As the foreign exchange market is mainly composed of liquid assets, the daily turnover of the international market is more than 1 trillion dollars. In comparison with the stock market and bond market, the degree of its reaction to political factors is much greater.

Changes in the international and domestic political situation have a great impact on the exchange rate of a country's currency. If the situation is stable, the exchange rate is stable; if the situation is volatile, the exchange rate falls; if the situation is striving, the exchange rate soars.

When faced with risks, speculators across the world quickly switch from one currency to another for risk reduction, which further increases the volatility of the currency market.

1) Economic situation:

The good or bad comprehensive effect of all aspects of a country's economy is the most direct and main factor affecting the exchange rate of that country's currency. Among the main considerations are the economic growth rate, the balance of payments, inflation level, the level of interest rates, and several other aspects.

2) Military dynamics:

Wars, local conflicts, etc. will cause insecurity in a certain region and will have a negative impact on the exchange rate of the region in question and on the exchange rate of the weaker currencies, while it will be favorable for the exchange rate of the currencies of countries far from the place of the event and traditional safe-haven currencies. For example, the most recent Russia-Ukraine war caused the Eurodollar to drop while strengthening the Australian dollar because Australia is a safer place on the other side of the world.

3) Government and/or Central Bank Policies:

The government's fiscal policy, foreign exchange policy, and the central bank's monetary policy play a very important and sometimes decisive role in the exchange rate. For example, the government announces the devaluation or appreciation of the country's currency; the central bank's interest rates rise or fall, market intervention, etc. As of writing, Americas hawkish policy drove the USD up while the dovish policy of Japan weakened the Yen.

4) Market psychology:

The psychological expectations of foreign exchange market participants seriously affect the direction of the exchange rate. For the appreciation or depreciation of a currency, the market tends to form its own views. In the case of a certain consensus, it will sway the exchange rate for a certain period of time. At times the market psychology could overpower the fundamental theories and even central banks‘ interventions because of the major change in that specific currency’s demand and supply levels.

5) Speculative trading:

With the accelerated process of financial globalization, the amount of international lending capital that flows into the foreign exchange market is becoming increasingly large. These funds are sometimes controlled by certain speculative institutions. Due to their large and mostly hedging transactions, sometimes will have a profound short to medium-term impact on the movement of a currencys exchange rate. For example, quantum funds blocked the British pound and Thai Baht, making their exchange rates depreciate sharply in a short period of time.

6) Contingencies:

Some major unexpected events can have an impact on the market psychology, thus causing changes in the exchange rate, and the extent to which they cause results will also have an impact on the long-term changes in the exchange rate. For example, the 9/11 incident caused the US dollar to depreciate significantly in the short term.

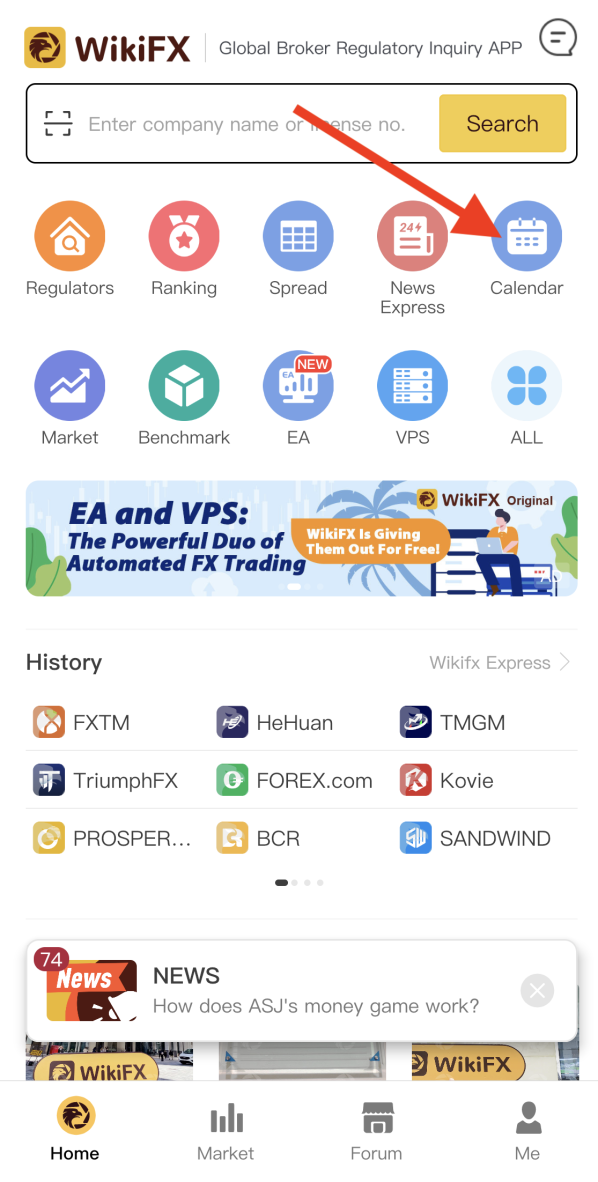

As mentioned above, catching up with the latest market news is an important task for all traders and investors. Conventionally and generally, reading and analyzing the market news can be daunting and time-consuming. However, it is not the case when you have the help of WikiFX.

