Gold futures failed to join the general market rally at the end of last week's trading, as a slew of positive economic data lifted investor sentiment. Stock traders flocked to better-than-expected numbers, as well as consumers' heightened expectations for the economy. The price of XAU/USD gold fell to the support level of $1697 an ounce, the lowest in ten months, and closed last week's trading around the level of $1707 an ounce. Accordingly, the yellow metal recorded a weekly loss of more than 2%, in addition to its decline since the beginning of the year 2022 to date by 7%.

In the same way, prices of silver, the sister commodity to gold, headed in the opposite direction on Friday. As silver futures rose to $18.36 an ounce. Despite the modest increase by the end of the week's trading, the white metal will suffer a weekly loss of 4.5%, which will lead silver to a bear market this year.

Despite rising inflation, which touched 9.1% in June, the US economy recorded positive economic data that surprised many market analysts. According to the US Census Bureau, US retail sales rose 1% in June, beating market estimates of 0.8%. This was also up from a 0.1% decline in May. On an annual basis, retail sales are still up 8.4%. In addition, core US retail sales, which remove auto services, food and gasoline, jumped 0.8% last month, up from a 0.3% decline the previous month.

New data from the Federal Reserve shows that US industrial output fell 0.2% in June, above market expectations of 0.1%. Industrial production fell 0.5%, greater than expectations of -0.1%. Also, capacity utilization has fallen to 80%, which is lower than the average estimate of 80.6%. On the pricing front, US import prices rose less-than-expected by 0.2%, while export prices also rose at a less-than-expected 0.7%.

Moreover, the University of Michigan's US Consumer Confidence Index rose to a reading of 51.1 in July, above market estimates of 49.9. Consumer expectations slipped to 47.3, while current economic conditions advanced to 57.1. Consumer expectations for one- and five-year inflation fell to 5.2% and 2.8%, respectively.

And other factors affecting the gold market. The US Treasury market was mostly down, with the 10-year bond yield slipping 2.9 basis points to 2.93%. But the yield curve for two- and 10-year bonds has remained inverted, widening to nearly -20 basis points. This is a major indication that the US may be heading into a recession. Lower returns are generally bullish for gold as it reduces the opportunity cost of owning non-returning bullion.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of currencies, took a breather from its massive rally. The DXY Dollar Index is down 0.39% to 108.12, from an opening at 108.67. The index will continue to post a weekly boost of 1%, adding to its 2022-to-date rally near 13%.

In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures fell to $3.195 a pound. Platinum futures rose to $827.00 an ounce. Palladium futures fell to $1,836.00 an ounce.

Gold Forecast

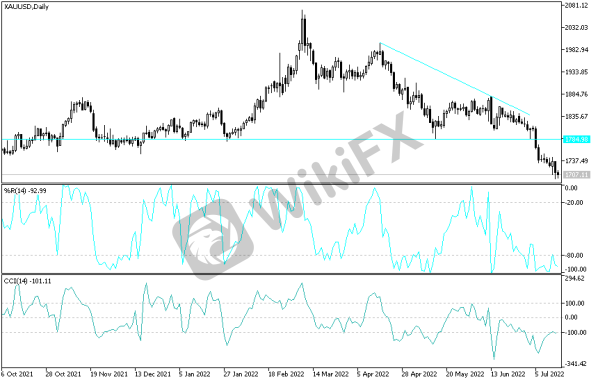

In the near term and according to the performance on the hourly chart, it appears that the price of XAU/USD is trading within a neutral channel formation with a bearish slope. This indicates that there is no clear directional bias in market sentiment. Therefore, the bulls will target a possible bullish breakout around $1,711 or higher at $1,716. On the other hand, the bears will be looking to pounce on short-term profits around $1,702 or lower at $1,697 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a sharp descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will be looking to extend the current declines towards $1678 or lower to $1649 an ounce. On the other hand, the bulls will target long-term profits at around $1,737 or higher at $1,766 an ounce.

Leave a Reply