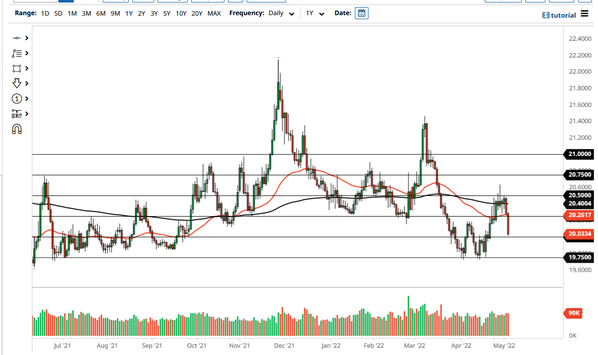

The US dollar has fallen a bit during the trading session on Wednesday as we have broken below the 20.25 pesos level. Furthermore, the 50 Day EMA sits just above the candlestick, so it looks like the greenback is going to have a little bit of a fight on its hands against the Mexican currency. That being said, another thing to keep in mind is that the crude oil markets did get a little bit of a bump during the day, which is typically good for the Peso, so you should also pay attention to that. Because of this, I think we will continue to see a lot of volatility and noisy behavior. Over the longer term, the US dollar looks as if it is trying to pick up its feet, but obviously, there is a lot of noise just above that comes into play rather quickly.

If we were to break down below the bottom of the candlestick for the trading session on Wednesday, it opens up the possibility of dropping back down to the 20 pesos level. This is an area that of course has a certain amount of psychology attached to it, but it is worth noting that it is in the middle of the massive “W pattern”, meaning that we have been on both sides of that level recently. Because of this, I am not overly worried about it, and I do think that the 20 level would probably even allow selling down to the 19.75 level where we had formed that double bottom.

On the upside, the area between here and 20.50 will continue to be very noisy, as there is a lot of action in that area. Furthermore, it is also the area stuck between the 200 Day EMA and the 50 Day EMA. Because of this, the market is likely to continue seeing a lot of noisy behavior, and therefore I think it is going to be difficult to break out. Once we get above the 20.50 level though, we really could see a lot of upward momentum in this market. Either way, this is a pair that is typically somewhat volatile, so keep that in mind and start to think about longer-term moves instead of short-term moves. The nice thing about this pair is it does tend to trend quite nicely.

Leave a Reply