About ASJ

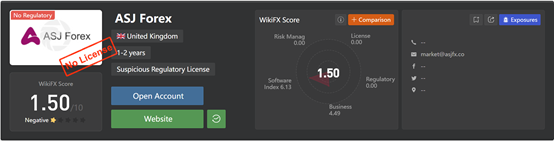

ASJ is also called ASJ Forex Global Limited. According to ASJs website, this broker was founded in 2009 with over 6,000,000 clients. ASJ currently employs over 600 professionals with many years of experience in the financial sector. In addition, ASJ offers global multilingual customer support. ASJ claimed to have a professional team and resources to help clients achieve their investment goals. This broker does not hold a legitimate license, which means that it is an unregulated broker. WikiFX has given this broker a pretty low rating of 1.5/10.

Ponzi Scheme: “Rob Peter to Pay Paul”

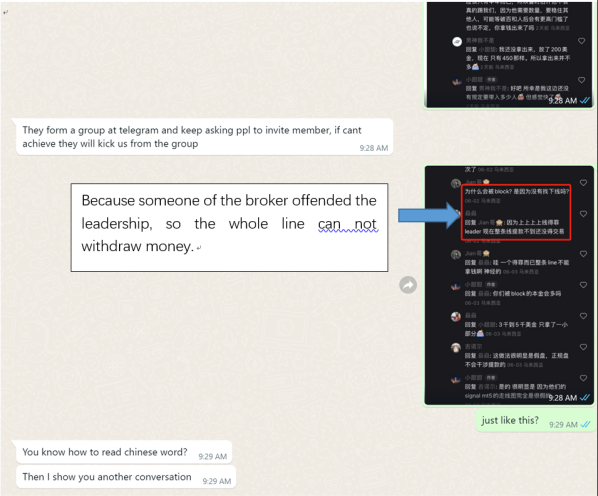

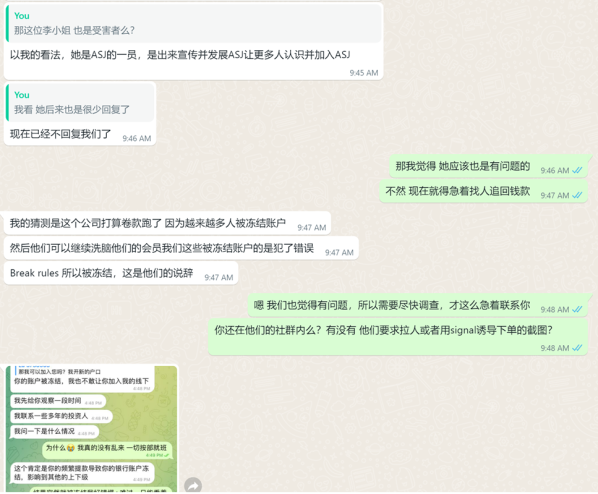

However, according to the investigation of WikiFX, ASJ is getting involved in a Ponzi Scheme. It is not a real investment. According to the victims, the agent of ASJ kept asking clients to invite downline. It is a financial investment scam where the money gathered from the new investors is paid to the existing investors. The scammers also can pay their new investors with deposits from early investors. Therefore, many investors didn't know the truth at the time, and they felt reassured and decided to invest more. This is pyramid scheme fraud, which is extremely concealment, and deceptive. Many investors will eventually lose money after depositing the money since they can no longer find these fraudsters.

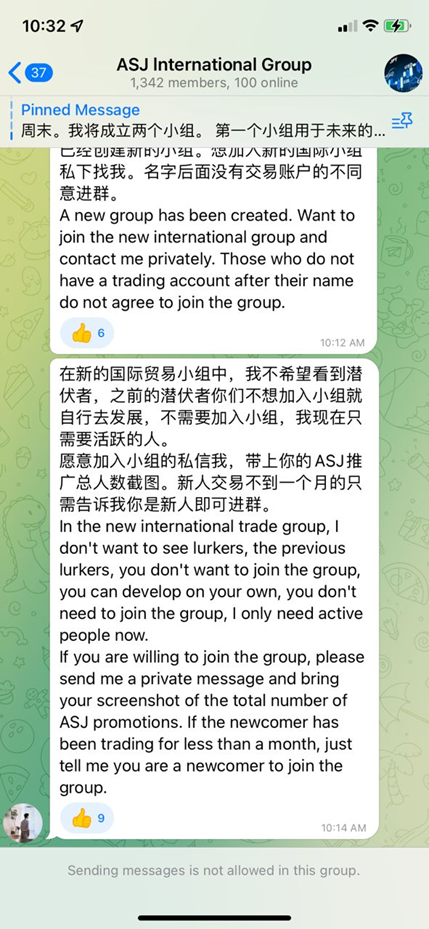

ASJ set a series of chat groups. In these groups, ASJ asked the clients to invite downline and expand new members as many as possible. It seems to use a fake signal as the bait to attract more investments from victims.

(Above is the chat group that ASJ set up. )

The evidence from a victim gathered by WikiFX

One victim, from Malaysia, told WikiFX about the horrors he encountered while investing in ASJ. This is a real-name reporting, and above is the victim's ID.

One victim, from Malaysia, told WikiFX about the horrors he encountered while investing in ASJ. This is a real-name reporting, and above is the victim's ID.

