Market Overview

Spot gold oscillated slightly lower during the Asian session on Tuesday, January 17, and is currently trading near $1,910 per ounce. The U.S. dollar has rebounded steadily from near seven-and-a-half-month lows, putting pressure on gold prices to pull back; as the previous session's K-line recorded a Doji, you need to beware of short-term topping risks if this session records a medium or long negative line.

However, the market is widely expected to slow the pace of interest rate hikes by the Federal Reserve, geopolitical situation concerns and global recession fears still provide support to gold prices, investors need to pay attention to the low buying situation.

More market attention began to turn to this week's Fed official speeches and economic data, no important economic data out on Tuesday, investors need to focus on the U.S. December PPI and U.S. December retail sales data to be released this Wednesday.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on January 17, 2023, Beijing time.

Intraday Oscillation Range:1883-1911-1929

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1883-1911-1929-1937

In the subsequent period of spot gold, 1883-1911-1929 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.1-23.9-24.5-25.3

Overall Oscillation Range: 20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1

In the subsequent period of spot silver, 23.1-23.9-24.5-25.3 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 17. This policy is a daytime policy. Please pay attention to the policy release time.

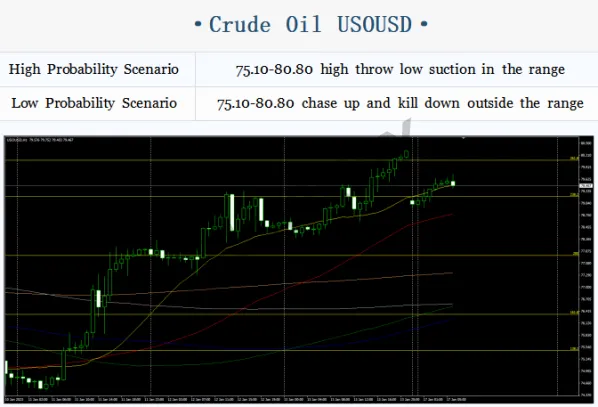

Intraday Oscillation Range: 75.1-77.3-78.5-79.9-80.80

Overall Oscillation Range: 70.1-71.2-72.3-73.1-73.8-75.1-77.3-78.5-79.9-81.3-82.1-83.5

In the subsequent period of crude oil, 73.8-75.1-77.3-78.5-79.9can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0910

Overall Oscillation Range:1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0910-1.1060

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0910 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.1920-1.2030-1.2135-1.2250-1.2375

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470

In the subsequent period of GBPUSD, 1.1920-1.2030-1.2135-1.2250-1.2375 can be operated as an intraday range of bullish and bearish; high throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January 17. This policy is a daytime policy. Please pay attention to the policy release time.

Leave a Reply