Fundamentals:

According to the “Wall Street Journal” on July 4, citing sources, U.S. President Biden is expected to announce the cancellation of some of the additional tariffs on China soon. The plan is understood to include a moratorium on tariffs on consumer goods such as clothing and school supplies.

On Tuesday, the Reserve Bank of Australia announced that it would raise its benchmark interest rate by 50 basis points to 1.35%, in line with market expectations. The bank said it will further tighten policy in the future in an effort to curb soaring inflation. The RBA expects inflation to peak later this year before falling back to 2% to 3% next year. The bank said the scale and timing of future rate hikes will be determined by data. The RBA said the global outlook was affected by the conflict in Russia and Ukraine and high energy prices, and the Monetary Policy Committee will closely monitor the global economic outlook.

Technical:

Dow: U.S. stocks were closed yesterday for the Independence Day holiday. The support position of the Dow is valid, the bulls continue, and the top is concerned about the position near the support pressure position of 31900.

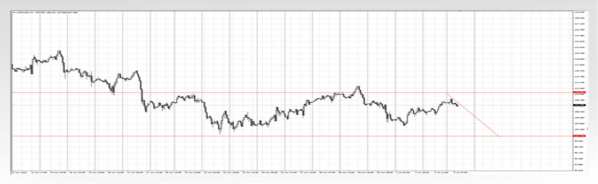

USD:The U.S. dollar index fell below the 105 mark for a time, but then recovered all lost ground and turned up, finally closing up 0.038% at 105.19; the dollar was under pressure, and bulls were cautious and focused on the target position of 103 below.

Gold: On Monday, spot gold fluctuated within the range of 1800-1814 and finally closed flat at $1808.04 per ounce. Gold fluctuates at a low level, and chasing the short is cautious. If the pressure level of 1824 breaks through 1824, then pay attention to the second target position of 1833.

Crude oil: In terms of crude oil, the two crude oils rose sharply during the U.S. session. WTI crude oil returned to the top of the $110 mark and closed up 2.23% at $111.94 per barrel; Brent crude oil returned to the top of the $115 mark and reported $116.41 per barrel . Crude oil fluctuated and fell, and the bears retraced to around 107, and the target position around 100 was concerned below.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply