IronFX opened for business in Cyprus in 2010 and has now expanded into more than 180 countries. In addition to EU regulation through the Cyprus Securities and Exchange Commission (CySEC), they are licensed as a registered investment firm in the United Kingdom, Australia, and South Africa. IronFX has closed down operations in China, Russia, and Nigeria in recent years, focusing client development in more traditional venues.

The broker's account diversity is impressive, with a tiered structure that includes floating vs. fixed and commission vs. no commission fee schedules. They round out their services with a variety of professional accounts, introducing broker (IB) branding and a portfolio management program. They recently added cryptocurrency coverage to a broad selection of forex, spot, and CFD trading products. Earlier in 2018, IronFX announced a partnership with EmurgoHK to open a cryptocurrency exchange, but the launch date hasn't been announced.

Trust

IronFX is licensed in the European Union through CySec (Cyprus) no. 125/10, in U.K. through FCA no. 585561 and Australia through ASIC (AFSL no. 417482). U.K. traders have broker default protection up to GBP 50,000 through the Financial Services Compensation Scheme (FSCS) while EU traders get protection up to EUR 20,000 through Cyprus' Investor Compensation Fund (ICF). They also provide excess insurance for UK clients, lifting coverage to GBP 1,000,000.

Client funds are segregated from company funds, reducing the potential for misuse. They operate a counterparty dealing desk, raising conflict of interest issues, but offer direct interbank trading access in some account types. They provide no guaranteed stop-losses but negative balance protection is now mandated under ESMA rules. Secondary security features are unimpressive, with standard encryption at the website and no two-tier platform authentication beyond Metatrader's one-time passwords (OTP).

Desktop Experience

IronFX offers Metatrader 4 and 5 but no dedicated or proprietary trading platform. Social and copy trading options are limited, with no dedicated third-party platform. They do offer a Mirror account, but that's a hedging tool, not a social trading interface. The website Trader's Dashboard shows the positioning of other clients, updated hourly, but account holders will need to use Metatrader's limited social functionality to take advantage of the information.

While Metatrader 4 and 5 are a bit outdated with some clunkiness, they provide reliability and vast functionality that frequent traders need.

Mobile Experience

Metatrader 4 and 5 for Android, iOS, and Windows Mobile provide easy integration with desktop and tablet versions. They also offer the free IronFX Research app, which has no trading functions. Metatrader 5 adds important features lacking in the older version but retains frustrating aspects of this industry-standard software, including weak customization and limited conditional orders. The lack of two-factor authentication in both Metatrader versions adds a security hole that needs to be fixed.

Research Tools and Insights

Broker research materials have been neglected, generating the biggest black mark in our review. The free IronFX Research app allows clients to look at stock market data, financial viewpoints, and videos in an easy-to-use format. However, stale and outdated information undermines the app's enormous potential, with the most recent entries going back several years in some cases. Daily videos stopped abruptly in late fall 2018. The “Live Economic News” showed up to date reports, but “Live Currency Quotes” produced a dead link. The “Intraday Comment” section had a single 18-month old entry about the Eurozone.

Inexplicably, the daily web-based “Market Insights” column was not reproduced on the research app. Unfortunately, that's the only research product available at the site, other than a single “Week Ahead” video and no video archive. A YouTube search uncovered additional videos that haven't been integrated into the site but the most recent content was more than two months old.

Education

IronFX Academy provides impressive educational features for smaller and less-skilled traders. Educational videos along with an encyclopedia and five e-books round out a broad curriculum, with skill trading across a variety of topics that include market analysis, trading psychology, strategies, signals, CFDs, and technical indicators. The portal would benefit from more advanced topics but the narrow focus on newer traders makes sense as a marketing tool. A webinar section was locked, leading to a live account application, while the seminar section contained just two non-English programs in MP4 format.

