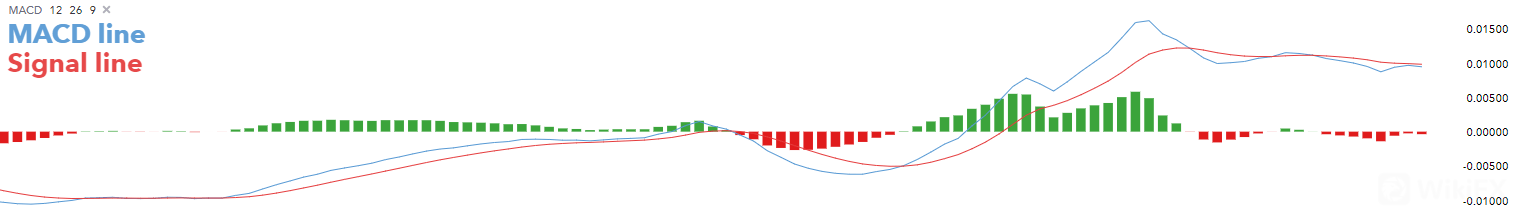

The Moving Average Convergence Divergence (MACD) is a technical indicator which simply measures the relationship of exponential moving averages (EMA).The MACD displays a MACD line (blue), signal line (red) and a histogram (green) – showing the difference between the MACD line and the signal line.

The MACD line is the difference between two exponentially levelled moving averages – usually 12 and 26-periods, whilst the signal line is generally a 9-period exponentially smoothed average of the MACD line.

These MACD lines waver in and around the zero line. This gives the MACD the characteristics of an oscillator giving overbought and oversold signals above and below the zero-line respectively.

The MACD measures momentum or trend strength by using the MACD line and zero line as reference points:

-

When the MACD line crosses ABOVE the zero line, this signals an UPTREND

-

When the MACD line crosses BELOW the zero line, this signals an DOWNTREND

In addition, the MACD signals buy or sell orders which are given when the two MACD lines cross over:

-

When the MACD line crosses ABOVE the signal line, traders use this as a BUY indication

-

When the MACD line crosses BELOW the signal line, traders use this as a SELL indication

Latest News About The Top & Branded Forex Brokers

IC Markets secures major 12 club pan-European football deal

Exness monthly volume crosses the trillion dollar milestone

Eightcap and BKForex Will Organise One of The Biggest Crypto Trading Events of the Year – CryptoFest 2021

Leading Forex Broking Firm TP Global FX Offers its Services Globally to its Users

IV Markets provides two discount cards to welcome new users

Leave a Reply