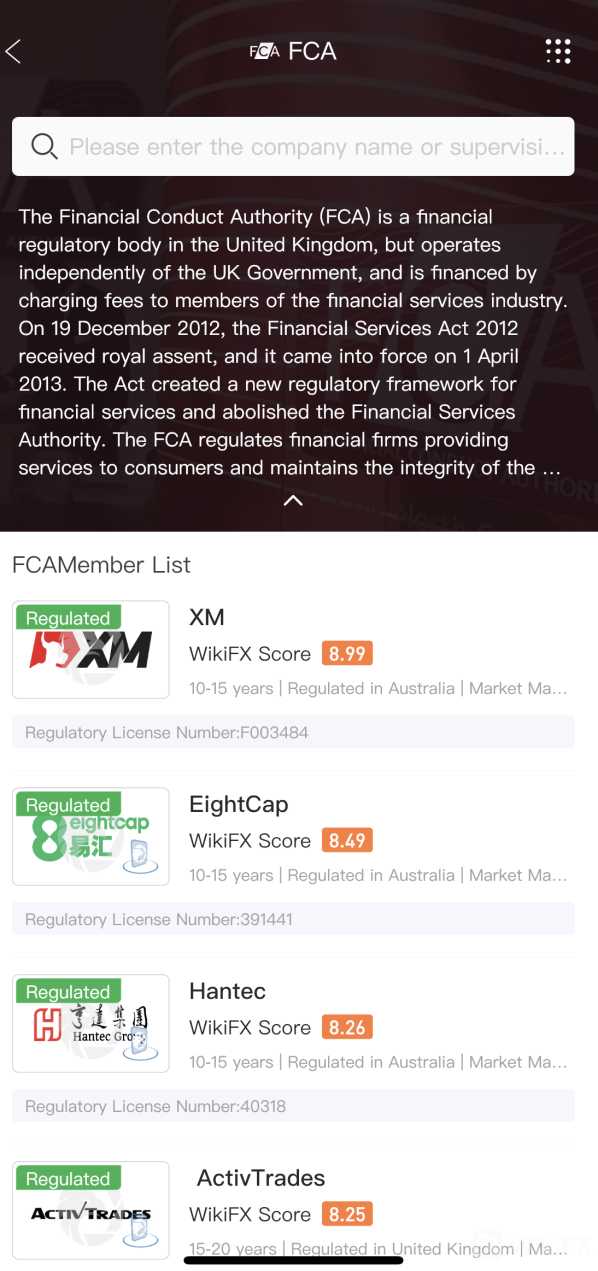

The FCA (Financial Conduct Authority) is a regulatory body of the United Kingdom.

On the other hand, the Australian Securities and Investments Commission (ASIC) is Australias main corporate regulator.

From the two photos above, WikiFX demonstrates the top-ranking brokers of each country.

If you are a trader looking for a credible broker to entrust your trading capital with, it is encouraged to always go for a broker with a high WikiFX score and ranking. This means that the broker has been verified by WikiFX from the rating rules in terms of:

