Short-Term Investing (Active Trading) Strategies

Short-term trading, often known as active trading, is characterized by more frequent transactions. Here's a rundown of the most popular short-term trading methods.

-

Day Trading

Trading during the day, the notion of bitcoin is similar to that of regular markets. Traders actively trade by entering and quitting positions during the day, usually within the same day, with the goal of making a profit. Despite the fact that crypto exchanges do not close, day trading refers to a short-term trading method in which traders aim to benefit from same-day price moves. Day traders focus their efforts on trading positive price fluctuations in bitcoin marketplaces as they occur. They may use a combination of fundamental research, technical analysis, and other analytical approaches to identify market inefficiencies and benefit from them. Day traders, for example, would try to trade off of one-, five-, or fifteen-minute price charts.

The volatility of cryptocurrency creates numerous possible possibilities, but relying on day trading for a consistent income requires strong market understanding, extensive trading expertise, and a little luck. The fact is that anybody can become a day trader. However, it requires time, effort, and may be unpleasant at times. As a result, day trading is less ideal for novice traders and more suitable for expert traders.

-

Scalping

Scalp trading focuses on extremely short-term trades in order to profit from tiny bitcoin price swings in large quantities. Scalpers can create and terminate bets in seconds or minutes, capitalizing on profitable market inefficiencies to generate tiny profits. Scalpers are swift on the move, frequently benefitting from bid-ask spreads and other inefficiencies in the crypto market with minor changes. As a result, scalping is akin to high-frequency trading (HFT). To take advantage of real-time volatility in the way that scalpers do, you must have deep understanding of cryptocurrencies as well as excellent analytical abilities.

Many day traders use scalping, allocating a percentage of their trading budget to it. Technical analysis and comprehensive charting are used by experienced traders to identify time-sensitive opportunities and swiftly determine whether to apply their trading plan. Traders must also have clearly-defined goals for scalping, as well as a clear exit plan. Scalping is better suited to traders who want to earn more money with larger holdings. Scalping makes the greatest sense for traders, institutions, or organizations with big quantities of cryptocurrency (whales).

-

Arbitrage Trading

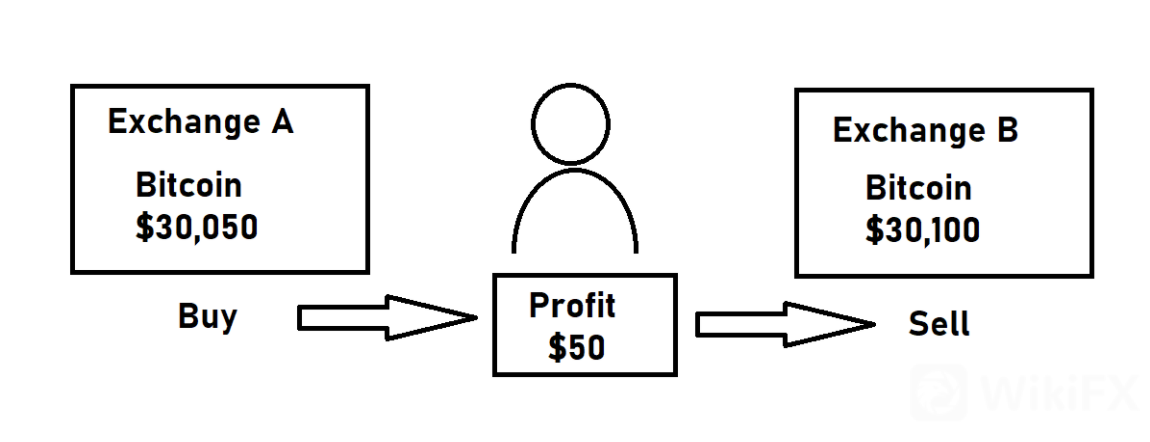

Arbitrage trading takes advantage of price disparities between cryptocurrencies in different marketplaces. Arbitrage traders generally buy a cryptocurrency on one exchange and instantly sell it for a greater price on another, profiting. While earnings are not guaranteed, arbitrage trading carries the lowest risk and typically yields the smallest rewards. Because of the wide variety of trading platforms available, short-term traders have several opportunities to identify and capitalize on inefficiencies. Arbitrage trading is only suggested for people who have prior expertise with this trading method. It's time-consuming and labor-intensive.

