Yields rise ahead of FOMC. As US stocks slipped further on Tuesday, bonds yields have been rising across the board ahead of the FOMC rate decision on Wednesday. Dow (-0.30%), Nasdaq (-1.14%), S&P (-0.75%) and Russell (-0.96%) were under pressure as investors continue to unload equities and demand cash, sending Dollar (DXY) higher to above 96.50 minor handle as the 10Y yields shoot to 147 basis points.

In the commodities market, demand concerns on crude continue to push the black gold lower to below $70/bl at writing. Gold was fixed lower at London close to around $1,770.20/oz as markets more hawkish Feds given rising producer prices. Elsewhere, iron ore stalled $108.50/tn as investors awaited new catalysts from the US infrastructure projects.

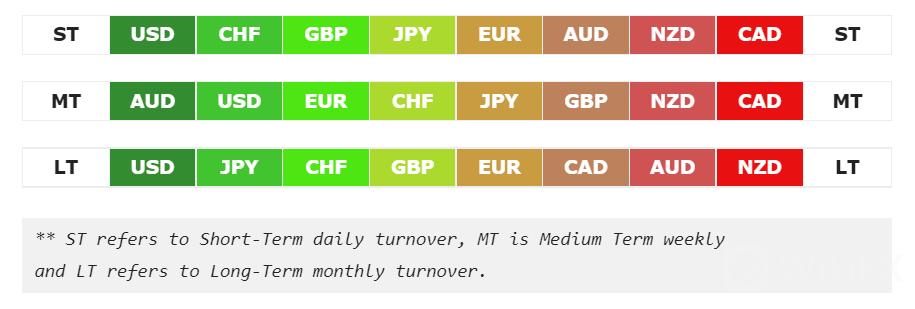

In the FX space, markets turned less bearish as King Dollar seized the helm of demand from Yen and Swiss in the long and short term accounts respectively. The comdolls trio very much remain under offers across all horizons except Aussie that is still leading demand in the medium term. On Tuesday, markets look for earnings reports from Lenmar (LEN), Trip.Com (TCOM), Nordson (NDSN), Toro (TTC) and Heico (HEI); as well as the much awaited FOMC rate decision and US retail sales. EIA petroleum status will be in the spotlight for oil traders.

G8 CURRENCIES SENTIMENTS

OUR PICK – No New Stock Picks

No new stock picks as we are at maximum equities exposure. Currently we are holding 8 stocks – 7 longs and 1 short. We are long AUY (21% undervalued) with dividends yielding 3.07%, COG (CTRA) (15% undervalued) yielding 2.44% and averaged down on T (19% undervalued) at 9.27% yields. CLVS is currently 22% overvalued with -7.19 z-score but Tudor Investment had stepped in recently and we decided to hold. We remain bullish with VIPS (47% undervalued with 5.59 z-score), GT (39% undervalued with 1.28 z-score) and CRON (13% undervalued with 9.18 z-score) while bearish GE (14% overvalued with 1.43 z-score).

For high probability stock picks, please use our Trading Central services.

Note: Cabot Oil & Gas (COG) recently merged with Cimarex Energy to form Coterra Energy (CTRA).

Leave a Reply