Fundamentals:

The G7 summit issued a statement on the Ukraine issue and reiterated its support for Ukraine, which promised to provide Ukraine with $29.5 billion in financial, humanitarian, military and diplomatic assistance this year. Further coordinate the sanctions against Russia, make it clear that the sanctions will not target food and ensure the free import and export of agricultural products to alleviate the global food crisis.

Yesterday, the White House issued a statement saying that U.S. President Biden will meet with G7 leaders and Ukrainian President Volodymyr Zelensky on the same day, and the G7 will announce new sanctions against Russia. The White House statement said the major new sanctions the United States will implement in coordination with the G7 include: imposing sanctions on hundreds of individuals and entities, imposing tariffs on hundreds of billions of dollars worth of Russian products, and targeting Russian military production and supplies chain to impose sanctions. G7 leaders will adjust and expand targeted sanctions to further restrict Russia's access to critical services and technologies, limit Russia's participation in global markets and further combat evasion attempts.

Technical:

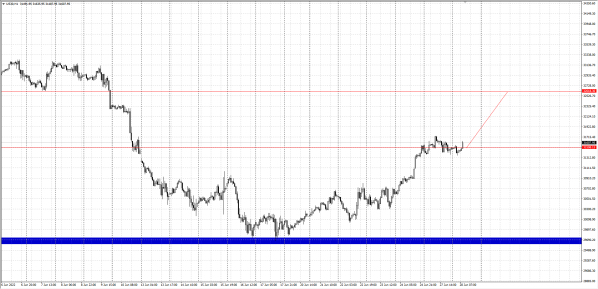

Dow: The U.S. stock market closed lower on Monday, affected by rising inflation concerns and tightening Fed policy. The three major U.S. stock indexes closed down slightly. The S&P 500 closed down 0.3% at 3,900.11 points; the Dow closed down 0.2%, and the Nasdaq closed down fell 0.72%. On Monday, it oscillated near the target of 31500, focusing on the position near 32600 above.

USD:The yield on the 10-year U.S. Treasury bond fluctuated higher to around 3.2%. The dollar index fell below the 104 mark and closed down 0.182% at 103.96. USD bulls are cautious, focusing on the target position of 103 below.

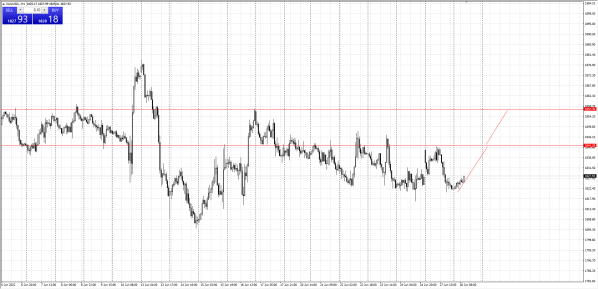

Gold: Spot gold opened higher and lower on Monday. During the European session, it fell from around the 1840 mark, fell about $20 from the intraday high, and closed down 0.47% at $1822.71 per ounce; focus on the pressure level of 1841 during the day, and if it breaks through 1841, focus on 1857 second target position.

Crude oil:Due tohelp ofthe prospect of tighter supply, after the Group of Seven (G7) pledged to further cut off the source of Russian President Vladimir Putin's war funds, oil prices rose slightly on Monday, with WTI crude oil closing up 3.13% at $111.72 a barrel; Bren Special crude oil closed up 2.69% at $114.44 a barrel. Crude oil prices focus on the 110 pressure level above, and the target position near 100 below.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply