Gold (XAU/USD) finished the day at $1,792.59 for a 0.54% gain at the time of writing. The yellow metal had a roller-coaster session, reaching a daily high at $1,813.82, then retreating the move down to $1,782.76, on Federal Reserve Chairman Jerome Powell comments at a virtual appearance at the Bank for International Settlements event.

Powell speech: High inflation will likely last well into next year

On Friday, Fed Chairman Jerome Powell commented that the US central bank is on track to begin the bond taper. Furthermore, he added that if the economy evolves as the Fed expected, the QE reduction program will finish by half of 2022. Nevertheless, he reinforced that once the bond taper ends, that would not mean hiking rates afterward.

Regarding inflation, Powell said that inflation would remain higher well into the following year. However, they [Fed] still expect it would move down towards the Fed 2% target. Moreover, he added that “If we [Fed] see persistent inflation, we will use our tools.”

Markets reaction

The US Dollar Index recovered some of its losses but ended the day in the red, lost 0.16%, closed at 93.60. The 10-year benchmark note rate dropped 3.7 basis points (bps) down to 1.638%.

XAU/USD Price Forecast: Technical outlook

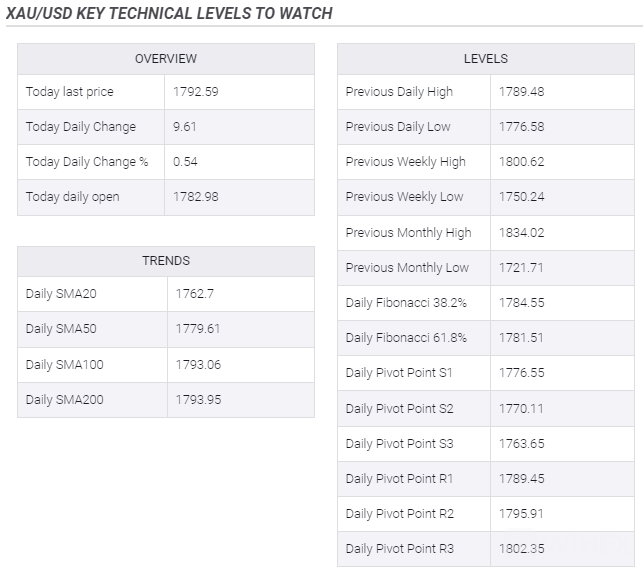

The XAU/USD daily chart depicts that the yellow metal is under heavy selling pressure. The 100 and the 200-day moving averages (DMAs) finished the session on top of the spot price, indicating that gold is under some selling pressure. Momentum indicator like the Relative Strength Index (RSI) at 58 shows the yellow metal is tilted to the upside, but to exacerbate an upward move, it will need a daily close above $1,800.00.

In that outcome, the first resistance level would be the confluence of a downward slope trendline with the September 3 high at $1,833.83. A sustained break above the latter could accelerate the XAU/USD rally towards $1,900.00.

On the flip side, another failure at $1,800.00 will keep gold prices trapped within the weekly range of $1,760.00-$1,800.00 range.

Leave a Reply