With the free WikiFX mobile app that can be downloaded for free from Google Play/App Store, users can gain access to the financial calendar, which is an important tool that every trader needs at their fingertips.

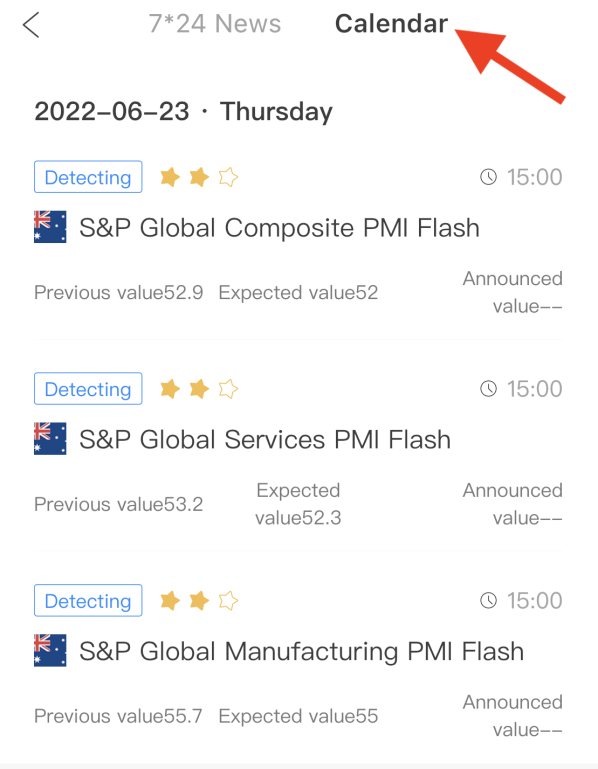

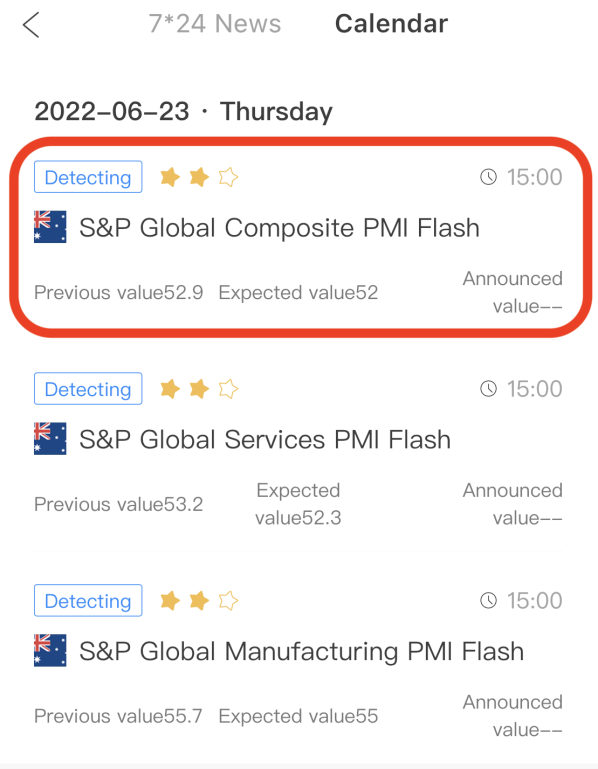

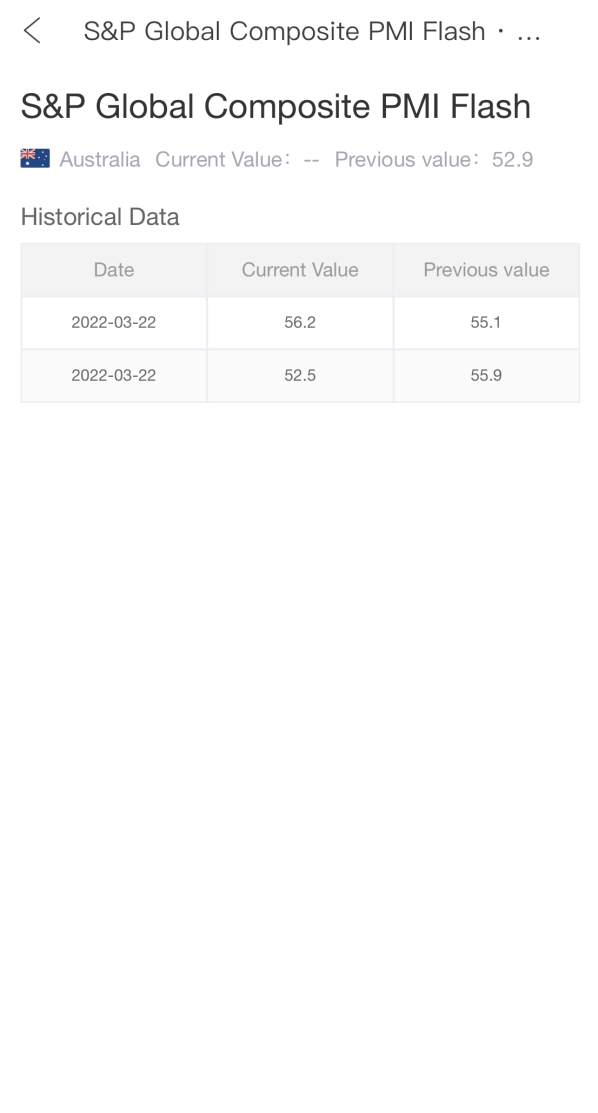

In the financial calendar tool, not only can users see the dates and times of impactful economic events that are coming soon, but they can also identify the level of importance of that specific event in order to plan their trades carefully.

When users click on the event itself, they can see more details, such as the previous value, projected value, and the actual announced value (during the event itself).

