Despite the fact geopolitical fears were still a big concern last Friday in view of the Ukraine crisis, the summit between US President Joe Biden and Russian President Putin yesterday has provided a boost to the euro (EUR) and pound (GBP), creating a good tone for all risk assets as the week begins.

“We are committed to pursuing diplomacy until the moment an invasion begins,” said White House press secretary Jen Psaki in a statement yesterday. Psaki announced that US Secretary of State Antony Blinken and Russian Foreign Minister Sergey Lavrov plan to meet in Europe later this week, “provided Russia does not proceed with military action”.

EUR and GBP also received another boost following the release of flash Purchashing Managers Index (PMI) data in Europe and the UK, which revealed a strong performance from the services sector. The better-than-expected results also reflected a boost in consumer demand in the travel, leisure and entertainment sectors following the ease in Omicron-variant restrictions.

On the monetary policy front, JP Morgan has updated its forecasts on the interest rate-hiking cycle. Its analysts are now expecting nine rate hikes totalling 25 basis points (bps) to come into force by March 2023.

The US financial markets are closed today in observance of Presidents Day, meaning there is no particular market-moving data coming out today.

Forex markets today – 21 February 2022

In the forex market, the US dollar (DXY) is down by about 0.3%, sliding to 95.77 by 11:00 UTC to lose ground against all G-10 currencies.

The euro (EUR) and the British pound (GBP) both gained 0.3% versus the US dollar (USD), boosted by optimistic early data on February services PMIs.

The IHS Markit Services PMI for the eurozone rose to 55.8bps in February 2022, the highest level in three months, up from 51.1bps in January and exceeding projections of 52bps. The IHS Markit/CIPS UK Services PMI

The Australian dollar (AUD) strengthened by 0.4% against the USD, owing to a rebound in risk appetite.

Meanwhile, the New Zealand dollar (NZD) was also up by 0.3% as markets anticipate the Reserve Bank of New Zealand‘s (RBNZ’s) decision on interest rates on Wednesday. Interest rates could rise by 50bps after data

Traditional safe havens the Japanese yen (JPY) and the Swiss franc (CHF) both gained traction against the dollar after US Treasury rates fell sharply, reducing rate differentials in the bond market.

The Norwegian krone (NOK) is today's G-10 best perfomer, rising by 0.5% versus the dollar after being among the worst-performing currencies on Friday. The Canadian dollar (CAD) remain unchanged.

EM currencies performances

In emerging markets (EM), the South African rand (ZAR) outperformed, rising 0.3% on the day due to stronger precious metals prices and expectations of more rate rises next month.

The Korean won (KRW) edged up by 0.3% as risk mood recovered in Asia.

The Russian ruble (RUB) also gained 0.2% versus the dollar amid hopeful expectations of a diplomatic solution to the Ukraine conflict.

The Turkish lira (TRY) did not join the EM–FX rally as the Central Bank of Turkey held interest rates steady at 14.5% on Friday even in the face of rising inflation and geopolitical worries.

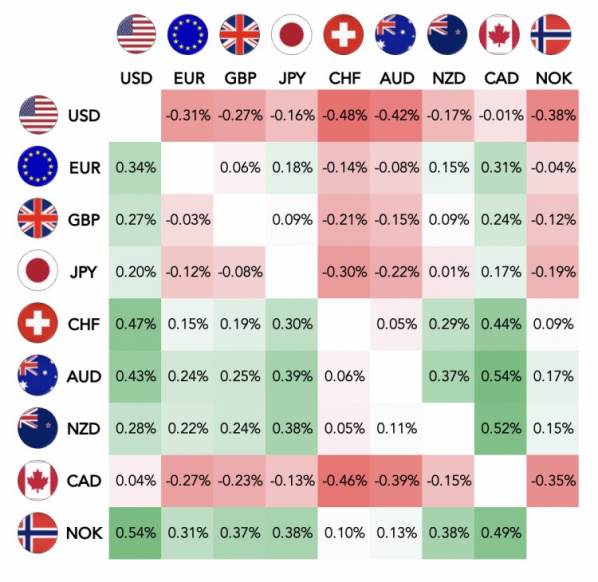

Performance matrix of major currencies – 21 February 2022

Performance matrix of major currencies as of 21 February 2022, 11:00 UTC – Credit: capital.com

