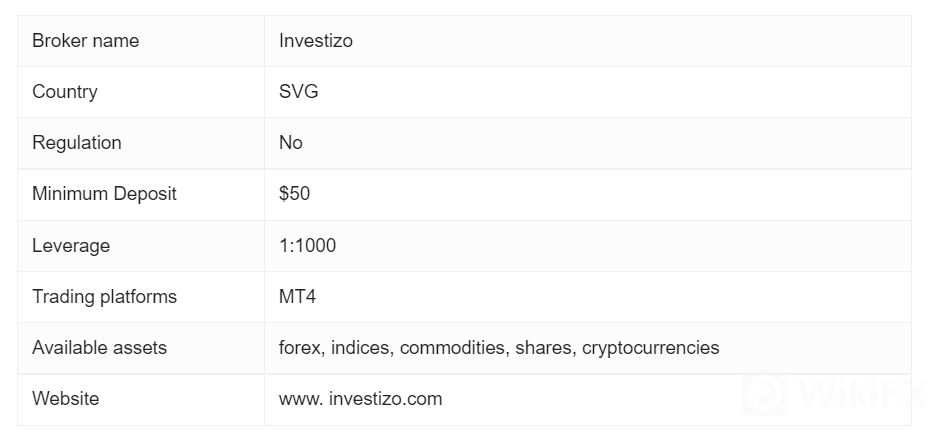

Investizo is an offshore forex and CFD broker that offers trading in wide range of assets on the popular MetaTrader4 platform. The broker also says to provide profitable trading conditions.

This might sound as legit offer and yet we would better suggest that you read the following lines before depositing any money with Investizo. There are a few key issues about this broker that make us question their credibility.

Is Investizo legit?

Investizo is an offshore broker, and doesn‘t hold a license to provide financial services, so, no, they aren’t legit. Therefore, we would rather suggest that you check our list of brokers regulated in Australia instead.

More specifically, Investizo says to be a trading name of Investizo LTD – a company allegedly registered in Saint Vincent and the Grenadines (SVG). This offshore zone is quite notorious because many scam brokers choose to register on this southern Caribbean island – because registering a forex business is easy, low cost, and there are no specific regulations in force, nor any oversight on the part of the government. In other words, brokers operating out of SVG are completely unaccountable for the way they handle clients‘ money, how they execute orders, handle deposits and withdrawals, etc. So, it’s no surprise that most of them are engaged in fraudulent practices.

And traders needn‘t have to worry themselves with any such problems if they deal with a broker regulated by a prestigious financial regulator such as the Australian Securities and Investments Commission (ASIC). ASIC has a neat set rules in place for financial services providers and sees to their compliance, thus effectively preventing their clients from falling victims to fraud. More specifically, ASIC requires licensed brokers to meet capital requirements of AUD 1 million, to keep clients’ money in segregated accounts and to follow certain internal procedures including risk management, staff training, accounting, audits, and more.

Can I make money with Investizo?

No. We seriously doubt that you will be able to withdraw a single dollar. Check our list of UK regulated brokers instead of wasting your time and money with shady brokers like Investizo.

Scam brokers are known to utilize different tactics to deny or delay withdrawals. One of these, for example, is including some unfair clauses in their Terms and Conditions or Deposit and Withdrawal policy.

Some of the most common among them are those referring to trading bonuses. Bonuses might appear attractive at first glance, but are usually traps linked to some minimum trading volume requirement, which scammers latter use as a pretext to cancel the withdrawal requests. And Investizo does exactly this. See for yourself:

Here, we‘d also like to elaborate on another part of Investizo’s offer. Namely, the broker offers a multilevel partnership program called RevShare that would allegedly allow their clients to get up to 80% of the spread. It basically seems like a referral program in which the referee gets a commission from every transaction made by a referral. This inclines us to suspect that Investizo might use forex trading as a way to lure investors in some sort of Multi -Level Marketing (MLM) scam scheme. a site that pays out existing members out of new members deposits.

What trading platforms are available at Investizo?

Clients of Investizo are offered the good old MetaTrader4 (MT4). That said, there are much better and safer options for those willing to trade on the MT4 – check out our extensive list of brokers supporting this platform.

The MT4 has stood the test of time and continues to be the favorite trading software of thousands of traders. That is why the large majority of brokerages support it, or offer its most recent version, the MetaTrader5.

The MT4 is known for its ease of use, customization options and useful functionalities, the most popular of which appear to be the great charting and technical analysis tools, and the Expert Advisors for automated trading. Besides, the platform is available as desktop download, web version, and mobile apps.

What are the spreads offered by Investizo?

According to the Account types information on the brokers website, spreads on majors start from

1.5 pips. When we tested Investizo‘s MT4, however, we found the EUR/USD spread floating above 2 pips which isn’t a competitive pricing. So here you may check as well our list of brokers, offering signifficantly lower spreads.

What leverage is available at Investizo?

Offshore forex brokers are usually generous with leverage, and Investizo is no exception to that – it offers up to 1:1000. If you need higher leverage, however, we recommend that you use a trusted broker.

Do have in mind that most financial regulators have capped the leverage offered to retail traders to significantly lower levels – 1:30 in the EU and the UK, 1:50 in the U.S. The reason for this restrictions is that using high leverage may quickly and easily result in a serious loss, so caution is recommended.

What is the minimum deposit at Investizo?

Investizo will allegedly let you trade live after an initial investment of USD 50. This isnt a high entry threshold, and yet again, some reliable and well-regulated brokers require less as a start. For example, you can open an account with FXTM and XM by depositing a mere $5.

And there is one more thing worth noting. Scam brokers can be very persuasive and most of their victims lose a lot more than just the initial deposit. So, beware!

What payment methods are available at Investizo?

We dont know about that. Mot brokers use bank wire and card payments (Visa, Maestro, MasterCard). As well as e-payment systems like Skrill or PayPal.

Another thing worth mentioning is that that If you pay with VISA or MasterCard, you will be allowed to file or a charge back in case you realize you have been scammed. And you have 540 days to do that.

Leave a Reply