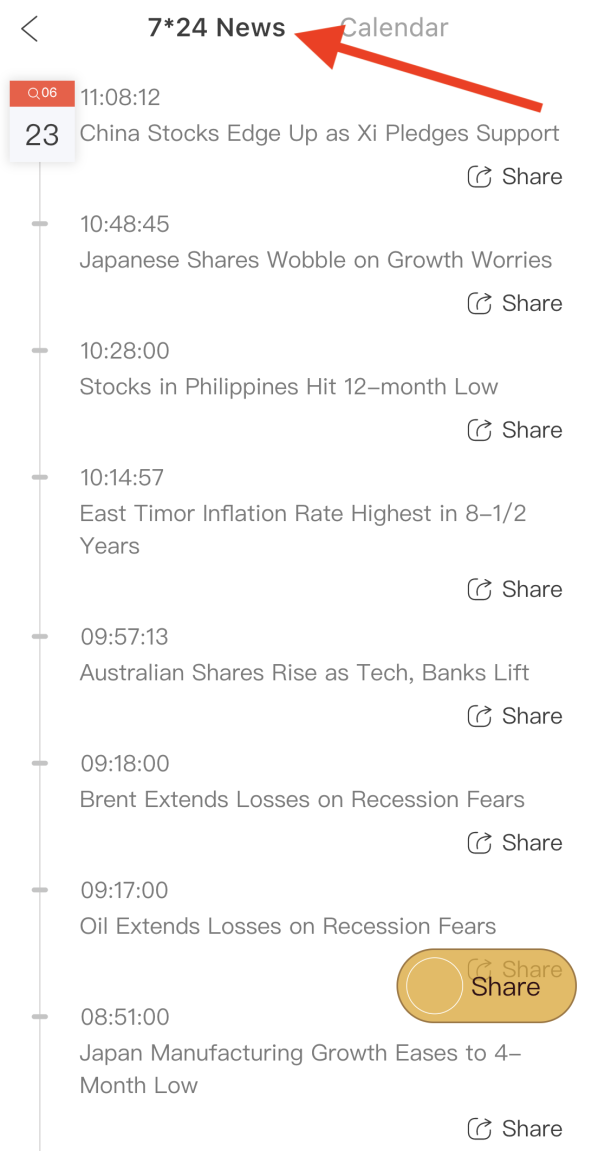

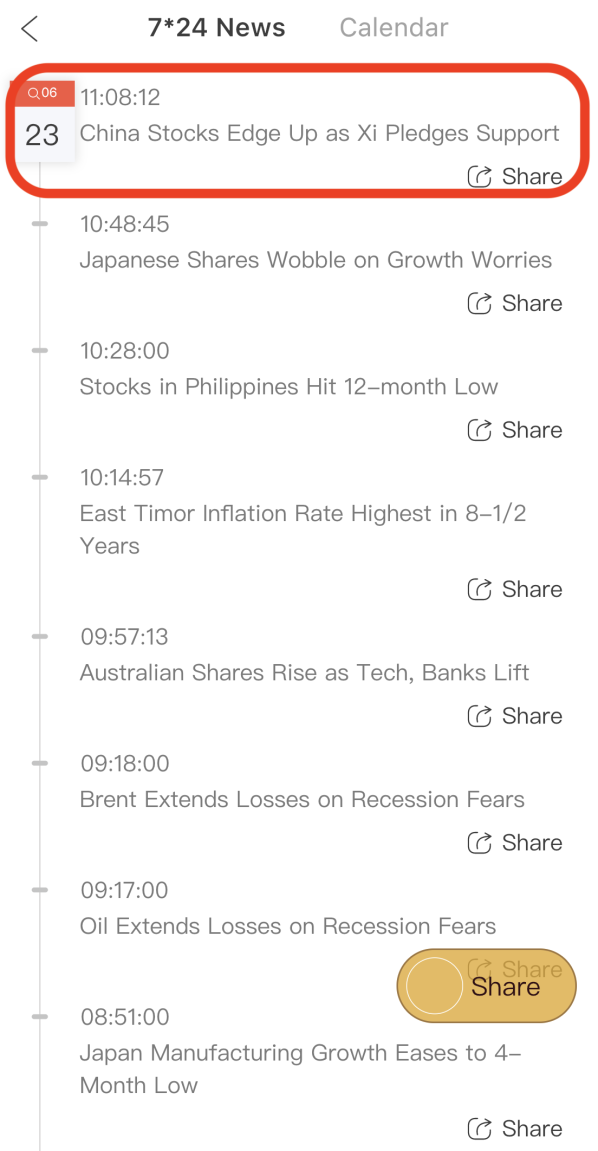

On the other hand, the 7*24 news section eliminates the complexity of financial news so traders can easily understand the latest happenings without overwhelming financial jargon. See how WikiFX has easily simplified the news into 1 single statement?

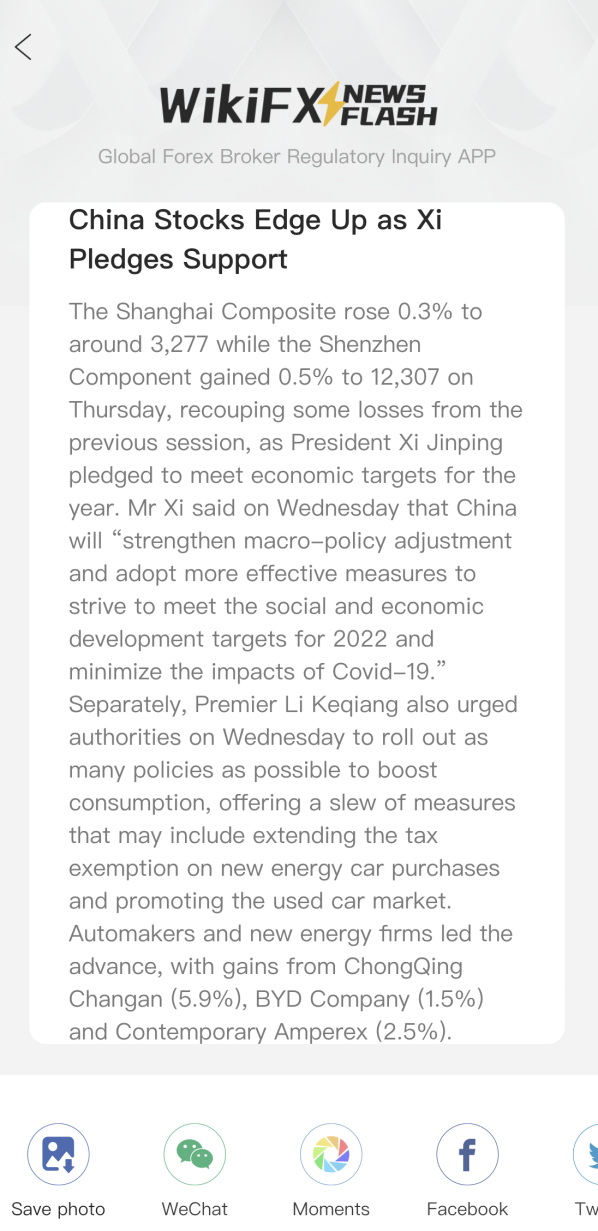

When traders click on the header, they can see a more elaborated version of that news.

The main role of fundamental analysis is to give investors a clearer understanding of the current state of the market so that we can better keep pace with the market, make trading strategies to adapt to the market, and adjust our trading plans according to the new situation with risk management, rather than predict the future of the market.

Leave a Reply