Market Overview

On Wednesday, February 1, the spot gold fluctuated in a narrow range in Asian time, and is currently trading at around $1926 /ounce. Near the decision of the Federal Reserve's interest rate, the market was in a strong wait-and-see mood, because the fourth quarter GDP data of the United States last week performed well, and the market was worried that the Federal Reserve might stress its determination to reach the terminal interest rate predicted by thedot-matrix chart.The key question of the meeting is what signals the Federal Reserve will send to further raise interest rates this year. Goldman Sachs expects the Federal Reserve to release the signal that it will raise interest rates by another 25 basis points in March and May respectively. This may be bad for gold price.

However, as the data shows that the growth rate of inflation in the United States has slowed down, the Federal Reserve also has the some dovish possibilities, and investors need to be vigilant.

After the last Fed's interest rate decision, gold prices fluctuated widely in the 1795-1814 range, but fell by nearly $30 in the following trading day. Then, gold prices started a wave of nearly $200 increase.

It should be reminded that this trading day will also usher in the US January ISM manufacturing PMI data and ADP employment data, which investors also need to pay attention to. The market expects that the employment growth rate will slow down, and the manufacturing industry will be below 50 for three consecutive months, and it will break the low point since May 2020, which is expected to provide support for the gold price.

US crude oil fluctuated in a narrow range and is currently trading at around 79.08 US dollars/barrel. Although OPEC production fell in January and US stocks rose sharply, providing support for oil prices, API crude oil inventory unexpectedly increased significantly, which was the fifth consecutive week of significant increase, and the increase in gasoline inventory was also greater than market expectations, which made crude oil bulls worried.

Investors need to pay attention to the performance of the US EIA crude oil inventory series data, ADP employment data and ISM manufacturing PMI data in the evening, the impact of the Federal Reserve's interest rate decision on the US dollar and US stock market, and the meeting held by the OPEC+Joint Ministerial Supervisory Committee (JMMC).

The Mohicans Markets strategy is for reference only and not for investment advice. Please read the statement clauses at the end of the text carefully. The following strategy was updated at 15:00 Beijing time on February 1, 2023.

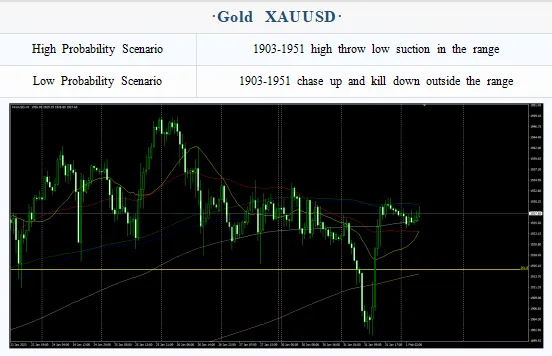

Intraday Oscillation Range:1903-1911-1929-1937-1951

Overall Oscillation Range:1730-1756-1780-1801-1817-1833-1856-1883-1903-1911-1929-1937-1951-1977

In the subsequent period of spot gold,1903-1911-1929-1937-1951can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 onFebruary 1. This policy is a daytime policy. Please pay attention to the policy release time.

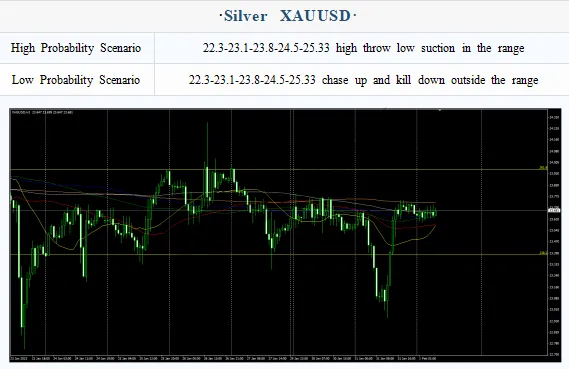

Intraday Oscillation Range:22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range:20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1

In the subsequent period of spot silver,22.3-23.1-23.9-24.5-25.3can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 onFebruary 1. This policy is a daytime policy. Please pay attention to the policy release time.

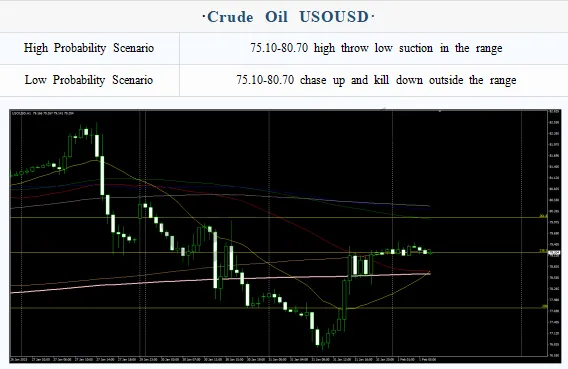

Intraday Oscillation Range:75.1-77.9-78.5-79.9-80.70

Overall Oscillation Range:70.1-71.2-72.3-73.1-73.8-75.1-77.3-78.5-79.9-80.7-82.3-83.5-85.3

In the subsequent period of US crude oil,75.1-77.9-78.5-79.9-80.70can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 onFebruary 1. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0690-1.0755-1.0830-1.0950

Overall Oscillation Range:1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1060

In the subsequent period of EURUSD,1.0690-1.0755-1.0830-1.0950can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 onFebruary 1. This policy is a daytime policy. Please pay attention to the policy release time.

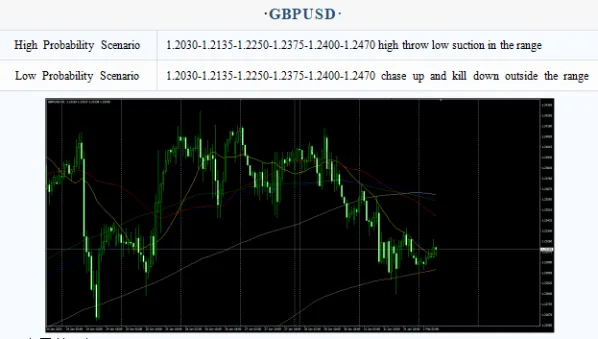

Intraday Oscillation Range:1.2030-1.2135-1.2250-1.2375-1.2400-1.2470

Overall Oscillation Range:1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550

In the subsequent period of GBPUSD,1.2030-1.2135-1.2250-1.2375-1.2400-1.2470can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 onFebruary 1. This policy is a daytime policy. Please pay attention to the policy release time.

Leave a Reply