The positive results of US economic data balanced out expectations of raising interest rates. The European Central Bank will be continuing its policy for a longer period, especially since Europe leads the new global infections with the coronavirus. This is a bearish environment for the EUR/USD pair, which fell to the 16-month low 1.1186 support level, before settling around the 1.1205 level as of this writing.

According to the official numbers, US economic growth slowed to a modest 2.1% annual rate in the July-September quarter according to the second reading of government data, slightly better than its first estimate. But economists have expected a strong rebound in the current quarter as long as rising inflation and the recent spike in COVID cases do not hamper activity.

The US Commerce Department reported that the increase in GDP, the economy's total output of goods and services, was up from an initial estimate of 2% for the third quarter. But the adjustment is still well short of the strong gains of 6.3% in the first quarter of this year and 6.7% in the second. The slight increase from preliminary GDP estimates a month ago reflected a slightly better performance in consumer spending, which grew at a still-weak 1.7% rate in the third quarter, compared to a 12% increase in the April-June quarter. The contribution to GDP from restocking business inventory has also been revised upwards.

With Germany nearing the 100,000-death mark from COVID-19, the country's prospective leader has announced plans to establish a team of experts at the heart of the next government to provide daily scientific advice on the response to the coronavirus pandemic. The measure, along with the creation of a permanent emergency committee, was announced by Olaf Scholz of the centre-left Social Democrats, at the start of a news conference outlining the deal in which his party and two others agreed to form a new government.

“Unfortunately, the Corona virus has not yet been overcome,” Schulz stated. And “every day we see new records in terms of the number of injuries.”

German officials – from outgoing Chancellor Angela Merkel to state governors and the three parties now poised to power – have been criticized for failing to take decisive steps to flatten the contagion curve during the transitional period since the general election in September. Doctors and virologists have warned for months that Germany faces a surge in new infections that could overwhelm the health care system, even as top politicians loom the possibility of further lifting of epidemic restrictions. Resistance to vaccinations – including those developed by German company BioNTech with US partner Pfizer – remains strong among a large minority in the country. Vaccination rates have stopped at 68% of the population, well below the 75% or higher the government is targeting.

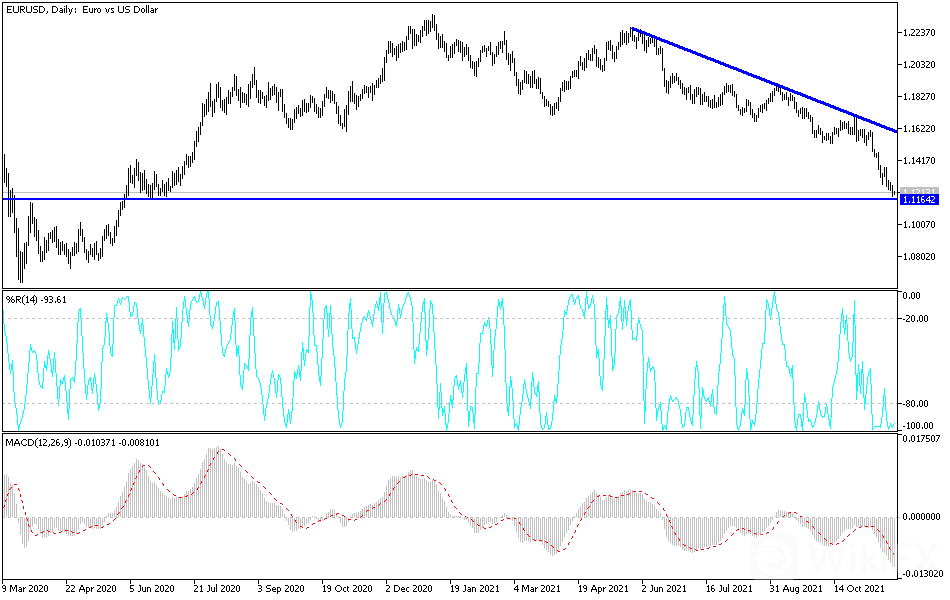

Technical Analysis

The general trend of the EUR/USD currency pair is still bearish and it must be taken into account that the American holiday may affect the currency pair by moving in narrow ranges around its recent losses. Bears seem uncconcerned about the technical indicators moving towards oversold levels, and the focus is now on the support levels 1.1165 and 1.1080 to push towards the 1.1000 psychological support.

On the upside, and according to the performance on the daily chart, the bulls are rushing towards the resistance levels 1.1382 & 1.1490 to break through the current general bearish trend. In the absence of US economic releases, the focus will be on the European side. The growth rate of the German economy will be announced, the German GFK index reading, and then expected statements from European Central Bank President Lagarde.

Leave a Reply