Fundamentals:

In the French general election on Monday, Macron's victory continued to be re-elected, and the news could not bring any support and stimulation to the euro. The focus is still on whether the European Central Bank will start raising interest rates this year. After the April meeting, the European Central Bank is hawkish on the language of interest rate hikes. The market continues to follow Powell's speech to basically finalize a 50 points interest rate hike in May. The US dollar index is constantly pushing to highs, the US dollar index has hit a new two-year high, the 10-year US bond yields are firm, and gold is limited by fundamentals. , showing a weak rebound.

Asia Pacific News: Singapore Straits Times Index fell 0.19%; Vietnam vn30 index rebounded by 1.26%, fell more than 3% during the session, Vietnam Ho Chi Minh index rebounded by 0.70%, and fell sharply by 3.78% during the session; Indonesia's Jakarta composite index rose 0.26%; Thailand set index fell 0.29%; The Philippine composite stock index fell 0.58%; India's Mumbai 30 index rose 1.02%; Malaysia's Kuala Lumpur composite stock index rose 0.26%.

Technical:

Dow: Five-year interest rates surged 13 points to 2.92% on Tuesday. And in September last year, the 5-year U.S. Treasury bond was still at 0.75%! After a slight retreat on Wednesday, the U.S. Treasury yield exceeded 3% on Thursday and was close to 3.05% on Friday. Federal Reserve Chairman Jerome Powell also delivered his most hawkish comments yet on Thursday. At present, the stock market has been hit by the Fed's turn hawk and the bears are strong, and continue to pay attention to the position near the bottom target of 32222.

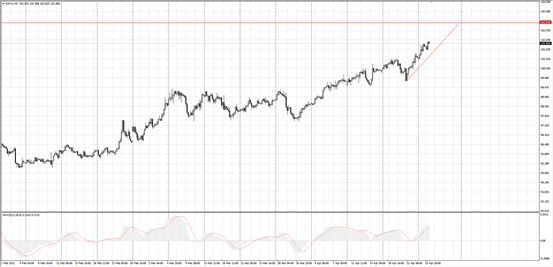

USD: Yields of various U.S. Treasury bonds fell across the board on Monday and remained at a relatively high level. The market's expectation that the Federal Reserve will raise interest rates sharply in the next few months continues to rise. Fundamentals supported the dollar, with the U.S. dollar index up 0.5 percent to 101.73 on Monday, after rising as high as 101.86 during the session, the highest since March 2020. The U.S. dollar index keeps hitting new highs, and the U.S. dollar continues to rise at a high opening. To chase more U.S. dollars at a high level, you need to pay attention to the profit-loss ratio, and pay attention to the high pressure position near 103 above.

Gold: Gold rebounded slightly on Tuesday, because the fundamentals of the dollar continued to make new highs, and the price of gold weakened sharply. After falling to the low support level before 1890, the price of gold pulled back slightly. The fundamentals of the U.S. dollar are strong, and gold is concerned about the continuation of the small band shorts in the later period, and the target position is near the target position below 1880.

Crude Oil: Concerned about the impact of the Russian-Ukrainian conflict: EU sanctions on Russia's oil and natural gas have been delayed, supply concerns have eased, and the risk premium of oil prices has fallen. Affected by the strengthening of the U.S. dollar, international oil prices fell significantly, with U.S. crude oil futures closing below $100 a barrel. Crude oil prices fluctuated downward, focusing on the 92 position at the bottom of the short continuation range.

(The above analysis only represents the analyst's point of view, the forex market is risky, and investment should be cautious)

Leave a Reply