Former JPMorgan traders Gregg Smith and Michael Nowak, who were convicted of fraud and spoofing, are attempting to stop the US government from altering the definitions of the charge.

Documents submitted by the defendants with the Illinois Northern District Court demonstrate this.

Smith and Nowak jointly ask the Court for an injunction blocking the government from what the traders describe a “belated and unjust effort to modify their accounts of the crime behavior”. According to the defendants, the government should not be allowed to extend their versions of the offending behavior now, three months late, with the presentence reports and sentencing memos coming in a couple of weeks.

On December 22, 2022, three months after the deadline of September 21, 2022, and without seeking the Court's leave or the Defendants' consent—the government submitted to the Probation Office a declaration of Prof. Venkataraman, more than twice the length of each of its versions, and containing broad, unclear, and novel analyses of a vast universe of purported spoofing sequences, which Defendants would need to parse and reproduce to be able to address. The government presented no justification for failing to fulfill the Court's deadline of September 21, 2022.

The traders argue that the government's attempt to avoid Court-ordered deadlines by revising its versions of the offense conduct now—during the end-of-year holidays and with only weeks before the presentence reports and sentencing memoranda are due—unfairly prejudices the defendants, who will not have an adequate opportunity to respond on the current schedule, including because the Probation Office will not have time to fairly consider such responses.

As a result, the dealers want the Court to prevent the government from modifying its interpretations of the crime behavior at this late point.

Let us recall that in August 2022, a federal jury in the Northern District of Illinois convicted Smith and Nowak, former JPMorgan Chase & Co. precious metals traders, of fraud, attempted price manipulation, and spoofing in a multi-year market manipulation scheme involving thousands of illegal trading sequences.

Gregg Smith was an executive director and trader on JPMorgan's precious metals desk in New York, according to court records and testimony produced at trial. Michael Nowak was a managing director at JPMorgan who oversaw the firm's worldwide precious metals department.

The evidence at trial established that the defendants, together with other traders on the JPMorgan precious metals desk, participated in a pervasive spoofing, market manipulation, and fraud conspiracy between roughly May 2008 and August 2016. The defendants executed orders that they planned to cancel before to execution in order to push prices on orders that they meant to execute on the other side of the market.

The defendants participated in thousands of misleading trading sequences for gold, silver, platinum, and palladium futures contracts traded on CME Group Inc.'s commodities exchanges, the New York Mercantile Exchange Inc. (NYMEX) and Commodity Exchange Inc. (COMEX). These fraudulent orders were designed to flood the markets with false and misleading information regarding actual supply and demand for precious metals futures contracts.

Smith was found guilty of one count of attempted price manipulation, one count of spoofing, one count of commodities fraud, and eight counts of wire fraud impacting a financial institution after a three-week trial. Nowak was found guilty of attempted price manipulation, spoofing, commodities fraud, and ten counts of wire fraud impacting a financial institution.

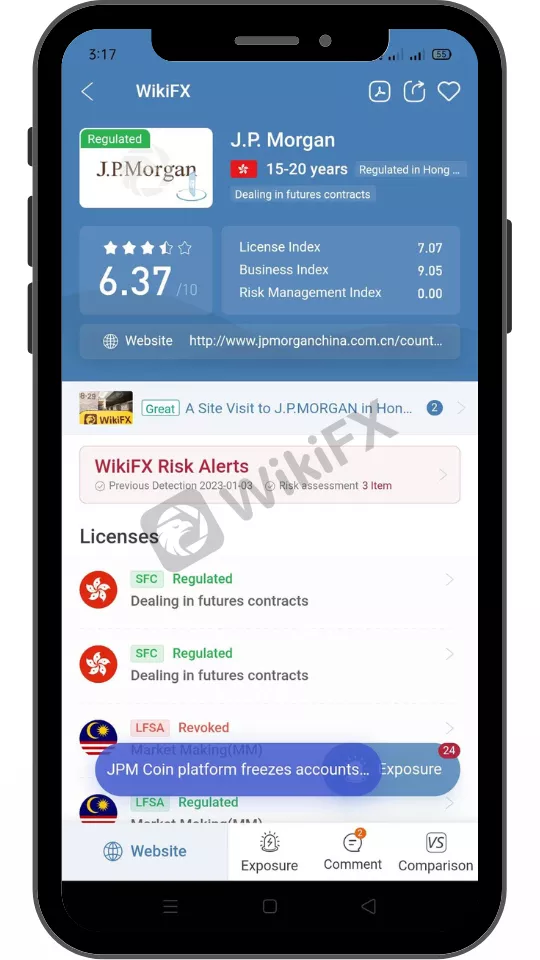

Find out for more JPMorgan news here: https://www.wikifx.com/en/dealer/8981623292.html

Keep an eye out for more Forex news.

Download and install the WikiFX App from the link below to remain up to speed on the newest news even while you're on the road.

Download link: https://www.wikifx.com/en/download.html

Leave a Reply