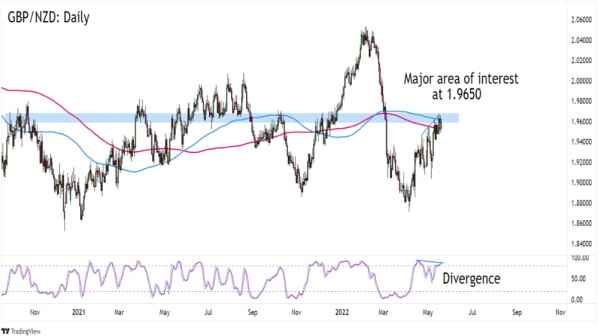

GBP/NZD cant seem to get past the 1.9650 zone!

Will the pair get rejected and see bearish pressure at the level?

Here‘s what I’m looking at today:

GBP/NZD: Daily

The April and May months have been good for the pound, which recovered a bit from its post-Ukraine war selloff and boosted by the Bank of Englands (BOE) interest rate increases.

GBP/NZD is hitting a ceiling at 1.9650, however.

As you can see, the level is near the 100 and 200 SMAs on the daily time frame. More importantly, GBP/NZD bulls and bears have been minding the area since October 2020.

Will the level hold as resistance this time?

The odds are slightly in the bears‘ favor after the U.K.’s inflation rate hit a 40-year high as food and energy prices rocketed.

And while a lot of major economies are experiencing notable inflation rates, it doesnt help the pound that talks of the BOE ending its interest rate increases are hitting the markets.

Meanwhile, the Reserve Bank of New Zealand (RBNZ) will publish its monetary policy decision next week. Word around is that the central bank will raise its cash rate by as much as 50 basis points to fight inflation.

The diverging monetary policy directions can weigh on GBP/NZD, which is already seeing a bearish divergence in the daily time frame.

Look out for rejection at the 1.9650 zone that can drag GBP to previous areas of interest like 1.9325 or even the 1.8900 lows.

If youre not confident about shorting at current levels, you can also jump in only after seeing a bearish momentum.

Not sure where to place your entry and exit levels? Take a look at GBP/NZDs average volatility for clues.

If you want to know more information about the reliability of certain

brokers, you can open our website (https://www.WikiFX.com/en). Or you

can download the WikiFX APP for free through this link

(https://www.wikifx.com/en/download.html). Running well in both the

Android system and the IOS system, the WikiFX APP offers you the easiest

and most convenient way to seek the brokers you are curious about.

Leave a Reply