Global financial markets are in absolute turmoil! The record-beating 11-year old U.S. bull market

has now come to an end, and with it, the fastest bear market in history. Bear markets, which are

defined as a 20% decline from the peak, have historically taken months to be reached. However,

this bear market took less than three weeks. Global markets have been gripped by fear and

uncertainty given two black swan events, namely Coronavirus and the oil price crash, both which

occurred concurrently

If there is one certainty in markets, it is that they hate uncertainty and typically fall during these

periods. Investors are currently concerned about the extent of the economic impact that both the

Coronavirus and the extreme measures taken by governments and health agencies around the

world will have on the global economy. There is no doubt that there will be negative consequences.

What remains to be determined is the severity of the impact and its duration. From a global investor

perspective, the Coronavirus is likely a temporary shock to the global economy similar to other viral

outbreaks in the past. Its effects, however, will undoubtedly cause economic pressure on a

multitude of companies across the global value chain. As long-term investors, we need to determine

whether the adverse effects of coronavirus will cause structural changes in the economy, or if

markets and business operations will normalize as the virus goes into remission.

The oil crash is also front of mind for investors. There are two different categories of investors

watching the oil story unfold. Those who are invested in energy directly or indirectly and are

concerned with value destruction. The other group is more extensive and stands to benefit from

lower oil prices as cheaper fuel and oil inputs translate to more affordable goods and services. With

the share of energy companies being relatively small within global markets, the impact is relatively

limited bearing in mind that the oil crisis of 1973 was the result of a rising oil price not a falling

one.

At the time of writing the S&P500 was down ~23% year to date and down ~27% off its all-time

high. While this is dramatic, it is worthwhile noting that the average drawdown in any given year

is ~15.8%. At the end of 2018, the S&P500 missed entering a bear market by a whisker only to rally to all-time highs once again in 2019. Financial markets are forward-looking, and market prices

tend to reflect future expectations. That is why timing markets is so tricky. By the time the virus

recedes, and the outlook improves, global markets would have already reflected the improved

expectations. Investors who wanted to sell during the panic and buy at the bottom would generally

be worse off than had they instead just stayed invested.

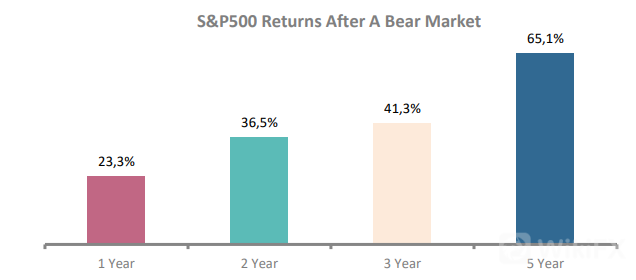

When markets fall, the long-term expected returns increase as stock prices go lower. Empirical

evidence supports this. Using historical data dating back to 1950, if an investor purchased the

S&P500 during any bear market and held the investment for two years, the investor

would have realised a median return of 36.5% in U.S dollars over that period. Only on three

occasions in 70 years has a 20% bear market followed into a greater than 40% drawdown from the

peak. This being 1974, 1982 and 2008. Even then, the recoveries from those lows were substantial.

With global markets already down ~25% from their peaks, there is a reasonable margin of safety

for investors with a longer-term outlook. The bear market provides investors with the opportunity

to buy high-quality growth companies at cheaper valuations than we have seen for a few years.

The coordinated fiscal and monetary stimulus packages unleashed by governments and central

banks in the wake of Coronavirus will also provide much-needed support for markets and

economies. These packages should assist in improving sentiment and aid a speedier recovery for

the global economy. After the US finishes its quarantine, financial markets will be characterized by

substantially lower interest rates, depressed oil prices (good for consumers), fiscal stimulus, trade

tariffs forgotten and reasonable equity valuations. These factors are favourable for equity markets

over the medium term.

According to popular media, there will always be reasons to sell and exit the stock market.

However, for the most part, when markets are their scariest and being invested is at its most

uncomfortable, it is usually the time to buy/hold stocks rather than capitulate. Empirical evidence

confirms investors are rewarded handsomely for enduring this discomfort as we have shown.

We believe that in the current market, it is prudent for investors to remain calm and not do anything

rash that may negatively impact their long-term investment strategy. Crisis, or no crisis, stocks

still offer investors the best opportunity to ensure their capital grows in real terms over the longterm

Leave a Reply