In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of IC Markets based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether IC Markets is a scammer or not, we evaluated IC Markets from different aspects, such as regulatory status, exposure, etc.

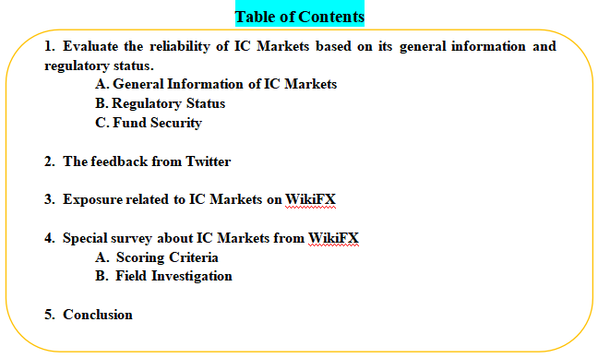

1. Evaluate the reliability of IC Markets based on its general information and regulatory status

To understand IC Markets better, we explore IC Markets by analyzing three main perspectives:

A. General Info of IC Markets

B. Regulatory Status

C. Fund Security

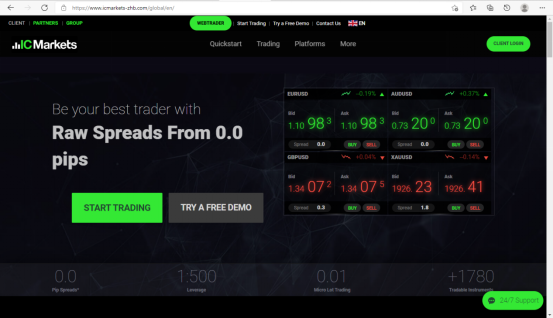

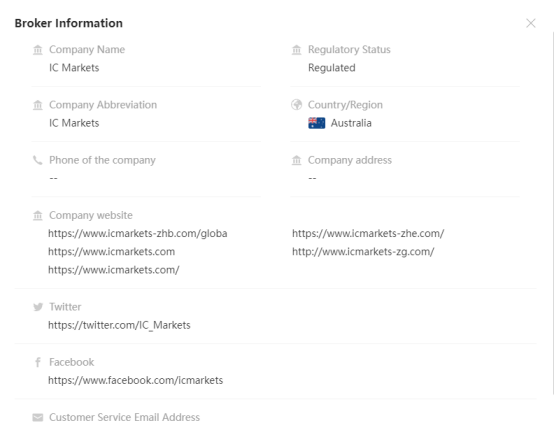

A. General Info of IC Markets

IC Markets's general info has been shown below:

(source: WikiFX)

(source: WikiFX)

With over 20 years of financial experience in forex and CFDs markets, IC Markets is a top online trading platform that offers traders excellent trading cost, high leverage, competitive commissions and spreads. It is considered by global investors as the one of the most trustworthy broker in the forex market.

IC Markets supports 16 languages, including English, Chinese and Spanish.

Market Instruments

IC Markets offers investors a large range of investment assets, mainly popular currency pairs in the forex market, including commodities, indices, bonds, cryptocurrencies, stocks, futures etc.

Account Types & Minimum Deposit

IC Markets offers three different types of account, which are Raw Spread Accounts (cTrader), Raw Spread Accounts, and Standard Accounts. The minimum deposit for them is $200

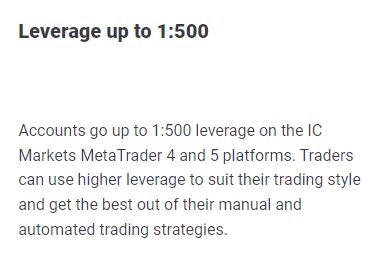

IC Markets Leverage

(source: IC Markets website)

IC Markets offer the highest leverage level of up to 1:500 from its offshore FSA regulatory division in the Seychelles. This leverage varies across the brokers 65 currency pairs and other CFDs (such as cryptocurrencies). The brokers offshore branch offers the following leverage:

| Forex, gold and commodities | 500:1 |

| Indices, futures and bonds | 200:1 |

| Shares | 20:1 |

| Cryptocurrency | 5:1 |

Spreads & Commissions

The spreads on the original spread account (cTrader) start from 0.0 pips, and the commission is €3/ per 100K traded. The spreads on the original spread account start from 0.0 pips, and the commission is €3.50/100K volume. Standard accounts have spread from 1.0 pips and no commission.

