The USD/JPY has been settling above the 114.00 psychological resistance for the past 5 sessions amid strong upward momentum from expectations that the US Federal Reserve may have to raise US interest rates as soon as possible to face the sharp inflation waves caused by the energy crisis and global supply chains. The gains of the USD/JPY reached the resistance level of 114.31 before settling around 114.15 as of this writing, awaiting the announcement of US retail sales figures, which directly affect investor sentiment.

Goldman Sachs Forex Analyst Zack Bundle wrote in the bank's 2022 macro strategy outlook, “We use a variety of models to translate changes in the Fed's forecast into dollar pairs. For the average G10 currency, a 75 basis point increase in the Feds forecast two years ago would lift the dollar by about 4.5-5.0%, all other things being equal.”

While the Federal Reserve said in November that it remained confident that inflation would ease back toward its 2% target next year, the Fed's rate-setters will likely wait patiently until the third quarter for that to happen. The market reaction was rather violent when the annual US inflation rate exceeded 6% for the month of October last week

If problems with parts shortages, labor shortages, and international shipping of goods persist, inflation is likely to remain high. However, if these pressures abate, as our scenarios predict – and Fed officials expect – then these pressures will gradually return to around 2%. Frances Jennox, chief economist at Desjardins, says scaling back quantitative easing measures and initiating interest rate increases expected in 2022 will also help cool inflation expectations.

Overall, Chinese retail sales data, industrial production and fixed asset investment could have an important impact on investors' risk appetite and dollar demand, although US inflation and its outlook will come back into focus soon with at least 15 monetary policy officials speaking. all the week.

Ben Randol, a currency analyst at BofA Global Research, says: “The US dollar rose after the CPI release, as broad gains in the US dollar extended to $2-3 on most pairs as US interest rates and the stock market sold off on reassessing the Fed's reaction function. The DXY is now at its strongest level – and EURUSD is at its weakest – since July 2020. We expect more strength ahead.”

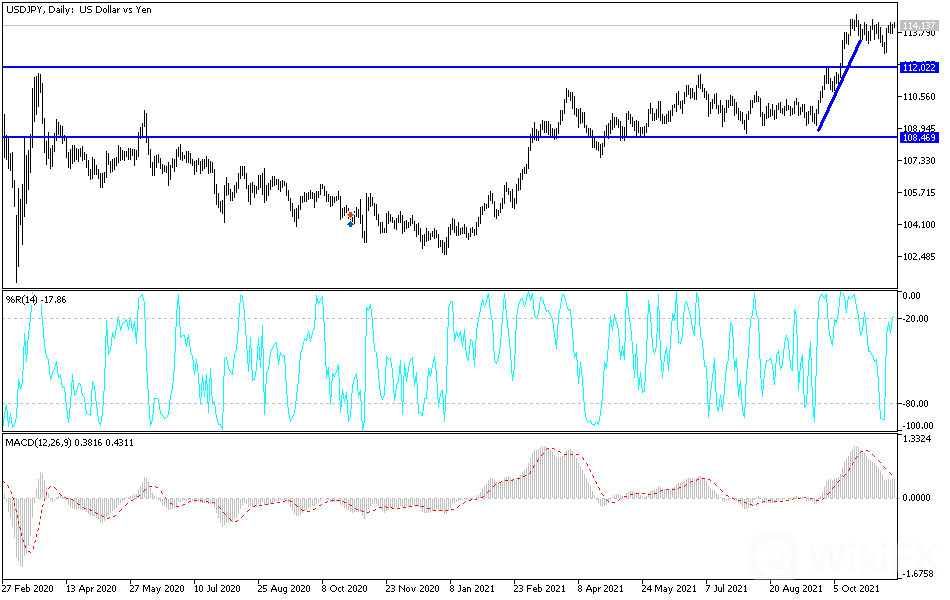

Technical analysis

The general trend of the USD/JPY currency pair is still bullish, and stability around and above the psychological resistance 114.00 confirms this. The nearest targets for the bulls are 114.65, 115.20 and 116.00. On the downside, the trend will reverse by moving below the 112.00 support as indicated on the daily chart below.

Today, the US dollar will react to the release of US retail sales figures and the industrial production rate, as well as investor risk sentiment.

Leave a Reply