Fundamentals:

In the early morning, the Fed released the minutes of the meeting. Among them, most Fed officials believe that growth risks are skewed to the downside, and it may take some time to reduce the inflation rate to 2%. The Fed sees “more restrictive” interest rate levels as possible if inflation persists. Fed officials see a 50 basis point or 75 basis point rate hike at the July FOMC meeting and expect economic growth to rebound in the second quarter.

The United States and its allies have discussed measures to cap Russian oil prices at around $40 to $60 a barrel, according to people familiar with the matter. That range includes what is believed to be Russias marginal cost of production, as well as Russian oil prices before the outbreak of the Russian-Ukrainian conflict on Feb. 24, the people said. The Biden administration believes the $40 cap is too low, two of the people said.

Technical:

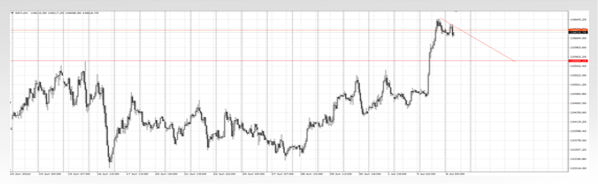

Dow: The three major U.S. stock indexes closed up slightly throughout the day. The Dow closed up 0.36%, the Nasdaq closed up 0.35%, and the S&P 500 closed up 0.36%. The Dow rebounded at 31,000 after a deep decline. Focus on the correction within the week Location near 31900.

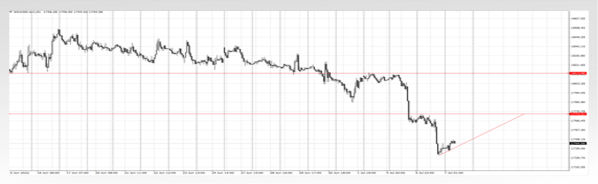

U.S. dollar:The U.S. dollar index is still strong, achieving four consecutive positives, and reaching a high of 107, closing up 0.545% at 107.09; the 10-year U.S. Treasury bond yield rebounded in the U.S. session and returned to above 2.9%. The US dollar is cautious in chasing more historical highs, and in the short term, it is concerned about the slight correction near 105.5.

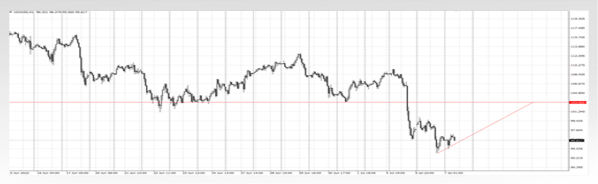

Gold: On Wednesday, spot gold maintained a downward trend and dived sharply during the US session, finally closing down 1.43% at $1,739 an ounce; spot silver closed up 0.05% at $19.2 an ounce. Gold is cautious in chasing the empty space, and it is concerned about the short-term correction target of gold at 1773 during the day.

Crude oil: In terms of crude oil, the U.S. session fell wildly. WTI crude oil fell below the $100 mark in intraday trading, and finally closed down 9.81% at $100.71 per barrel; Brent crude oil fell about $13 from the daily high and finally closed down 9.59% at $105.25 a barrel. Crude oil is chasing after the deep fall and is cautious, focusing on the crude oil band callback 103.5 position.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply