Non-farm payrolls (NFP) data include non-agricultural employment, unemployment rate, average hourly wage growth rate, employment rate, labor force participation rate, etc., and are divided into previous, expected, and published values.

The NFP reports are compiled on a monthly basis, with the previous month's statistics released at the beginning of each month. The U.S. non-farm employment data is released on the first Friday of each month at 08:30 a.m. Eastern Time (Daylight Saving Time) by the Bureau of Labour Statistics of the U.S. Department of Labour for the previous month.

The NFP data reflects the current employment situation in the manufacturing and service sectors in the U.S. and is an important indicator for the Federal Reserve Board (Fed) to assess the overall U.S. economic situation and adjust monetary policy.

The main goal of the Federal Reserve Board (Fed) is to control inflation and stimulate employment, so in the formulation of monetary policy, non-farm employment data is one of the key data to be considered. Therefore, the monthly release of non-farm payroll data will attract high market attention. Non-farm payrolls generally release three values: the number of new jobs, the unemployment rate, and the employment rate, of which the number of new jobs and the unemployment rate are the most important.

The difference between the actual and expected values of the monthly non-farm employment data will usually trigger greater volatility in the financial market, and the greater the difference, the greater the volatility in the financial market.

A decrease in non-farm employment means the economy is slowing down or in recession. On the contrary, if the number of non-farm employment grows significantly, it means that the employment situation is good, which can raise the consumption level and drive the positive development of the economy. Therefore, good non-farm employment data has a very important impact on the exchange rate of the U.S. dollar and vice versa.

Therefore, the time before and after the release of the non-farm payroll data is likely to cause greater volatility in the foreign exchange market, commodities, America's stock market, and any relevant financial market.

Traders can then analyze the market's reaction based on the difference between the actual published value and the previous and expected values, and further, evaluate the trend of foreign exchange prices and take advantage of this increased price volatility.

WikiFX's financial calendar is a free tool that can be utilized by investors and/or traders to stay up to date with all economic events, especially high-impact ones like the NFP report.

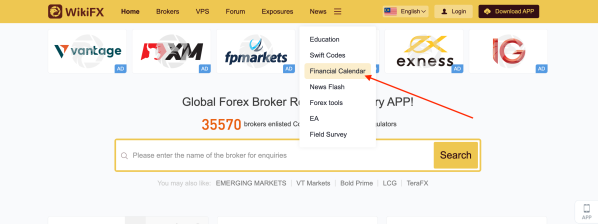

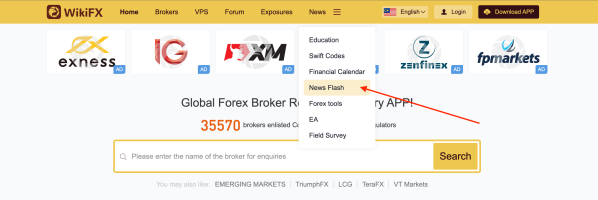

On the homepage of www.wikifx.com, head to the “news” section and then select “financial calendar” in the dropdown menu.

You could also use this link (https://live.wikifx.com/en/calendar.html) to head directly to WikiFX's financial calendar tool.

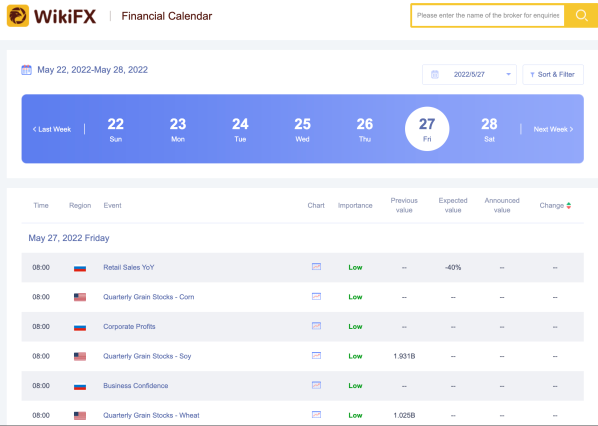

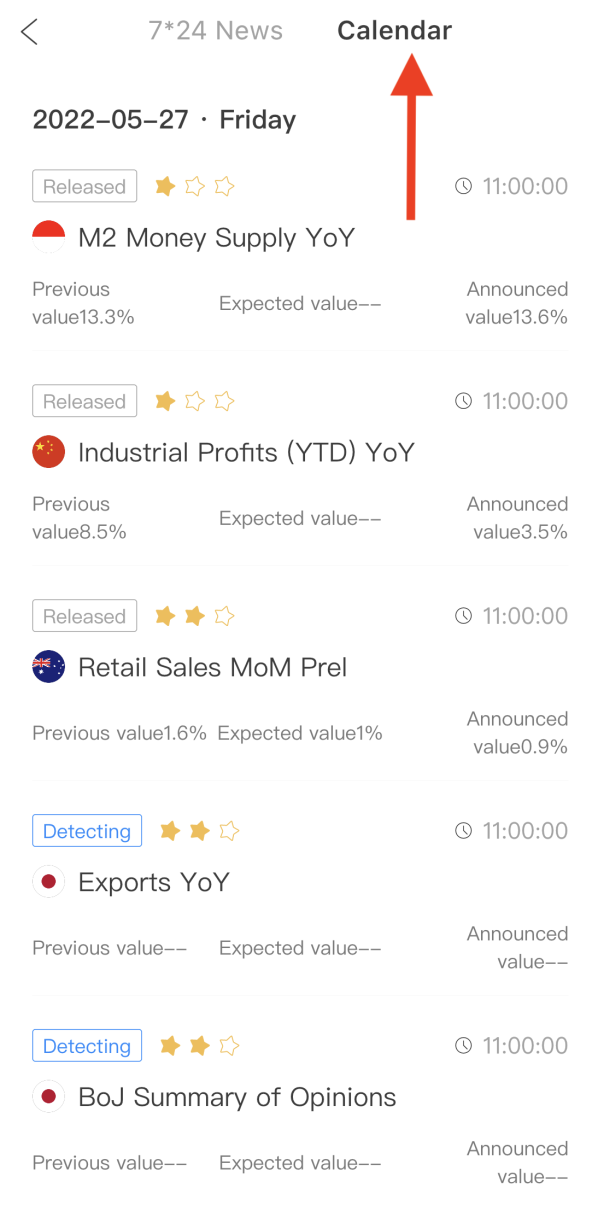

All events are displayed in chronological order along with their level of importance, previous value (from the earlier month), expected value, and the actual announced value and degree of changes.

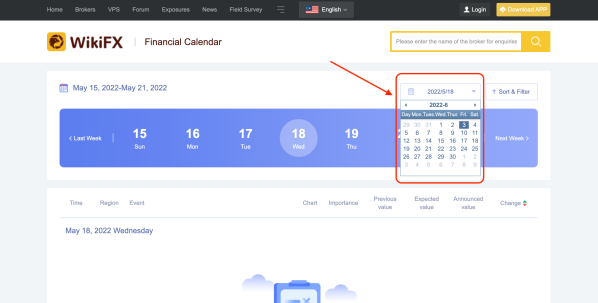

On the top right, select the date of your choice here.

You could easily backtrack to look at past events or check upcoming events in the (near) future.

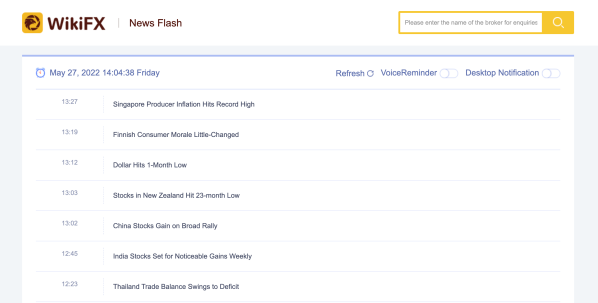

Another function that goes hand-in-hand with the WikiFX financial calendar tool is the 24/7 News Flash section (https://live.wikifx.com/en/7×24.html)

The WikiFX News Flash section allows users to set voice reminders and desktop notifications so they will never miss out on any important economic events.

This News Flash section is also handy for traders that do not have time to read through lengthy jargon-filled financial articles as they could be informed of the latest changes in just under one sentence.

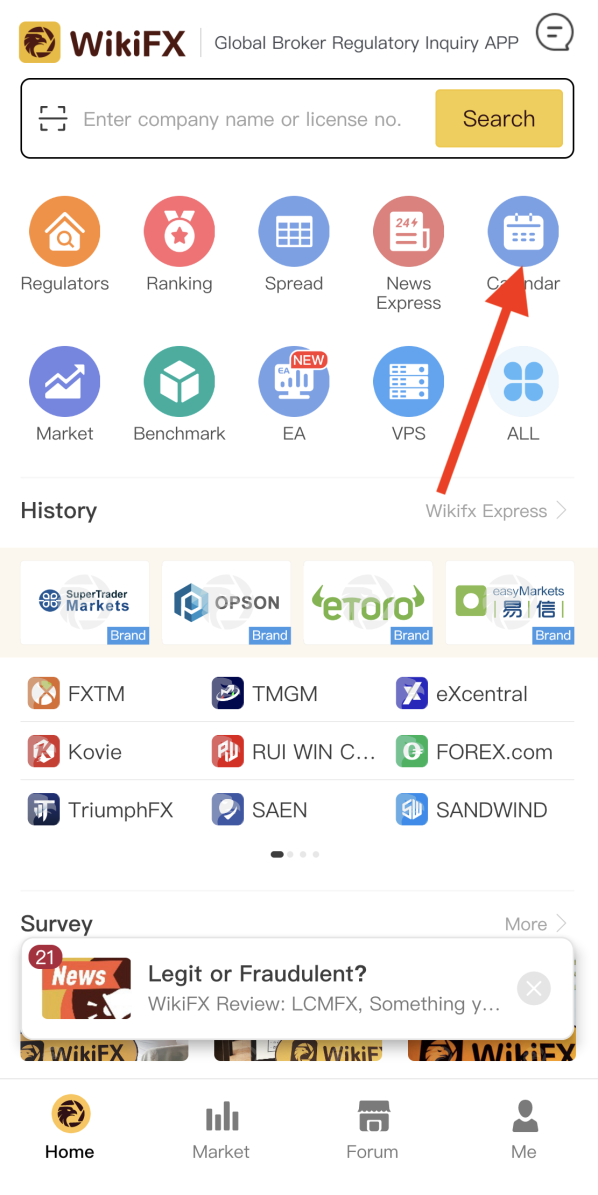

Both WikiFX's financial calendar and news flash functions are available on the WIkiFX free mobile app too – download now at Google Play at App Store.

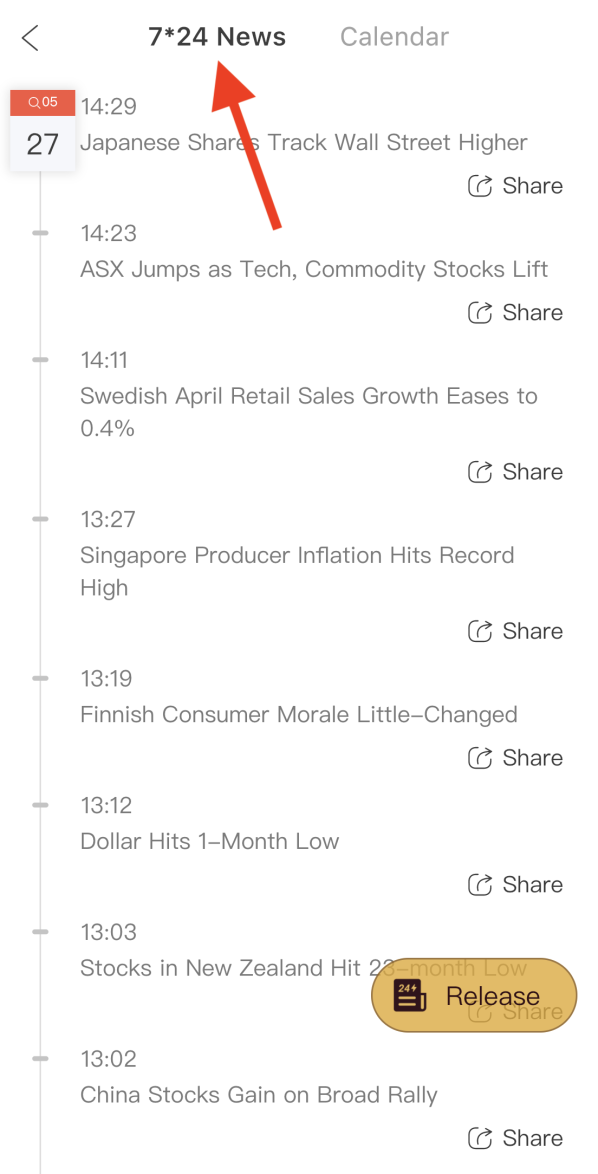

On the WikiFX mobile app, the 7*24 News Flash and Financial Calendar functions are located side by side.

With just a single scroll, you will be able to catch up with all the latest happenings that happened and are going to happen. No more being caught off-guard by the “sudden” changes in the currency markets that could cost you unnecessary losses or miss out on golden trading opportunities unknowingly.

Leave a Reply