Raw IC Market Spreads start from 0 pips. IC Markets pride themselves on super fast 40 milliseconds order execution speeds which process over $15 Billion USD or around £10 billion Pound Sterling in trades daily

Trading Platforms

IC Markets offers traders the MT4, MT5, and cTrader to meet the needs of over 180,000 users. MT4 is currently the most popular trading platform with a highly customizable, user-friendly interface with several technical indicators and data analysis tools to help traders develop different trading strategies. MT5 is the latest version of MT4 and has all the positive features of MT4 with more powerful trading capabilities. cTrader is a platform specifically designed for high-speed execution through which traders can trade global markets. cTrader's independent design, elegant interface, and advanced features make it a favorite among freelance traders.

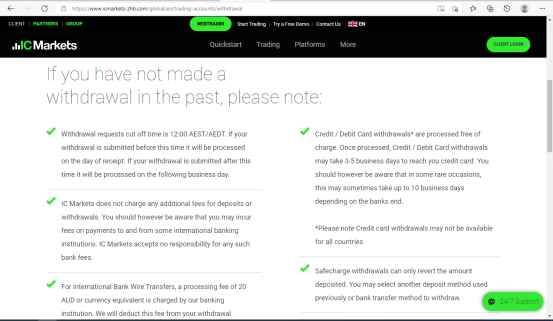

Withdrawal

(source: IC Markets website)

IC Markets supports traders to deposit and withdraw funds to their investment accounts via VISA, MasterCard, NETELLER, Skrill, and wire transfer.

IC Markets can process all the withdrawal requests very quickly as long as clients required. In addition, there is no withdrawal charge fee, and IC Markets is very transparent about its withdrawal process.

Customer Services

IC Markets offers 24/7 customer support via a range of contact methods. The local customer support is available from their Sydney office at Level 6 309 Kent Street Sydney, NSW 2000. CFD traders can reach them through different channels such as email, Skype or by phone. Live chat customer service is also offered by the CFD provider.

(source: WikiFX)

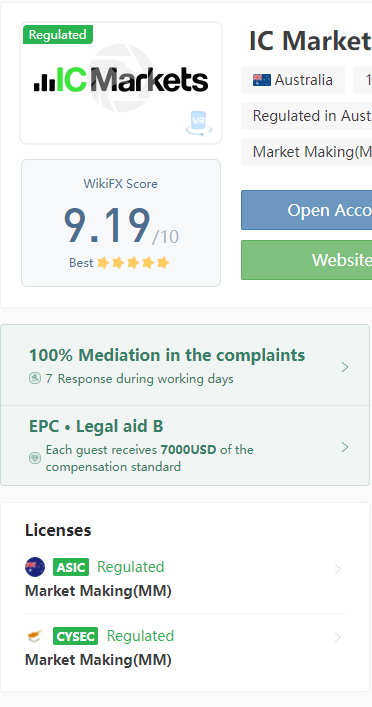

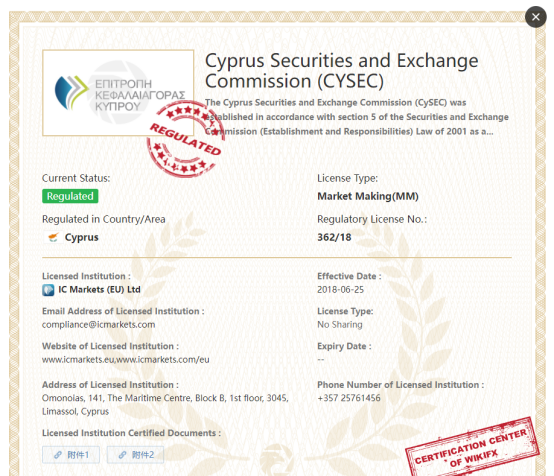

B. Regulatory Status

The legitimate license of IC Markets

According to WikiFX, IC Markets is a regulated broker. IC Markets is regulated by ASIC with license number: 335692. IC Markets also regulated by CySEC with license number: 362/18.