-

Swing Trading

Swing trading is a longer-term trading technique in which traders try to profit from short-to-medium-term price patterns, or “swings,” in bitcoin market activity. The majority of swing trades entail gains that last from a few days to a few weeks. Swing trades, as opposed to day trading, often run longer than 24 hours and might even span days or weeks. Swing traders recognize the volatility waves of a cryptocurrency coin or token that is anticipated to move and then get into a position for a variable amount of time. If the move occurs, the trader makes a profit. Swing trading is ideal for new traders since it allows them more time to develop dependable trading strategies. Swing charting approaches include looking for highs and lows using the Gann swing method, reversal pinpointing with candlesticks and oscillators, the relative strength index, momentum indicators, and patterns such as bearish and bullish engulfing patterns.

-

Trend Trading

Trend trading, also known as position trading, makes cryptocurrency investment decisions based on the momentum of a coin or token. It is common for traders to maintain a position for a lengthy period of time, which might span many months. Trend crypto traders examine momentum, searching for upward or downward trends, and then engage into a trading position, gambling on whether the coin or currency will trend upward or lower.

Long-Term Investing (Passive Trading) Strategies

Long-term trading, also known as passive income trading, has significant advantages over short-term tactics for traders who do not have a lot of time or sophisticated knowledge of cryptocurrency markets. The following is a breakdown of the primary long-term cryptocurrency trading methods:

-

Buy and Hold (HODL)

Buy and hold, sometimes known as the misspelled acronym “HODL,” is a trading strategy that entails hanging onto investments in the hopes of making long-term gains. HODLers may ignore much of the volatility of cryptocurrency markets by purchasing and holding bitcoin and gambling on exponential growth. Traders no longer suffer from Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt by disregarding short-term fluctuations and instead “Holding On for Dear Life” (FUD). FOMO is the leading reason for overpaying for a product, whereas FUD leads to SODLing (or “selling at a loss”). A buy-and-hold approach provides other benefits, such as eliminating short-term market noise, minimizing transaction costs, and relieving investors of the psychological load of continually monitoring markets.

-

Index Investing

Investing in tokens or coins gathered together as an index is what cryptocurrency index trading entails. Indices are used to monitor the overall movement of assets. These pooled assets are also less volatile than separate ones. The nicest feature is that it is available on both centralized cryptocurrency exchanges and within the Decentralized Finance (DeFi) ecosystem. Decentralized Finance (DeFi) brings the blockchain's decentralized notion to the world of finance. Crypto indices classify crypto assets based on price weighting and market capitalization. A cryptocurrency's market capitalization (or market cap) is a measure of its market worth. To put it another way, weighting. Price weighting occurs when higher-priced coins and tokens have a greater effect on the index's movement than lower-value assets. Market cap weighting categorizes cryptocurrencies by ranking them by market capitalization. Index traders use derivatives such as options and futures to trade these assets. The purpose of index trading is to obtain a larger exposure to several assets.

-

Staking

Proof-of-stake (PoS) blockchains confirm transactions by staking rather than crypto mining. PoS-based blockchains reward cryptocurrency owners with staking incentives for verifying transactions. This is storing a fixed amount of money in a cryptocurrency wallet to support the security and operations of a specific blockchain network in exchange for predetermined rewards. A wallet that maintains a minimum balance qualifies as a staking node. The stake's value improves the likelihood that the node will be utilized to build the next block. Stake incentives are delivered to the validator when a block is formed on the node.

- END –

Stay tuned on WikiFX for more trading strategies!

Leave a Reply