Wedge Chart Patterns for Trading Traders with a longer time horizon should be cognizant of the FOMC's market-moving potential. Any changes in interest rates often take over a year to be fully felt across the economy. As a result, while investigating a possible instrument, this time lag should be included into any investing decisions.

It's simple to see why the wedge chart pattern is so popular among traders when you look at it. This is due to the fact that it is simple to spot and hence has a “self-fulfilling prophesy” quality to it. It also helps that it includes a simple measurement tool built in, which is quite easy to use as a tool.

Finding a wedge is a difficult task.

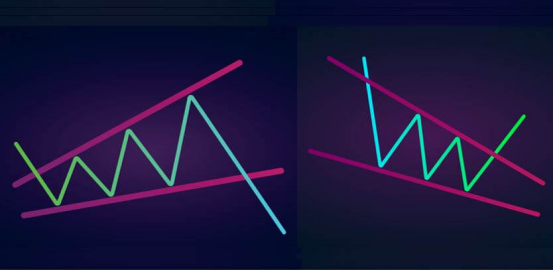

The first step is to figure out exactly what a wedge is. A wedge is made up of two trend lines that meet at an apex. In other words, both selling and buying pressure is squeezing the price. It resembles a triangle, but it does not converge horizontally. In other words, you may have an uptrend line as normal, but the sellers are growing more aggressive at the peak of trade over the final several candlesticks, compressing the market. The wedge formation is characterized as a rising wedge if there is an uptrend line. Compression is something that should constantly be considered since markets do not compress indefinitely and inertia ultimately kicks in.

The New Zealand dollar has been climbing for quite some time on this chart, and the red uptrend line illustrates where support was on the latest advance towards the top of the chart. However, you can see that the sellers were growing more aggressive on the way up, compressing market action. The highs were growing higher than the previous ones, but the pace was fading. A rising wedge is seen by the two red lines.

It's what's known as a “rising wedge” in this case. A rising wedge indicates compression in an upswing, indicating that something is awry. We're losing some steam, and as a result, the highs aren't quite as remarkable as they previously were. The beauty of this pattern is that a break below the uptrend line indicates that we are approaching the pattern's bottom, which is indicated by the blue line. What's more essential is that most traders across the world will notice that the trend line has been broken at the very least. Almost all traders pay heed to trend lines, even if they are not trading wedge patterns and are ignoring the present rising wedge. They attract everyone's attention when they are shattered.

The stop loss would be put on the other side of the rising wedge formation, and the risk-to-reward ratio would be a simple 1:2 in this example. If you pay attention to the rising wedge, you'll see that the market is losing steam and that a reversal is on the horizon. Wedges can be found in any time frame.

Wedges can emerge at any point in time.

While traders frequently employ them on shorter-term time frames, they can also be seen on daily and weekly charts, and I would argue that they have a bit more strength and relevance built into them on these higher time frames because forming the pattern requires a lot more work to begin with.

Take a look at the US dollar/Swiss franc currency combination in the example below. The market has been surging over the months of January, February, and March of 2017, as you can see. As soon as the market fell below the rising wedge's uptrend line, it moved quickly towards the pattern's bottom goal. The stop loss that would have been set above the top of the rising wedge was never threatened, and as you can see, we not only hit the objective, but also rallied back towards the break down, and then hit the target twice more in the spring and early summer.

When you draw the two trend lines together, you can see that a wedge is forming. On the breakout, we very quickly touched the blue line, which symbolizes the top of the wedge. The stop loss would have been on the opposite side of the wedge, which would have been backed up by the hammer that formed the wedge's last candle before the breakout. If you check back a few days, you'll notice that the same region provided support on at least two pullbacks. When it comes to market patterns, this is a typical occurrence due to a phenomenon known as “market memory,” which occurs when support turns into resistance and vice versa.

This is due to those who missed the original move or who want to get in on what appears to be a shift in direction, while those who are on the wrong side of the trade are delighted to get out around breakeven or near to it in order to safeguard their trading money.

Time and cost are two distinct concepts.

Many traders make the mistake of becoming worried when a deal does not immediately work in their favor or hit their objective. Remember, time and price are not the same thing, and even if you have a trade workout, it will follow the market's timetable, not yours. Wedges may be seen in all time frames, as well as emerging market currencies, as seen in the illustration below. In February 2018, the US dollar/South African Rand currency pair created a falling wedge, and after breaking through the downtrend line, the pair rose. The market, on the other hand, had to make multiple tries before reaching the objective, which was attained by a big gap higher. Even though the market did not close the gap on the retreat, the market did pull back later in May and challenged that blue target line. To put it another way, the collapsing wedge was still having an effect. The stop loss beneath the wedge was never challenged, even if the market took its time.

Another technique to trade charts is to use a charting program.

Wedges are just another tool to employ when trading your charts. Wedges are quite common, and they also reflect trendline breaks, so even if your opponents aren't paying attention to wedges, they're most likely paying attention to trendlines, which is about as fundamental as it gets. It's for this reason why wedge designs are so effective. It also has the advantage of having a “built-in measuring stick” to help you set your target. If you're a systematic and mechanical trader, this provides a number of advantages since you may simply buy or sell depending on the pattern's break and aim for the other side of the pattern as per conventional norms.

This eliminates a lot of the guessing, and it's a tried-and-true pattern that many traders have used for years. To play the market, we just utilize the standard principles with whatever filters you like, such as oscillators, moving averages, and so on.

Leave a Reply