As predicted, the USD/JPY is ripe for profit-taking, which is what happened over the last three trading sessions and is settling around 112.72 as of this writing. The pair is in the middle of a correction path after it tested the 114.70 high. The DXY was testing a pocket of key resistance levels on the charts before slipping in the wake of Friday's stronger-than-expected US non-farm payrolls report, which came along with bullish revisions to job growth estimates in previous months. There was also the Federal Reserve's decision to scale back its $120 billion per month quantitative easing program over the eight months through mid-2022.

Economists widely expect US inflation to remain above 5.4% in October data and the core measure of inflation to remain at 4%, while many have warned that price growth could pick up further over the coming months, which could tempt the market to believe an urgent end to the program Federal Reserve quantitative easing or some other policy action may become likely in the coming months.

But some notes from Fed Chairman Jerome Powell last Wednesday indicated that the Fed already assumes that abnormally high levels of inflation will last longer and that it can be patient to wait for them to dissipate, given that recent increases in inflation have been driven almost entirely by temporary factors. Yesterday, the Federal Reserve said that the risks to the US financial system have decreased significantly compared to the previous year. The US central bank indicated that as the economy recovers from the recession caused by the pandemic, the balance sheets of individuals and companies continue to strengthen.

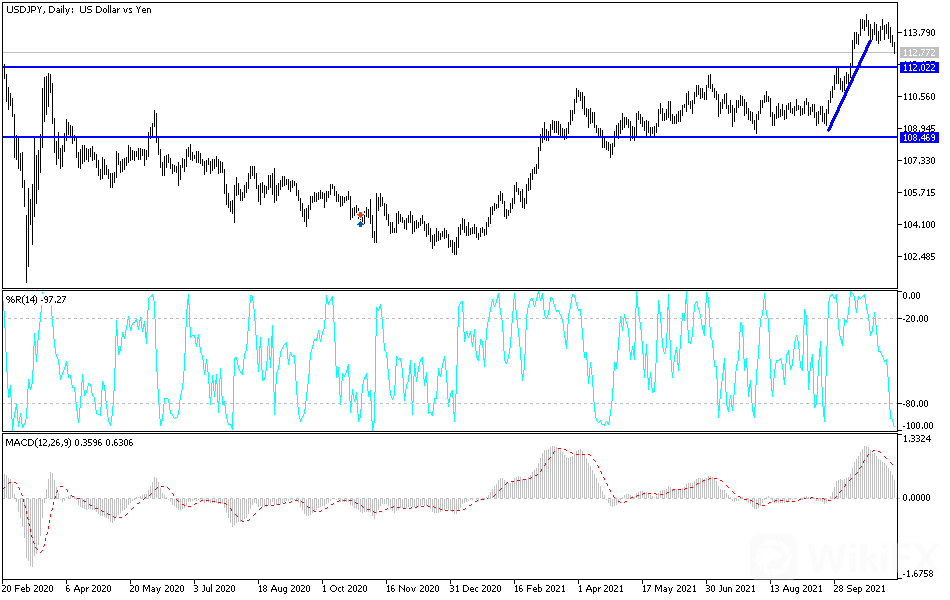

Technical Analysis

On the daily chart, there is a clear break in the general trend of the USD/JPY currency pair, and the bearish outlook will increase if the pair breaks through the 112.00 support. The US dollar will be strongly affected this week by the announcement of inflation levels in the country and a new round of statements by US monetary policy officials led by Jerome Powell. On the other hand, the bulls will return to control the performance again by breaching the 113.48 resistance. I still prefer selling the currency pair from every bullish level. After the Japanese elections, the yen will be affected in the Forex market by risk sentiment, at a time when fears of the economic and epidemic situation in China are increasing.

Leave a Reply