Gold prices plunged overnight following US President Joe Biden‘s decision to renominate Jerome H. Powell to head the Federal Reserve as chairperson. While the market largely expected Mr. Biden to do so, speculation that Leal Brainard could take the spot in recent weeks grew going into the decision. That had caused some dovish pressure on markets given Ms. Brainard’s comparatively dovish lean.

Those bets were unwound overnight, with Fed Funds futures pricing in a more aggressive rate hike path following the news. Bullion fell hard against the US Dollar, which was supercharged by the repricing seen in the Treasury market. The rate-sensitive 5-year notes yield rose above 1.3% for the first time since February 2020. A stronger Greenback and higher Treasury rates hurt the non-interest-bearing asset.

The yellow metal may see increased volatility through the coming days as markets digest Biden‘s decision while at the same time unwinding far-shot Brainard bets. Moreover, the Thanksgiving holiday will see a shortened trading week in the United States, which is likely to spur the potential for increased volatility in the broader markets. Gold’s Average True Range – a technical measure of volatility – increased to the highest level since September overnight.

With the political implications over the Chair nomination removed, the Fed may zero in on inflation in a more aggressive manner given current levels. The US consumer price index (CPI) hit 6.2% y/y in October, the highest print in more than 30 years. Rising price pressures are now a key concern among the US voter base, making it a key issue for the Biden administration.

This will likely lead to more political weight on the Fed coming from the executive. The personal consumption expenditures price index (PCE) will cross the wires Wednesday, giving markets an updated view on prices. Analysts expect core PCE – which strips out volatile food and energy prices – to rise at 4.1% for October. That would be up from 3.6% in the prior month.

Gold may fall on a larger-than-expected figure as it would likely bolster rate hike bets further. Fed funds futures reflected a more aggressive path following Bidens announcement, with the chance for a 50 basis point rate hike at the June 2022 FOMC meeting increasing from 17.9% on November 19 to 26.5% on November 22. This week will also see minutes from the latest FOMC board meeting cross the wires. Traders will analyze the minutes for any hints on the potential pace over balance sheet tapering.

GOLD TECHNICAL FORECAST:

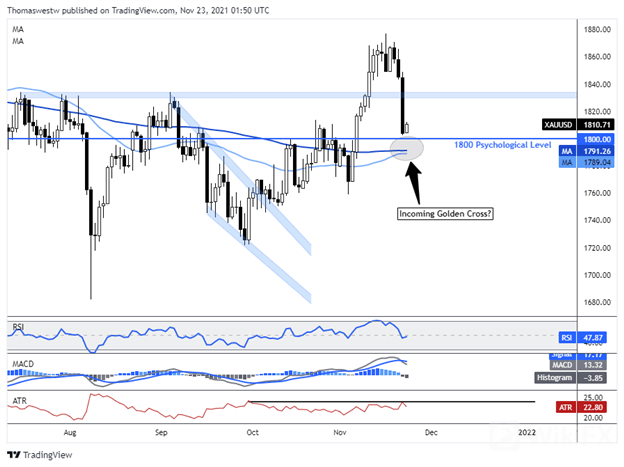

Gold is seeing a small bounce after the overnight drop brought prices near the psychological 1800 level. A potential Golden Cross between the 50- and 200-day Simple Moving Averages (SMAs) remains on the table, although further weakness may see those SMAs diverge. MACD crossed below its signal line, a bearish signal generated by the recent weakness. A drop below 1800 would likely open the door for further weakness.

GOLD DAILY CHART

Leave a Reply