(source: WikiFX)

(source: WikiFX)

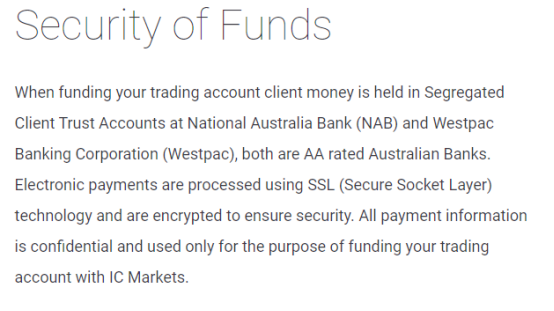

C. Fund Security

(source: IC Markets website)

According to its website, IC Markets guarantees that clients‘ funds are under protection. “When funding your trading account client money is held in Segregated Client Trust Accounts at National Australia Bank (NAB) and Westpac Banking Corporation (Westpac).” As a broker regulated by both CySEC and ASIC, IC Markets needs to keep the clients’ funds on segregated bank accounts. Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back. These accounts will be opened at National Australia Bank (NAB) and Westpac Banking Corporation (Westpac), both are AA rated Australian Banks.

2. The feedback from Twitter

To figure out whether IC Markets is a scammer or not, we made a survey about IC Markets on Twitter.

Reviews on Twitter:

(source: Twitter)

As of March 3th 2022, IC Markets does have official account on Twitter. This account was opened in 2010. And it currently has 8,905 followers, it is following other 1,726 accounts. As a forex trader with a lot of influence, we can see IC Markets didnt put so much efforts to the growth of its Twitter followers within last 10 years.

It is hard to find the negative comments related to IC Markets. Most of recent comments from traders actually praised this broker.

3. Exposure related to IC Markets on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

As of March 3th 2022, WikiFX didnt receive any complaints related to IC Markets yet.

4. Special survey about IC Markets from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform,instruments etc |

| Risk management index: the degree of asset security |

According to WikiFX, IC Markets has been given an excellent rating of 9.19/10.

(source:WikiFX)

In terms of the information above, we can see IC Markets is doing the great job in every aspect.

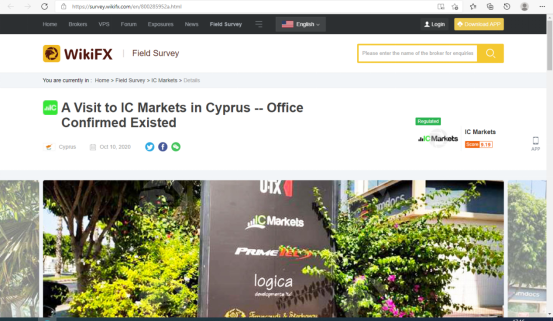

B. Field Investigation

-

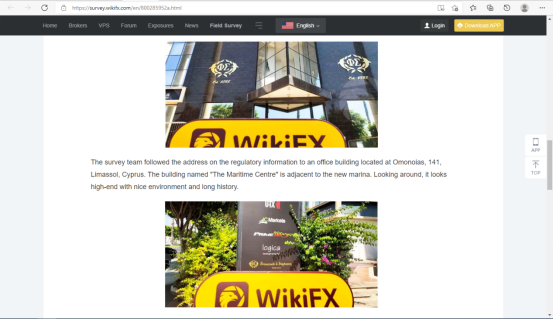

To help you fully understand the broker, WikiFX investigates the brokers by sending surveyors to the brokers physical addresses.

-

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

-

WikiFX did make a field survey on IC Markets on Oct 2020 and the survey team successfully found the physical address.

(source:WikiFX)

5. Conclusion:

As one of the best forex and CFDs broker, IC Markets attracts many traders by offering excellent trading service. Its reputation for over 15 years has shown people how reliable it is. If you want to choose a trustworthy broker to invest in, IC Markets is a wise choice, although some other brokers are also as good as IC Markets.

WikiFX contains details of more than 31,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Leave a Reply