Fundamentals:

The 2024 FOMC vote committee, San Francisco Fed‘sPresident Daly, said the Fed’swill reach a similarly neutral level by the end of the year, and she expects the federal funds rate to be raised to 3.1% by the end of 2022. Support the Fedsto raise interest ratesfurther by 75 basis points in July.

JPMorgan economists cut their mid-year U.S. growth forecasts after most U.S. data released last week were weak, most notably a slowdown in consumer spending. The bank lowered its U.S. second-quarter GDP forecast to 1% from 2.5% previously and lowered its third-quarter GDP forecast to 1% from 2%. Growth in the final three months of the year is set to rise to 1.5 percent, driven by robust auto production and a pullback in inflation.

Technical:

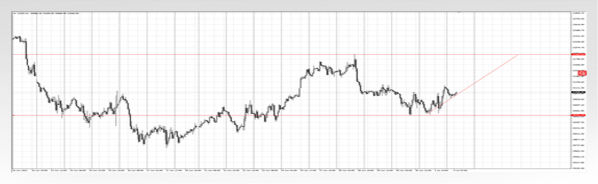

Dow: The three major U.S. stock indexes closed higher, the Dow and S&P 500 both closed up more than 1%, and the Nasdaq closed up 0.90%. AMD, Amazon, Apple, Nvidia, and Micron Technology occupied the top positions in intraday trading volume. The Dow is oscillating at the 30600 support position, and the top is concerned about the support pressure position near 31900.

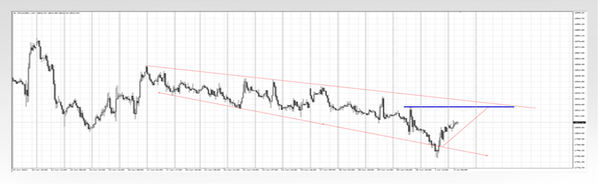

USD:The U.S. dollar index rose sharply, fell slightly in late trading but was still at a high level, and finally closed up 0.43% at 105.15; the 10-year U.S. Treasury yield fell sharply to 2.889%. The top of the dollar is under pressure, and the bulls are cautious, focusing on the target position of 103 below.

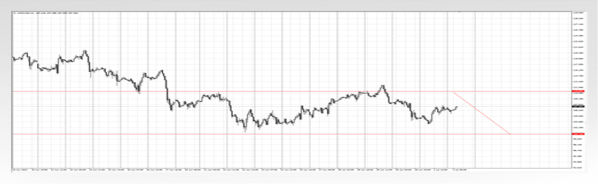

Gold: Last Friday, spot gold once fell below the $1,800 mark during the U.S. session, and then recovered all lost ground, and finally closed up 0.18% at $1,810.18 per ounce; gold fluctuated at a low level, chasing shorts cautiously, and concerned about the 1824 pressure level during the day.

Crude oil: In terms of crude oil, the two crude oils rose sharply in the pre-US session. WTI crude oil finally closed up 2.03% at US$109.94 per barrel; Brent crude oil closed up 1.97% at US$114.5 per barrel. Crude oil fluctuated and fell, and the bears retraced to around 107, and the target position around 100 was concerned below.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply