As opposed to the centralized exchange model used for stocks, Forex is run as a decentralized over-the-counter (OTC) transaction, operating 24 hours a day, five days a week, with four major markets, namely Sydney, Tokyo, London, and New York.

The currency code usually has three letters, and the exchange rate is a pair of two currencies, such as “EUR/USD” which is the Eurodollar to the U.S. dollar. The former is the base currency and the latter is the counter currency. When the pair is traded, the base currency is used as the standard, e.g. how much USD can be exchanged for one Eurodollar.

With so many online Forex brokers offering their FX services, the cost of trading is often the primary consideration for retail investors. Investors can determine the cost of trading through spreads.

What is spread?

The “pip” in “spread” refers to the unit of currency movement in the foreign exchange market quotes. In order to accurately represent the exchange rate, almost all currency pairs are quoted in five digits. A pip is equal to 0.0001, and a pip is used as a unit for buying and selling.

As its name implies, the “spread” is the “difference in points”, that is, the difference between the bid price of the buyer and the ask price of the seller.

Spreads fluctuate with the market and are influenced by factors such as currency liquidity, transaction amount, market direction, and investment strategy, with currency liquidity having the greatest impact. Generally speaking, the higher the currency liquidity, the smaller the spread. From a traders perspective, the lower the spread the better because that is equivalent to a smaller loss and a bigger profit.

For a more detailed explanation about spreads, read this article here: https://www.wikifx.com/en/newsdetail/202206215324873095.html.

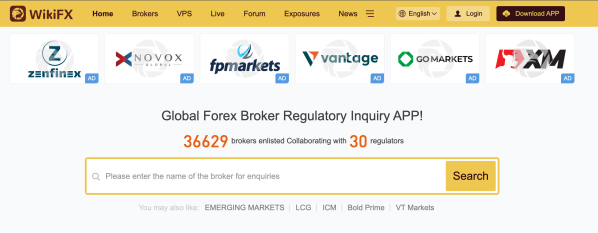

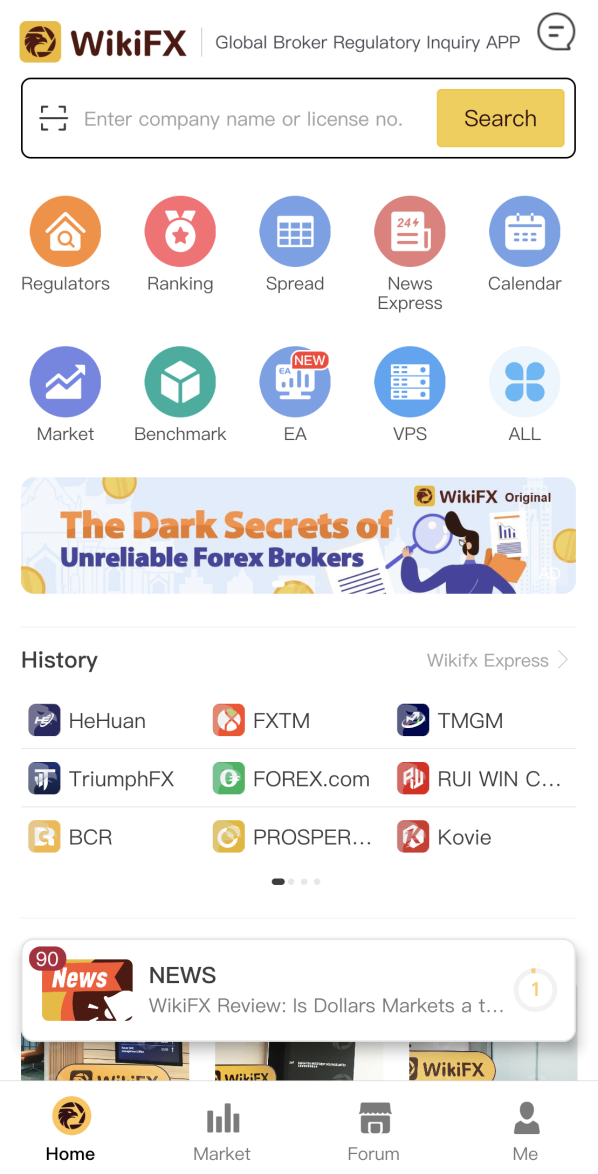

Moreover, new forex traders need to seek a reputable and established forex broker to set up their trading accounts. This is a crucial step because engaging the wrong broker could become a costly mistake. For newbies especially, you do not want to start on the wrong foot and be forced out of the game before it begins. To do this, all you need is to download the WikiFX app from Google Play/App Store or log on to www.wikifx.com.

WikiFX is your one-stop forex broker solution platform that specializes in providing verified information related to not just forex brokers but FX trading as well. At WikiFX, we make it easy for users to research, survey, and compare forex brokers at ease with just a few clicks. Our database holds information of over 36,000 forex brokers (to date) and we work closely with 30 national regulators in protecting our users.

All you need to do is open the WikiFX application and utilize the search bar fully to your advantage. Type in the name of the broker that you would like to learn more about then look at its profile.

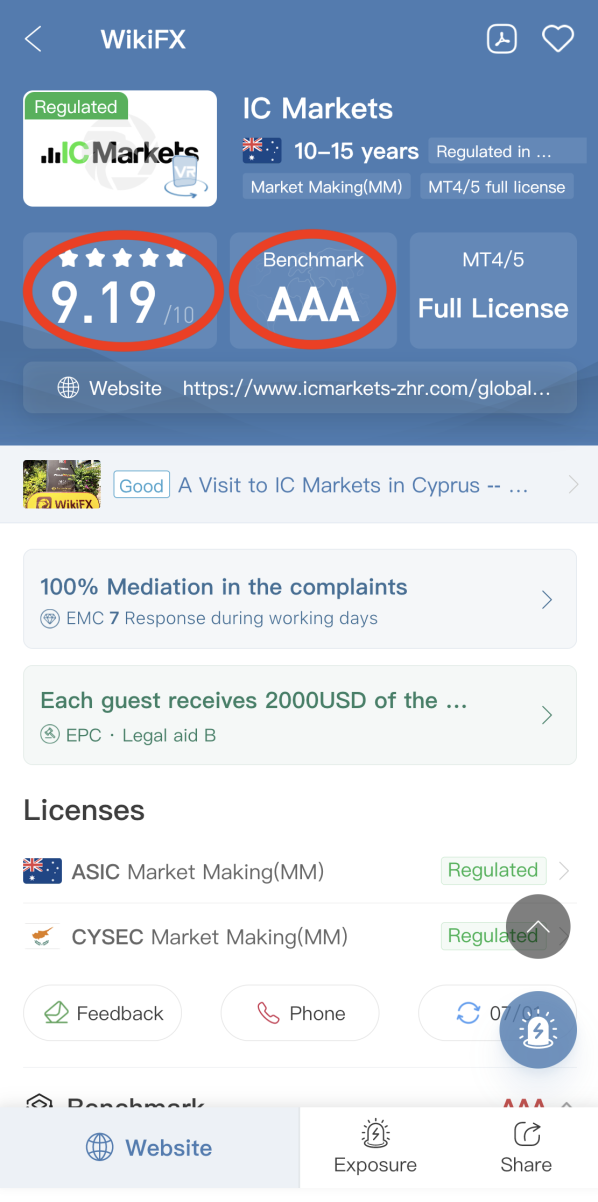

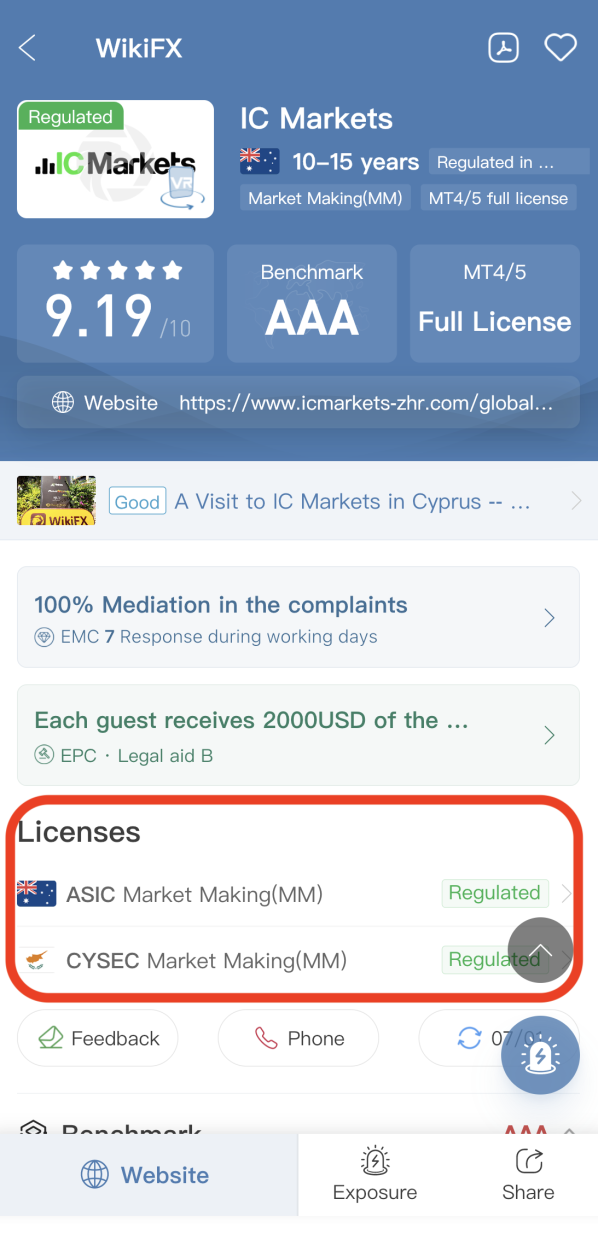

It is important to choose a FX broker with a high WikiFX score because it means this broker has passed a few aspects of verification and is relatively reliable among its peers.

Next, it is also important to check a brokers regulatory statutes and licenses that it holds. Make sure to check their legitimacy and validity.

On the WikiFX app, you can do this by simply clicking here:

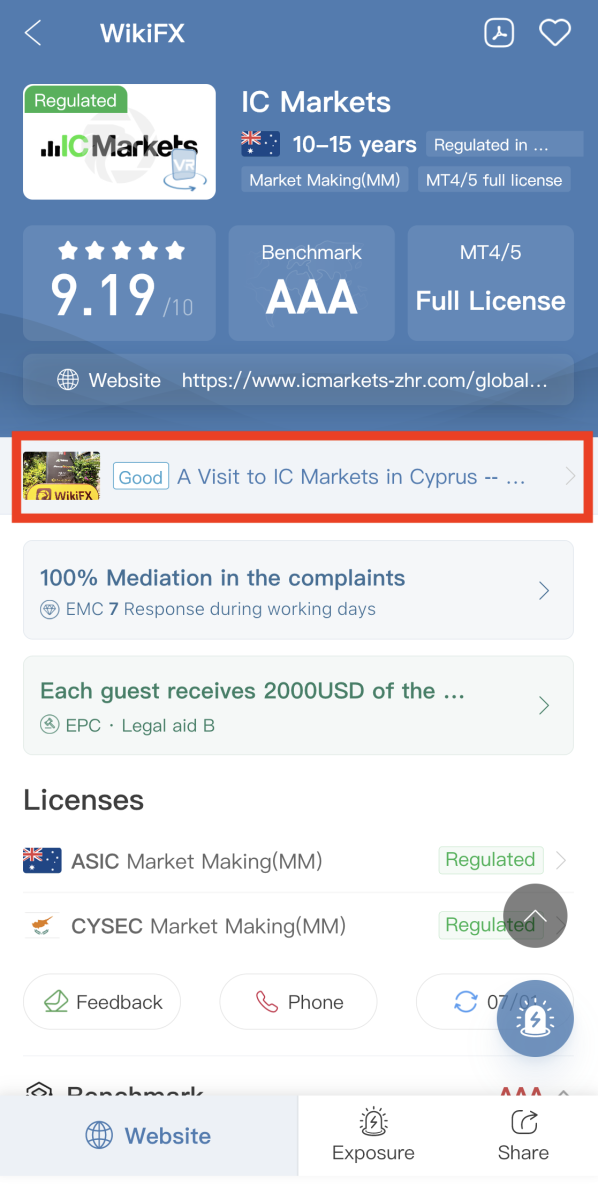

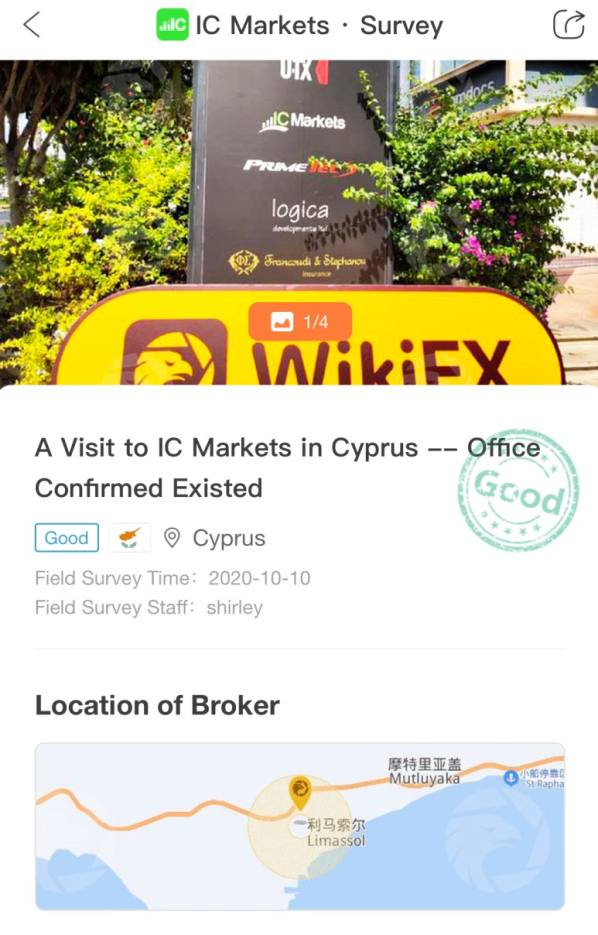

Next, watch out for the WikiFX field survey documentation. This is one of the special features of WikiFX wherein we send our research team to visit brokers at their registered business addresses to prove that they have a real business premise.

Make sure the broker of your choice does possess these qualities to avoid falling into the traps of some malicious forex brokers.

Another useful tool curated by WikiFX for newbie traders is the Education section: https://www.wikifx.com/en/education/education.html.

We know that there is a myriad of forex trading courses available online. Some are offered for free but some come with hefty price tags. WikiFX offers this FX course completely for free in a well-planned manner. Tailored for traders with different levels of knowledge and experience, there are a total of 7 levels for users to choose from.

For more tips on improving your FX trading skills, read this article here: https://www.wikifx.com/en/newsdetail/202206249704114920.html

A gentle reminder to end this article:

As FX trading newbies, your focus should be on learning and practicing, instead of chasing quick profits. Slow progress is fast improvement in Forex trading as long as you are patient enough throughout the learning process.

Leave a Reply