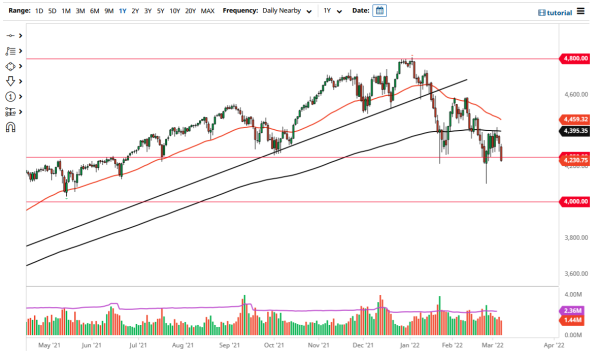

The S&P 500 initially gapped lower to kick off the trading session on Monday, but then turned around to try to fill that gap before plunging even lower. The S&P 500 will continue to face an uphill battle as long as there is a lot of risk aversion out there. At this point, the market looks as if it is going to continue to struggle with the idea of rallying.

The 4200 level looks to be in its sights, which is an area where we have seen a bit of support previously. If we were to break down below there, then the market is likely to go looking towards the 4100 level. Keep in mind that the market is still in the midst of making “lower lows” and “lower highs.” Ultimately, this is a market that is still in a significant downtrend, and I think the market will probably see plenty of selling opportunities going forward. There is nothing out there that even remotely resembles the idea of a market rally.

On the upside, the 4400 level features the 200-day EMA as well. Because of this, the market is likely to see a lot of selling pressure in that area, and I think it will be difficult to break above that area anytime soon. It is worth noting that the 50-day EMA is starting to crash towards the 200-day EMA, which would set up a “death cross” in the market which is a longer-term negative sign. This is a market that I think will continue to find plenty of reasons to go lower, not the least of which would be the war in Ukraine, but we also have to worry about inflation and a slowing rate of growth in the United States.

At this point, I do not have any interest in buying the S&P 500, at least not as things stand right now. It is possible that this market will turn around eventually, but I think at this point we need to get a little bit of help from the Federal Reserve for traders on Wall Street to jump back into this market, as for the last 13 years it has been all about liquidity, but the Federal Reserve is essentially stuck as inflation demands rate hikes.

Leave a Reply