Fundamentals:

On Thursday, the U.S. core PCE price index recorded an annual rate of 4.7% in May, the lowest since November last year, slightly lower than the expected 4.8%, and a decline from the previous value of 4.9%. The United States recorded 231,000 initial jobless claims in the week to June 25, compared with an expectation of 228,000 and the previous value of 229,000.

US. inflation-adjusted personal spending fell for the first time this year in May, with gains in the first four months of the year being revised down, and surveys of home sales and manufacturing also pointed to a bleak picture, showing the U.S. economy is on increasingly shaky ground. The Atlanta Fed's GDPNow model's forecast for second-quarter GDP on Thursday slumped to a 1% contraction, after rising 0.3% earlier in the week.

Technical:

Dow: In terms of U.S. stocks, the three major U.S. stock indexes closed down collectively. The Dow Jones closed down 0.82% at 30,775.43 points; the S&P 500 closed down 0.88% at 3,785.38 points; the Nasdaq Composite closed down 1.33% at 11,028.74 points. The Dow is oscillating at the 30600 support position, and the top is concerned about the support pressure position near 31900.

USD: Yields on 10-year U.S. Treasuries fell sharply, falling below 3% at one point in the session. The US dollar index fell sharply after hitting an intraday high of 105.56, and fell below the 105 mark, closing down 0.4% at 104.7; the US dollar was under pressure, and bulls were cautious and focused on the target position of 103 below.

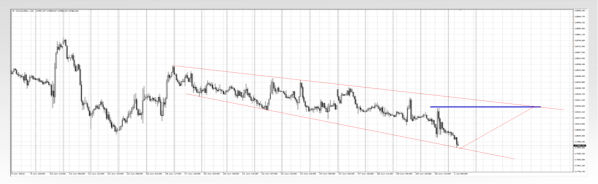

Gold: On Thursday, spot gold went on a roller coaster ride again. Spot gold rose by $22 in a short-term during the U.S. session, and then gave up all gains and turned down. At midday in Asia on Friday, the price of gold fell below the $1,800 mark. Gold fluctuated at a low level, chasing shorts cautiously, and concerned about the 1824 pressure level during the day.

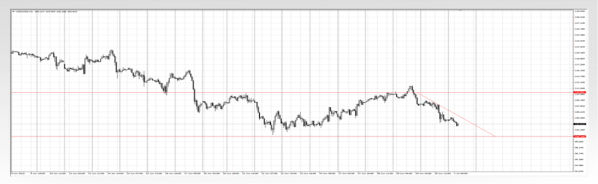

Crude oil: In terms of crude oil, the two crude oil continued to decline. WTI crude oil fell about 5 US dollars from the daily high and closed down 3.47% at US$107.53 per barrel; Brent crude oil closed down 2.88% at US$112.19 per barrel. Crude oil fluctuated and fell short and continued, and the target position near 100 was concerned below.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply