Sterling's strong start to 2022 found further support from higher inflation figures than the market had been expecting. Economists expect additional hikes in inflation. After the recent selling of the GBP/USD pair, which pushed it towards the support level 1.3572, the sterling returned to rise towards 1.3645 amid the factors of the continuous sterling gains.

The UK inflation rate for December was released at 5.4% y/y according to ONS, topping expectations of 5.2% and exceeding 5.1% in November. Core CPI inflation came in at 4.2%, beating market expectations of 3.9%. The numbers that beat expectations – especially the core CPI reading – will increase pressure on the Bank of England to act as inflation is now well above its 2.0% target, boosting the odds of a rate hike in February.

The Bank of England raised interest rates on December 16 due to concerns that inflation in Britain was in danger of anchoring above its 2.0% target and markets are anticipating another rate hike in February.

In fact, markets are now expecting the bank rate to reach 1.25% by 2022.

But there is already a significant level of anticipation regarding the direction of interest rates already included in current GBP values. Accordingly, Audrey Ong, a strategist at Barclays, says that the “strong” adjustment in expectations for higher rates at the Bank of England means that the pound has already achieved “the appreciation we expect for the first half of 2022 as a whole”.

Ong added that the extent to which sterling has risen since the fourth quarter of 2021, and especially since mid-December, makes her cautious about further gains in the near term. Other forex analysts are of the view that sterling may advance further in 2022 amid a combination of strong employment levels, high inflation and a proactive Bank of England.

Economists have warned that inflation is likely to rise further in the coming months as the full impact of the recent rise in energy prices affects consumers. Gas and electricity bills for millions of households are expected to rise 50% or more in April when a biannual adjustment to the energy price cap takes effect.

The government is under pressure to mitigate higher energy prices, with inflation now rising faster than wages. High energy prices, supply chain backups and other issues led the Bank of England to raise interest rates last month for the first time in more than three years, raising costs for borrowers, despite worries about the economic fallout from increased coronavirus cases.

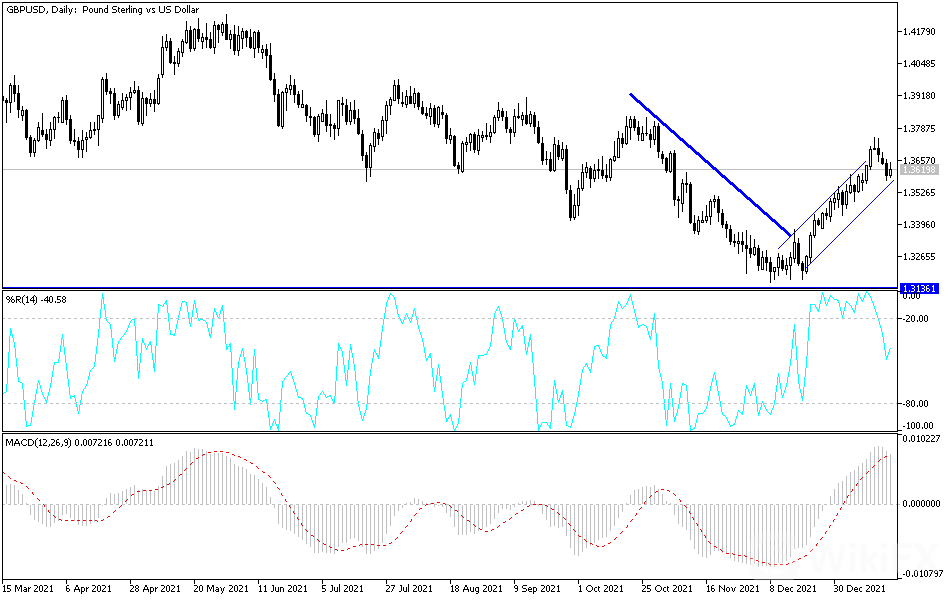

According to the technical analysis of the pair: GBP/USD is trying hard to maintain the path of its ascending channel as shown on the daily chart below. Breaking the resistance of 1.3690 is important for the bulls for more strong bullish launch. On the other hand, the support level is 1.3520, the beginning of the breach of that channel to the bottom. The factors of the sterling's gains are still the strongest, and therefore any chance of a decline may be an opportunity to consider buying. There is a balance in the performance of the currency pair because the reasons for the strength of the sterling are very similar to the reasons for the strength of the dollar.

The sterling dollar pair will be affected today by the extent to which investors take risks or not, as well as the reaction from the results of the US economic data, the number of jobless claims, the Philadelphia manufacturing index, and the US existing home sales.

Leave a Reply