Fundamentals:

The U.S. CPI for April, which was not seasonally adjusted, recorded an annual rate of 8.3%, which was lower than the previous value of 8.50%, but higher than the expected 8.10%. The monthly rate of the CPI in the United States after the seasonal adjustment in April was recorded at 0.30%, which was higher than the expected 0.20%, and was greatly reduced from the previous value of 1.20%. After the U.S. inflation data was released, although U.S. inflation fell slightly in April, it still exceeded expectations in an all-round way, strengthening the Feds expectation of expanding the scale of interest rate hikes. U.S. stock index futures plunged. Dow futures, which had previously risen more than 300 points, fell more than 200 points, while NASDAQ futures tumbled 200 points, a percentage drop of nearly 2%. After the release of the U.S. CPI data, money markets were betting on the Fed to raise interest rates by 70 bps in June, from 68 bps previously.

On Wednesday, European Central Bank President Christine Lagarde said the asset-buying program is expected to end at the beginning of the third quarter, with a possible rate hike a few weeks after bond purchases end, with action as early as July. European Central Bank Governing Council Villeroy also said that the European Central Bank will start raising interest rates this summer. European Central Bank Governing Council Mueller also said that the asset purchase program should end in early July or in the first few weeks of July, and25 bps interest rate hikes are certainly not far away suitable.

Technical:

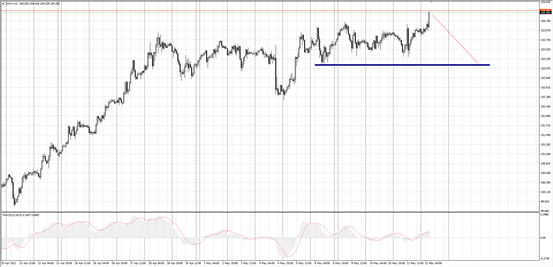

Dow:US stocks closed collectively; the S&P 500 closed 1.65% at 3935.18 points; the Dow closed 1.02% at 31834.11 points; the NASDAQ closed 3.18% at 11364.24 points. Technology stocks tumbled. Tesla closed 8%, Coinbase fell 26%, Apple fell more than 5%, and Saudi Aramco once again surpassed Apple to become the world's largest company by market value. The Dow bears continued to be strong and fell below the first support level, focusing on stabilization near 31,000 below.

USD: The yield on the 10-year U.S. Treasury bond fell sharply after hitting 3.20% again, and finally closed at 2.925%. The U.S. dollar index rose for the second time after falling back in the U.S. session, and finally closed up 0.096% at 104.04. After the US dollar index fell back to a new high, chasing long does not have the advantage of holding positions, and pay attention to the first support position near 103.2 below.

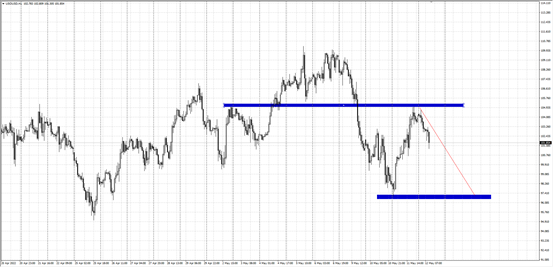

Gold: Spot gold generally fluctuated higher on Wednesday. The CPI data in the U.S. session reversed in a V-shape, with a volatility of more than $20, then stabilized above the $1850 mark, and finally closed 0.73% at $1851.62 per ounce; gold has chased the shorts. Does not have the profit-loss ratio and price advantage, pay attention to the target position of the band callback target 1890.

Crude oil: The last two oil prices rebounded strongly. WTI crude oil recovered the ground lost the previous day, stood at the $105 mark, and finally closed 6.62% at $105.57 per barrel; Brent crude oil finally closed 5.59% at $107.49 per barrel. Today, crude oil pulled back after encountering the upper pressure level, focusing on the first target position below 97.

(The above analysis only represents the analyst's point of view, the forex market is risky, and investors should be cautious)

Leave a Reply