Special Features

The broker lists an impressive variety of well-documented account types that cover nearly all trading styles and objectives. Clients can choose between two types of floating and an equal number of fixed accounts that offer different spread schedules and fee structures. Several account types allow retail clients to bypass IronFX's dealing desk, which carries a systematic conflict of interest, and trade directly with the interbank system. Accounts are tiered into Micro, Premium, and VIP levels, depending on capital commitment, with spreads dropping on major Forex pairs between tiers.

The web-based Trader's Dashboard social sentiment indicator provides hourly updates of client positions on a subset of popular Forex pairs, spot markets, and CFDs but there's no direct interface into the MT trading platforms.

Investment Products

The list of Forex, spot, and CFD trading instruments is well-constructed but some rivals offer more comprehensive listings. Clients can now trade cryptocurrencies directly on the Metatrader platform. Pricing for Forex, spot, and CFD instruments is average-to-competitive, with significantly lower costs at higher account tiers. There's no bond CFD coverage but spot, metals, and index products cover the most popular instruments worldwide. U.K. and Ireland clients can also place spread bets, although the costs are not fully disclosed.

It takes just $100 to open a Micro account, increasing to $2,500 for a Premium account and $20,000 for a VIP account. Well-documented account subheadings outline fee schedules and side-by-side comparisons for floating vs. fixed, commission vs. no commission, and dealing desk vs. direct interbank trading. All withdrawals incur fees that vary among credit cards, electronic tellers, and bank transfers/locations.

Commissions and Fees

Minimum EUR/USD spread is listed at 0.7 pips while average spread is listed at 1.2 pips. These numbers may be deceiving, given the broad variety of accounts, fees, and routing choices. Spreads drop significantly on major Forex pairs between Micro and VIP tiers but minor pairs show no variation. In addition, tiers apply only to forex, with all account types paying similar spreads and/or commissions when trading CFD or spot instruments. Several pages not properly linked to the main site announce the availability of cryptocurrency trading but our reviewer found no contract, spread, or fee information.

They charge a $50 fee after one year of account inactivity and “reserve the right” to charge a hefty 3% of “deposited funds” for an undisclosed period in which funding or withdrawals are made without trading activity. They may also charge markup or markdown fees. Finally, the fine print advises that spreads widen significantly during volatile and off-market periods, even with fixed spread accounts.

Customer Support

IronFX provides 24/5 support, email, and live chat for prospective and existing clients in over 180 countries and in 30 different languages, and in chat was responsive during several contact attempts. Twitter and Facebook portals are active and populated. A comprehensive FAQ addresses most inquiries while tutorials on trading platforms shorten relatively steep learning curves. Email address and phone numbers are provided for satellite offices in Cyprus, South Africa, and Australia, allowing local contact. However, there's no U.K. or international phone number, forcing potential charges for calls made to Cyprus or other satellite offices.

What You Need to Know

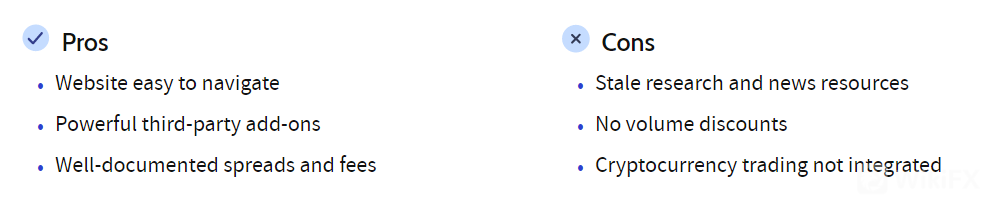

IronFX offers a great fit for traders at low to medium skill levels, with flexible account types that suit many investment and trading styles. Money managers can also benefit from a personal multi-account manager (PMAM) that allows trading of multiple Metatrader accounts. Professionals trading their own accounts may wish to look elsewhere, despite tiered pricing, due to the lack of volume discounts or a proprietary high-end trading platform.

Leave a Reply