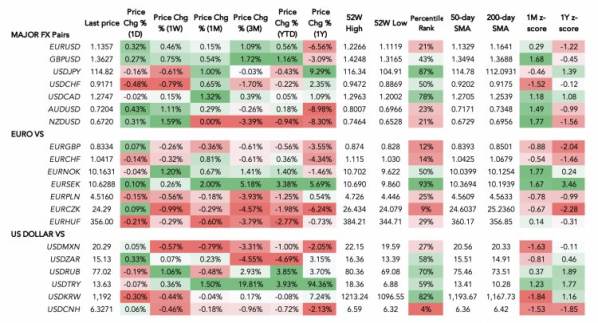

Forex performance heatmap – 21 February 2022

Forex performance heatmap as of 21 February 2022, 11:00 UTC – Credit: capital.com

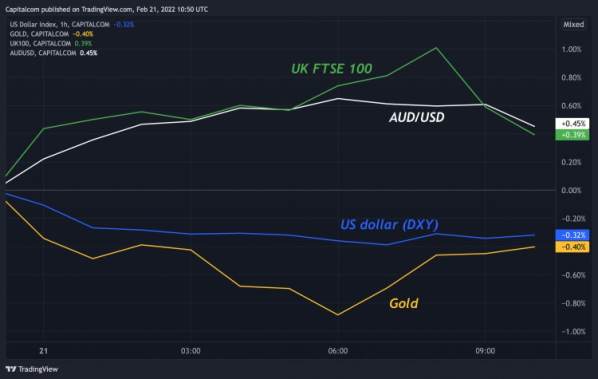

Chart of the day: News of a Biden–Putin summit provides relief for risky assets

AUD/USD and FTSE 100 rose while gold and DXY weakened overnight as Biden and Putin agreed on a summit – Credit: Capital.com / Source: Tradingview

US dollar today – 21 February 2022

-

The US Dollar Index (DXY) was at 95.80 at the time of writing, flat on the day.

-

At the 2022 US Monetary Policy Forum, Federal Reserve (the Fed) governor Lael Brainard issued a speech concerning the role of the US dollar in an increasingly digitised world.

The Fed governor stated: “It is prudent to consider how the potential absence or issuance of a US central bank digital currency (CBDC) could affect the use of the dollar in payments globally in future states where one or more major foreign currencies are issued in CBDC form.”

Brainard encouraged the US to remain at the forefront of CBDC research and policy development in order to address it.

-

Last week, Federal Reserve Bank of St Louis president and CEO James Bullard delivered another hawkish message, highlighting increasing inflationary risks should the Fed refrain from hiking rates quickly.

Bullard urged the Fed to start reducing its balance sheet in the second half of this year and provide 100bps rises by July. Additionally, he believes that a more-persistent-than-expected inflation may warrant the need to hike rates beyond the Federal Reserves neutral target (2%).

-

Fed futures are now pricing only a 17% chance – down from 60% a week ago – of a 50bps hike in March, according to the latest CME Group FedWatch tool.

-

US Treasury yields continue to soften. The yield on two-year notes eased to 1.47%, while yields on the 10-year maturity slipped to 1.93%, down from a high of 2.06% last week.

US dollar (DXY) technical levels

-

52-week high: 97.38

-

52-week low: 89.49

-

50-day moving average (one-day chart): 95.93

-

200-day moving average (one-day chart): 93.83

-

14-day relative strength index (RSI) (one-day chart): 59

Leave a Reply