Market Overview

At the beginning of Asian market on Friday (January 6), the stop loss of USD fluctuated in a narrow range. At present, the trading volume is around 105.12, holding most of the overnight gains. The dollar index hit a new four week high on Thursday, after data showed that the job market was strong, supporting the expectation that the Federal Reserve might maintain the pace of aggressive interest rate increases.

The technical side shows that the US dollar index has initially bottomed out near the half year low of 103.38, and the short-term market is expected to see a wave of rising prices. The initial goal is to look near the 55 day moving average of 105.64, and the radical goal can even look near the 100 day moving average of 108.55.

Spot gold rose in shock. Gold prices were supported by bargain hunting and rebound demand from technical overshoot, and the current trading volume is around 1836.65 dollars/ounce. Many officials of the Federal Reserve tend to further increase interest rates and maintain higher interest rates for a long time to reach the inflation target of 2%. Employment data such as ADP and the number of people applying for unemployment benefits also provide data support for the Federal Reserve to further increase interest rates. The dollar index initially bottoms out in the short term and tends to further fluctuate upward, which is unfavorable for gold prices.

The gold price also showed some signals of reaching the top in terms of technology. Unless the non farm data performed extremely poorly unexpectedly in the evening, the gold price has further downside risks in the short term.

US oil traded at 73.98 dollars/barrel; Oil prices rose nearly 1% on Thursday, supported by US data showing a decline in fuel stocks, while economic concerns limited gains. Colonial Pipeline, the largest pipeline operator in the United States, issued a statement saying that its pipeline 3 was closed due to unscheduled maintenance and was expected to restart on January 7, which supported the price.

This trading day needs to focus on the US December non farm employment report, US December ISM non manufacturing PMI and Fed officials' speeches.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on January 6, 2023 Beijing time.

Intraday Oscillation Range:1817-1833-1856

Overall Large Oscillation Range:

1730-1756-1780-1801-1817-1833-1856-1873-1890

Spotgoldin the subsequent period,1817-1833-1856can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 6. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.1-23.9-24.5-25.3

Overall Large Oscillation Range:20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1

Spotsilverin the subsequent period,23.1-23.9-24.5-25.3can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 6. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:72.3-73.1-73.8-75.1-77.3

Overall Large Oscillation Range:

70.1-71.2-72.3-73.1-73.8-75.1-77.3-78.5-79.9-81.3-82.1-83.5

Crude Oilin the subsequent period,72.3-73.1-73.8-75.1-77.3can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 6. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0460-1.0570-1.0690

Overall Large Oscillation Range:

1.0290-1.0360-1.0460-1.0570-1.0690-1.0755

EURUSDin the subsequent period,1.0460-1.0570-1.0690can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 6. This policy is a daytime policy. Please pay attention to the policy release time.

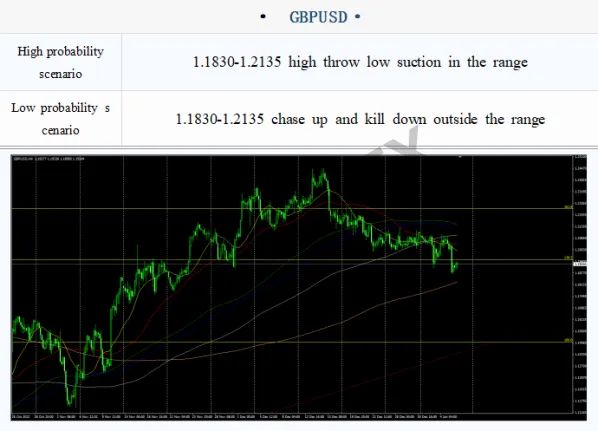

Intraday Oscillation Range:1.1830-1.1920-1.2030-1.2135

Overall Large Oscillation Range:

1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2400-1.2470

EURUSDin the subsequent period,1.0460-1.0570-1.0690can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 6. This policy is a daytime policy. Please pay attention to the policy release time.

Leave a Reply