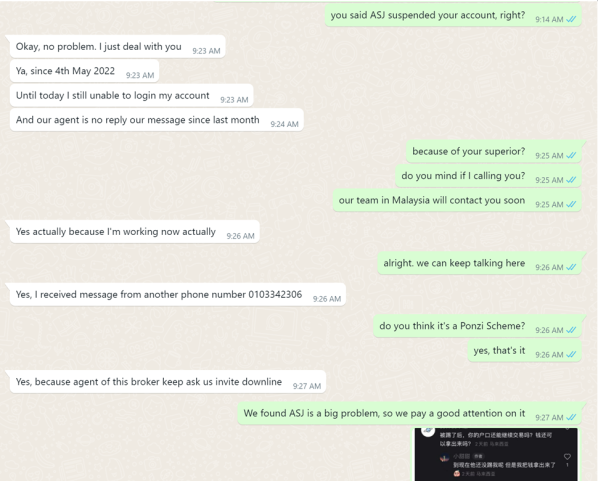

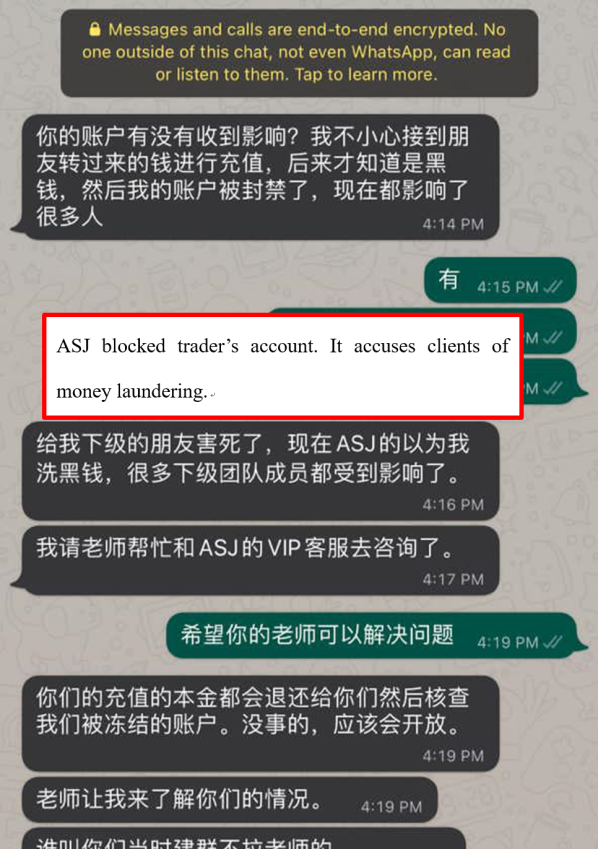

This victim told WikiFX that ASJ suspended his account. The victim could not log in to his account. In addition, this victim suspects that this broker is a Ponzi Scheme, the agent of this broker kept asking the clients to invite downline.

According to the description of the victim, the agents of this broker always required customers to invite downlines. If the client fails to extend new members and bring profits to the broker. The clients account will be frozen.

ASJ seems to use a fake signal to promise a profit. The profit is bait to induce investments from the clients.

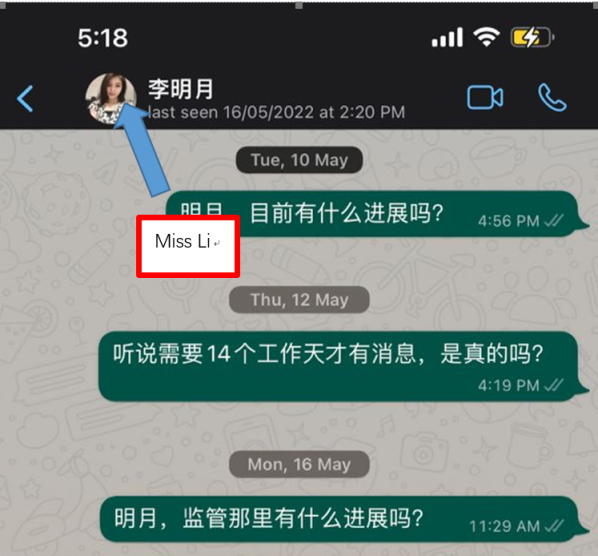

Based on the above we recognized, that Miss Li is the agent of this broker. Posing as an investor, Miss Li lured other investors into the chat group to put in more money and encouraged others to keep adding new people to the group. Induce others by offering profits to those who join early. Roll money with money. After the scam became so obvious, she did not respond to the victims anymore.

This victim whose account has been frozen suspects that this broker is about to escape after taking clients money away fraudulently.

The Warning from Securities Commission Malaysia

The Securities Commission Malaysia recently updated its Investor Warning List, which includes lists of unauthorized websites, investment products, companies, and individuals for investors to use as a reference for decision making.

The list issued a warning against ASJ Forex Global for “capital markets activities that engage in unauthorized trading of securities”.

SC Malaysia will continue to update this list and encourages investors to alert the public if they detect suspicious capital market activity.

Conclusion

ASJ set multiple Telegram groups in advance and invite the traders in. They use the fade signal as the bait to induce peoples investment. They kept asking clients to expand to new members. Then they use the money gathered from the new investors to be paid to the existing investors. It is no doubt that ASJ is a scam. We do not know if this broker will escape irresponsibly. But we are sure that this broker is getting involved in Ponzi Scheme. It is extremely dangerous for you to invest in this broker as you may lose everything to the last penny. Therefore, WikiFX advises you to avoid ASJ as much possible as you can.

Leave a Reply