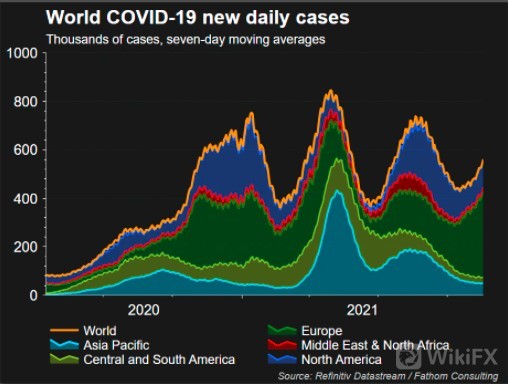

Markets have suddenly woken up to COVID-19 risks, and after Austria imposed 10-days of nationwide restrictions to fight the winter virus wave, investors swiftly shifted to lockdown trading mode.

Oil hit 7-week lows in Asia hours, and equities in Europe look set for a muted start after clocking on Friday their first weekly decline in seven weeks, as bond yields and banking stocks tanked. The euro is also under pressure at 16-month lows.

Concerns are that Germany and other countries could follow suit, forcing million of people to stay at home, hitting tourism-dependent economies and outdoor businesses just before key Christmas holidays and spending.

Little wonder then that Italian and Spanish stocks look particularly vulnerable at this stage, while Big Tech and online economy names are once again in favour, sending Nasdaq futures to new record highs overnight.

Shares in vaccine makers meantime could also benefit. German politicians are debating making COVID-19 vaccinations compulsory, and other countries are also pondering what to do with the unvaccinated.

On the corporate front, eyes are on Telecom Italia after KKR made a $12 billion approach to take the Italian phone group private. Ericsson is also on the watch-list after the equipment maker agreed to buy cloud communications firm Vonage for $6.2 billion.

Leave a Reply