-

License index

-

Business index

-

Risk management index

-

Software index

-

Regulatory index

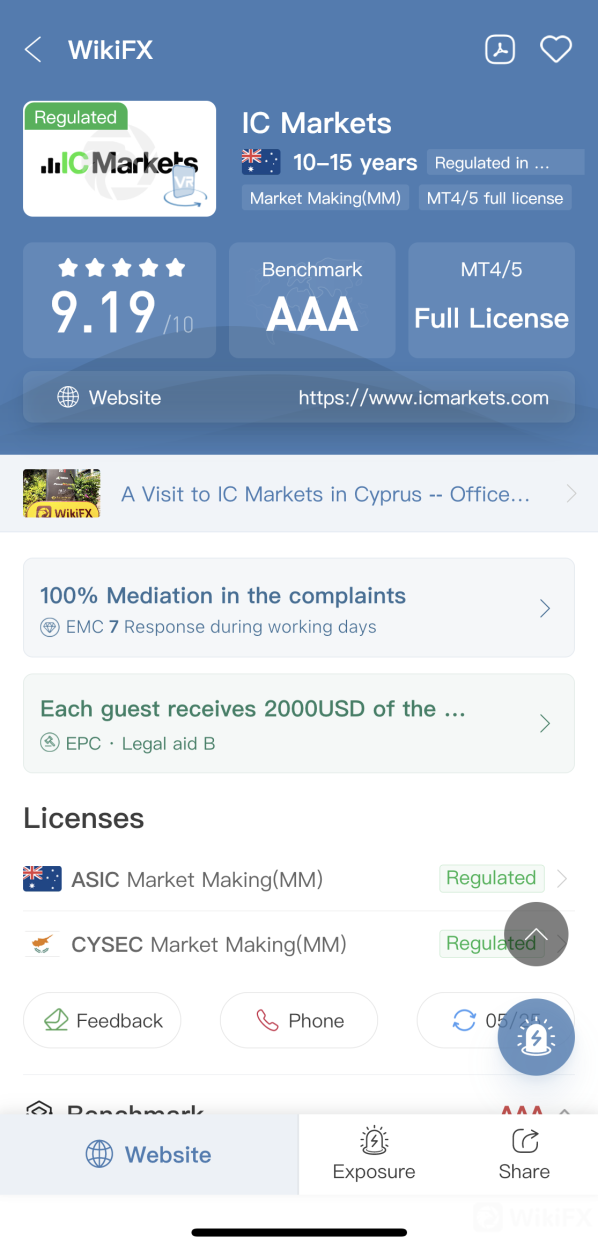

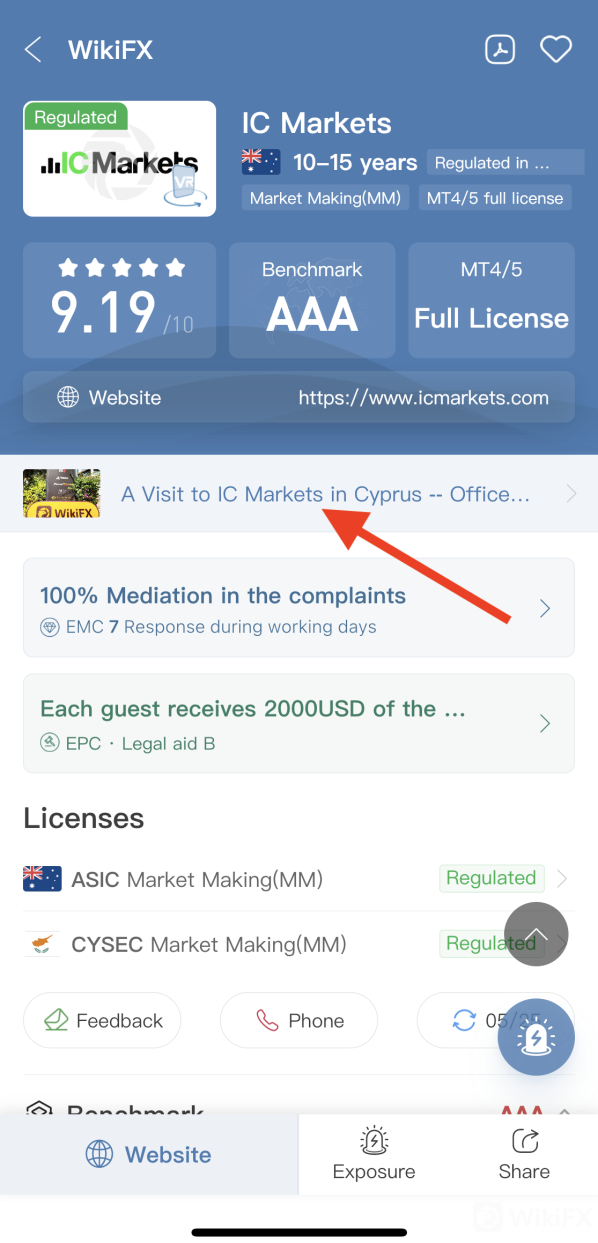

Taking IC Markets as an example, this forex broker is regulated and has verified licenses.

Clicking on this link here, users can witness the IC Markets‘ business premises through WikIFX’s global field survey team. For more information on how WikiFXs field survey could help verify a broker, read more here: https://www.wikifx.com/en/newsdetail/202205195614327502.html.

WikiFX users can find another helpful tool over here.

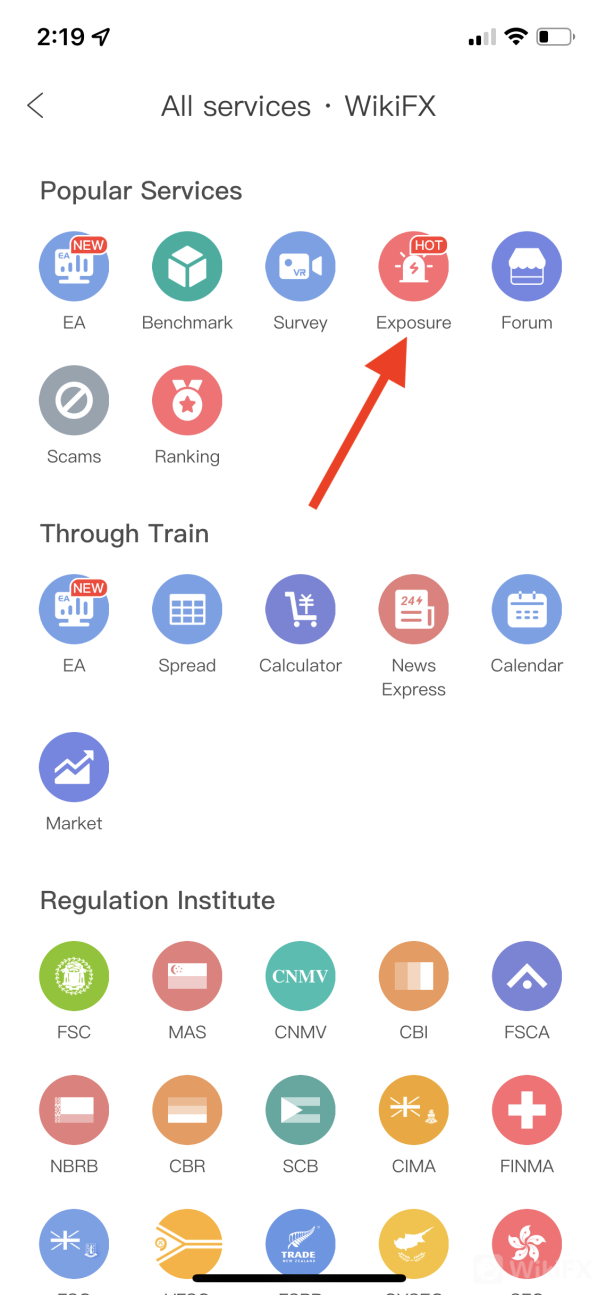

Click “ALL”.

Then, select “Exposure”.

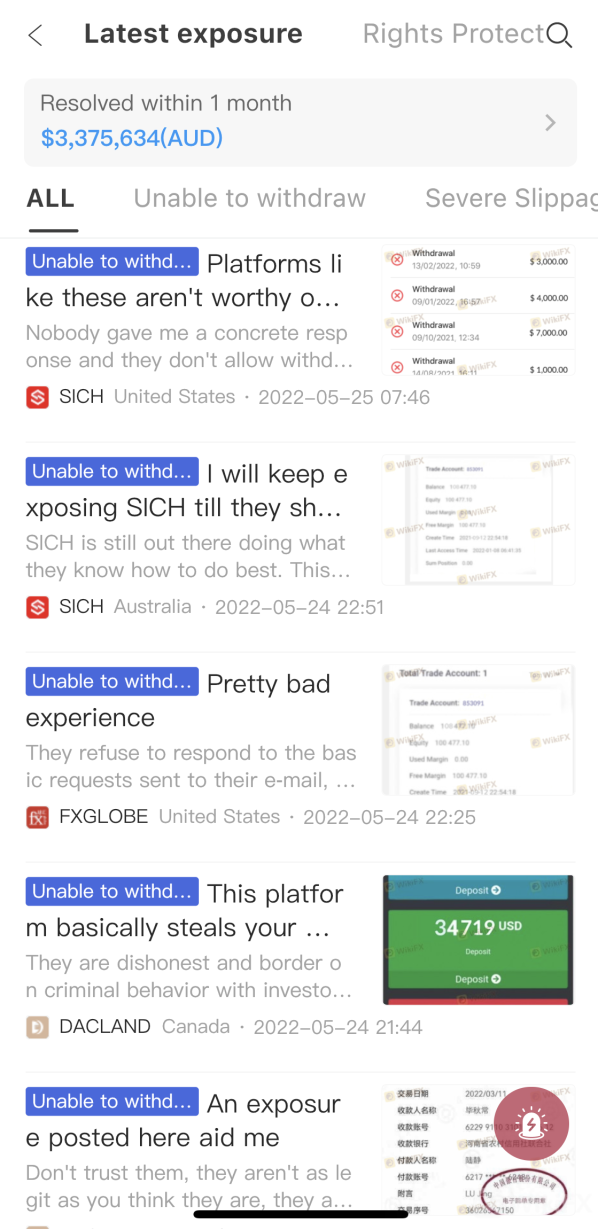

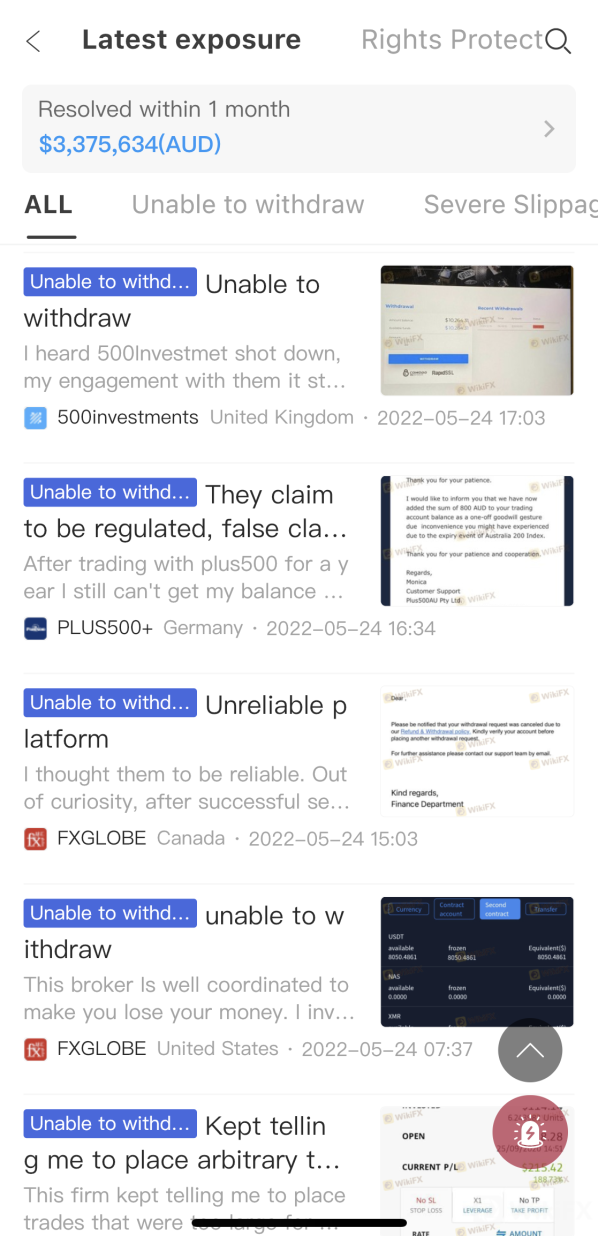

Here at the Exposure section of WikiFX, users can gather as well as upload their honest reviews and disputes with a certain forex broker.

If you are a beginner in the forex industry, you will be able to obtain useful yet transparent information before making a final decision to engage with a particular broker. Surveying and reviewing meticulously is always a wise move to protect one's trading capital, and it is better to save all the trouble and frustration that could come in the future if the wrong broker is chosen.

Leave a Reply