Thankfully, we no longer live in an age where Bitcoins sole function is a dark web currency. Bitcoin and other cryptocurrencies have now started to gather interest in investing tools.

-

Why Invest in Crypto Funds?

-

Ok, So Where Do I Start?

-

Whats in Store for Crypto Investing in 2018?

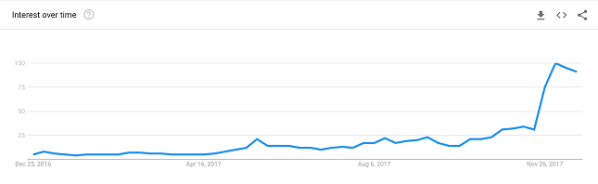

We dont need to tell you how well Bitcoinis doing right now, nor do we need to spell out how the surrounding crypto market is booming. Plenty of mainstream media outlets, online publications, and social media coverage have that front covered.

Indeed, Bitcoin and its peers have been all over the news recently. Whereas this time last year crypto was largely confined to the grimy underbelly of the Internet, the markets 2017 runup has everybody and their grandmother interested in the digital tokens. Unfortunately, not everybody knows where or how to start investing, let alone their grannies.

Crypto has seen a slew of institutional and public interest in 2017, and from this interest, new investing options have been brought to the public in the forms of cryptocurrency-related index funds, ETFs, hedge funds, and trust funds.

I won‘t tell you where to invest your money, nor will I guarantee that, if you decide to invest, you’ll be driving a Maserati in a few years. If anybody does, run for the hills. However, Ill give you a glimpse into the potential upside of investing in these funds, and give you a rundown of some of the more popular and successful ones out there.

Why Invest in Crypto Funds?

There are a number of benefits to buying cryptocurrency funds rather than buying the cryptocurrencies themselves.

The biggest reason for many people is that its generally easier. For fledgling, non-technically savvy investors, the learning curve for getting involved can be pretty formidable.

Navigating the myriad of exchanges and wallets to maintain a cryptocurrency portfolio can leave a newcomers head ringing. With an index, trust, or mutual funds, the assets are handled for you, and you never have to deal directly with the currencies you own a share of.

Having a third party manage your funds for you brings us to another benefit: security. The organizations that spearhead these funds manage millions (or even billions) of dollars.

This should at least serve as a sigh of relief, as these organizations absolutely must take the proper precautions to keep their assets safe. Most funds keep all of their holdings in paper wallets, and such cold storage ensures that hackers or malicious actors on the internet cannot tap into and drain the funds capital.

The average investor, on the other hand, may have his/her computer compromise, could fall prey to an exchange attack, or may even mismanage the funds altogether and lose them in a faulty transaction. With a cryptocurrency asset fund, you can rest easy knowing that the fund is taking every precaution to protect its assets, lest it compromises its own financial wellbeing, legitimacy, and reputation.

Lastly, the funds can protect investors from the risks of investing in such a volatile market. Many of these asset funds diversify their portfolios by including a variety of cryptocurrencies, and some even include cryptosphere platforms like exchanges and a few tech stocks. Instead of going all in on one asset, your portfolio is spread out over a wider terrain, and you have experts cherry picking what they believe will ensure the best returns (as well as the best assets to minimize your exposure to risk if things go south).

Ok, So Where Do I Start?

Between the 175 hedge funds to date, and a handful of trust and index funds, youve got a few options.

Sitting atop the list of hedge funds, the Pantera Bitcoin Fund is a solid option. Since its inception in 2013, Pantera boasts over a 25,000% return on investment. No need to check your vision, you read that right: 25,000%.

A healthy and well-diversified portfolio (not to mention the booming cryptocurrency market) is largely credited for these returns. In recent years, the Pantera Bitcoin Fund has expanded its holdings to a variety of altcoins and blockchain sector stocks. To learn more, check out Pantera and subscribe on its website. As with all hedge funds, you have to be an accredited investor to get involved. The minimum buy-in is $50,000.

If that barrier of entry is too high for you, there are more affordable options out there.

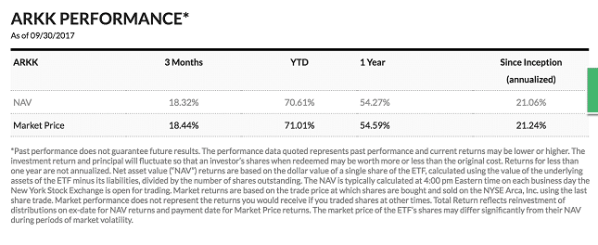

ARK Invest, for example, offers a few ETFs for the more casual investor. While these ETFs do not handle crypto assets exclusively, they include shares of Bitcoin Investment Trust (BIT), a cryptocurrency trust fund for accredited investors.

The ARK Innovations ETF carries 9.04% of its portfolio weight in BIT and has offered nearly a 100% return over the year. The ARK Web x.0 ETF offered comparable one-year returns with 9.87% of its holdings in BIT, as well. To get started with ARK ETF funds, you can buy them on ARKs website using one of many types of brokerage accounts.

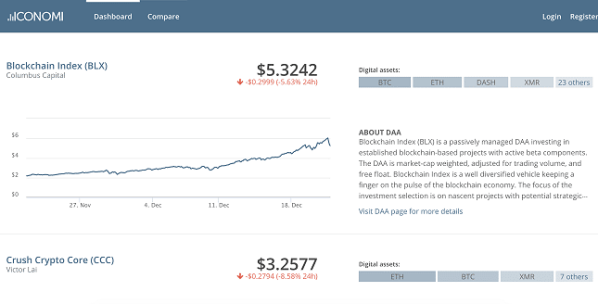

If neither of these options tickles your fancy, there‘s one more place to turn. Your last option comes in the form of crypto index funds, in which holdings are diversified through a number of top cryptocurrencies. You can only purchase these index funds using the tokens that fuel their platforms. For example, If you wanted to buy into the Bit20 fund, you’d have to go onto the BitShares exchange and use BTS, the BitShares token, to buy shares.

Iconomi, a Slovenian company, functions in the same vein, but Iconomi has plans to release a fiat gateway in Q1 2018. This will allow investors not interested in dealing with cryptocurrencies in any capacity to buy shares of Iconomis various index funds.

Suggested Articles

-

Understand Bitcoin Futures: A Step by Step Guide

-

How to Buy Bitcoin?

-

Bitcoin Mining for Dummies: How to Mine Bitcoin

-

What is IOTA and How Can you Buy it?

Whats in Store for Crypto Investing in 2018?

Following a bullish year in 2017, cryptomarkets have piqued institutional interests, and the floodgates of adoption have been opened. Legacy markets are awash with Bitcoin buzz, and the public will likely have more investment options come 2018.

One of these burgeoning options, Bitcoin exchange-traded funds, have yet to see the light of day in crypto markets. While ARK ETFs deal in part with cryptocurrency investment funds, the SEC has yet to approve a cryptocurrency-specific ETF for formal trading.

That‘s not to say that they haven’t had plenty of interest. The New York Stock Exchange recently filed to list two ProShares Bitcoin ETFs, and earlier in December, REX and VanEck investment management firms filed for their own Bitcoin ETFs.

The SEC has been unwavering in their rejection of such filings in the past, but given the launching of Bitcoin futures, theyre likely to budge from this hardline stance.

As such, its probable that you will see a new asset class in Bitcoin ETFs rise up in the future, alongside a propagation of more index, hedge, and mutual funds.

Leave a Reply