<WikiFX Malaysia Original – Editor: Fion>

MetaTrader (MT) is a trading platform widely used by retail forex brokers. Its developer is the Russian company MetaQuates, which is currently the “giant” of the entire retail forex industry with its HQ located in Cyprus.

Launched in July 2005, MT4 was the dominant player in the market as it nearly occupied half of the foreign exchange market. The MT5 platform was then launched in June 2010 and offers more functions, typically faster backtesting features and simultaneous testing of multiple currency pairs, while maintaining a similar user interface. This has led some brokers and traders/investors to abandon MT4 and switch to MT5.

The main differences between MT4 and MT5:

1. The supported markets are different

This is the main point of difference between the two platforms. MT4 is designed for trading in the foreign exchange market and supports CFD trading. On the other hand, MT5 allows traders to not just trade the Forex market but also futures, stocks, bonds, commodity options, and other instruments.

2. Market Depth

The MT5 platform's Depth of Market (DOM) is an important tool for traders, allowing them to see how liquid the market is at each price level. This brings an additional level of transparency and market insight which could be beneficial for traders. MT4, on the other hand, does not have this feature.

3. Order Fulfillment

MT4 executes orders on a Fill or Kill (FOK) model – orders are either filled immediately or cancelled in full with no partial fills allowed. However, MT5 allows partial execution, which means that assuming one part of a trader's order is executed, while the other unexecuted part is turned into a limit order or market order.

MT4 can record each trade flow independently and manage each position separately, while MT5 automatically consolidates all trades.

4. Pending orders

MT4 has 4 different types of pending orders: buy limit, sell limit, buy stop, and sell stop, while MT5 has 6 types of pending orders, with the additional buy stop limit and sell stop limit. These two new forms of pending orders allow traders to buy or sell at a set entry price.

5. Operating System

When MT4 was released in 2005, the majority of computers on the market had 32-bit operating systems, which made the MT4 platform more compatible with this type of operating system. MT5, on the other hand, was developed in a 64-bit operating system environment.

6. Order path

The MT5 platform was developed much closer to the present time and its order path is more optimized compared to MT4. Using the MT4 platform, foreign exchange brokers need to upgrade their systems to connect with large international banks (such as JP Morgan, and Citibank) and other financial institutions to establish connections. The MT5 platform comes with integrated systems of the major liquidity providers in the forex market.

7. Transaction processing

MT4 can handle millions of transactions, while MT5 is not limited to the number of its database as it is specially designed to handle an enormous order flow.

8. Technical Indicators

MT4 offers more than 30 different technical indicators that could help traders better analyze price trends. MT5 adds another 8 indicators. The point to emphasize here is that both platforms allow traders to add additional technical indicators by downloading from the Internet, so the number of indicators on the platform itself is not a pivotal advantage.

Which platform is better?

Many people have their own opinions and will not easily change their minds just because MT4 is more popular or MT5 carries more features. These 2 products are built differently for different purposes, so it is not an apple-to-apple comparison. In short, it is not meaningful to compare the advantages and disadvantages of the two platforms as they are both designed for different target users.

Specifically, if you have to comply with US regulatory requirements and if you need to do a lot of backtesting offline, and/or if you want to trade stocks and commodities markets, MT5 is the better choice than MT4. Other than that, the MT4 platform is still a more popular choice, typically among forex traders.

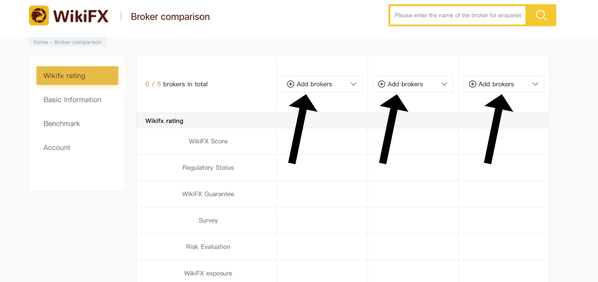

If you are unsure of which broker is reliable and consequently, if your preferred broker offers the trading platform (be it MT4 or MT5) of your choice, simply go to WikiFXs Compare page at https://compare.wikifx.com/en/compare and you can compare several brokers at one glance.

At https://compare.wikifx.com/en/compare page, click “add brokers” across the top row.

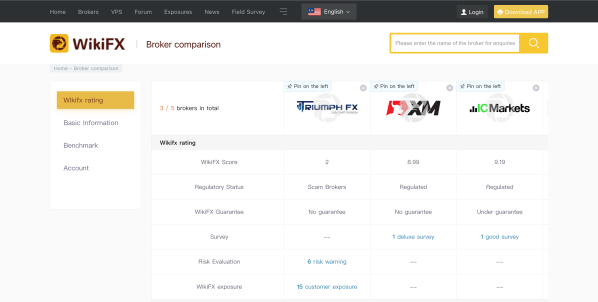

A table full of information will appear immediately.

It is always encouraged to go for a broker with a higher WikiFX Score because it implies that the broker has been reviewed and passed as a reliable broker from various aspects by WikiFX, a global forex broker inquiry platform that you can trust.

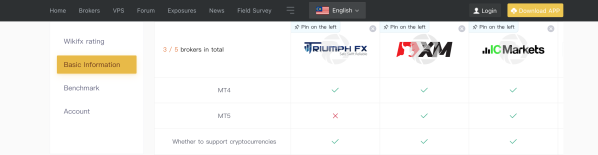

Further down the results page, you can easily spot which broker offers the trading platform of your choice – be it MT4 or MT5.

<WikiFX Malaysia Original: Editor – Fion>

Leave a Reply