Fundamentals:

Atlanta Fed‘sPresident Bostic, who voted on the 2024 FOMC vote, said he supports the Fed’sraising interest rates by a second straight 75 basis points later this month, arguing that it won't do much lasting damage to the broader U.S. economy.

The U.S. nonfarm payrolls rose by 372,000 in June seasonally adjusted, the smallest gain since April 2021, and well ahead of expectations for a gain of 268,000. The Fed's swap rates showed an increased likelihood of a 75 basis point rate hike by the Fed after the June nonfarm payrolls report. Biden said the U.S. private sector has recovered all of the jobs lost during the pandemic, but he expects job growth to slow in coming months as the country transitions to “steady growth.”

Technical:

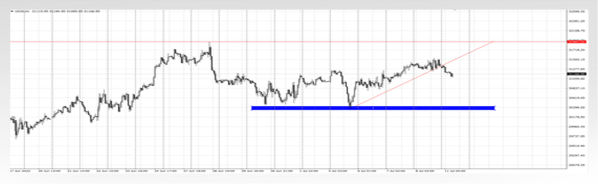

Dow: The three major U.S. stock indexes fluctuated widely throughout the day. The S&P 500 closed down 0.08%, the Dow closed down 0.15%, and the Nasdaq edged up 0.12%. The Dow finished higher and fell back at 31100, focusing on the position near 31900 above.

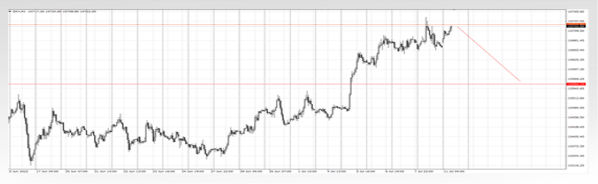

US dollar:The US dollar index weakened after rising to a daily high of 107.81, and fell to the 107 mark, and finally closed down 0.168% at 106.91; the 10-year US bond yield soared in the short-term in the US market, once rose to 3.101%, and finally closed at 3.082 %. The US dollar is cautious in chasing more historical highs, and in the short term, it is concerned about the slight correction near 105.5.

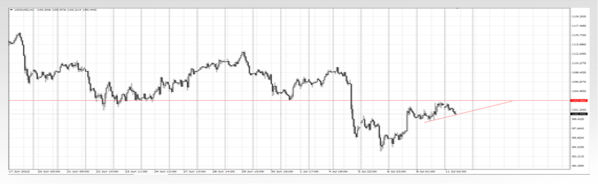

Gold: On Friday, spot gold fluctuated sharply, reaching the daily high of 1752.35 and then falling back, finally closing up 0.13% at $1741.82 per ounce. Gold is cautious in chasing the empty space, focusing on the short-term callback target of gold at 1773.

Crude oil: In terms of crude oil, the two crude oils continued their rebound trend. WTI crude oil rose above US$105 and finally closed up 1.95% at US$105.8 per barrel. Brent crude oil closed up 2.67% at US$109.34 per barrel. Focus on the crude oil band callback 103.5 position.

(The above analysis only represents the opinions of analysts, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply