The euro fell again on Friday and even closed at the very low of the range. As we are exiting the week at roughly 1.1250, I cannot help but think there are multiple things going on that are decidedly negative for the euro, both from a fundamental and a technical standpoint.

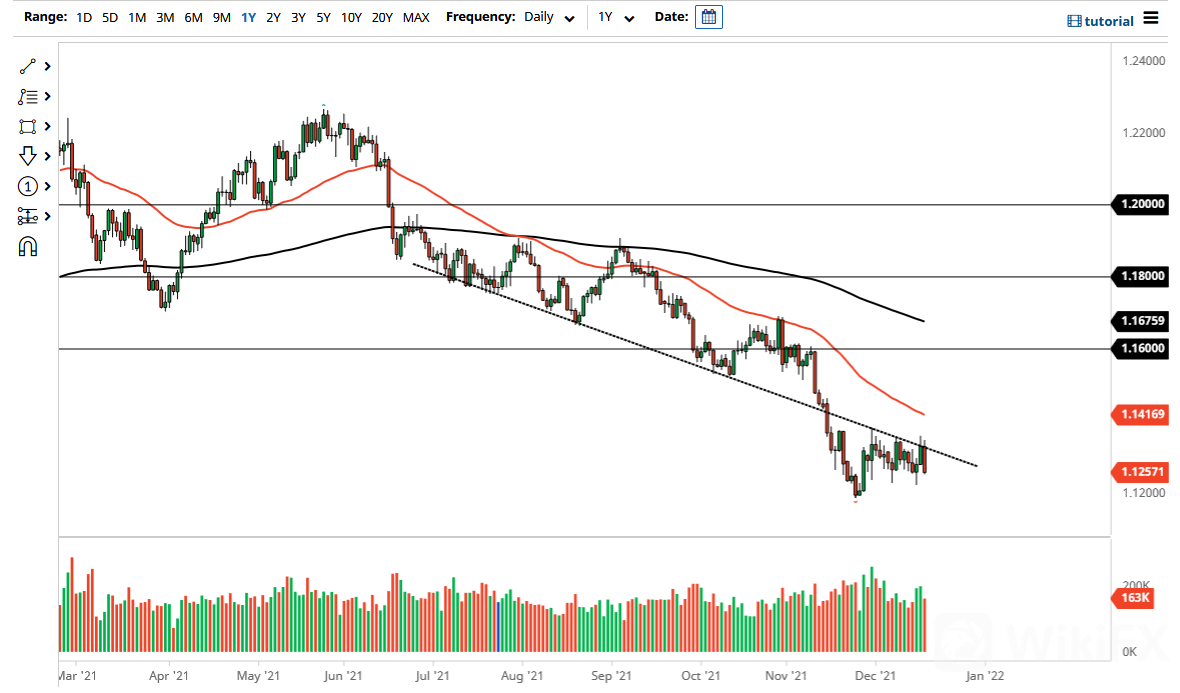

From the technical standpoint, we have been in a downtrend for a while. We also have a downtrend line that I still have on the chart, which has offered resistance. The 50-day EMA is currently sitting that the 1.1416 level and sloping lower, which will attract a lot of negative pressure. That being said, there is the 1.12 level underneath that seems to be rather supportive, but it must be noted that we have tried to break down below there multiple times over the last couple of days. In other words, you need to believe that there is a real possibility that the support will finally give up.

If we were to break down below the 1.12 handle, then it opens up a move to the 1.10 level rather quickly. I am not necessarily calling for that, but the way we are closing out the Friday session certainly suggests that is a real possibility. The market has been falling for a while, but we could also be trying to establish some type of range between now and New Years Day as traders walk away from the markets.

The European Central Bank finally admitted that there was something called “inflation” in the European economy but stopped short of actually doing much about it. It is because of that lack of action that the euro got eviscerated on Friday. When you contrast that with the Federal Reserve, it is a stark difference to say the least. The Federal Reserve is threatening as much as six interest rate hikes over the next two years, while tapering bond purchases. Furthermore, you have Germany looking to lock itself down again and Austria doing the unthinkable and segregating their population. Europe has a very serious issue when it comes to power, as natural gas continues to be a main source of headache for the Europeans, but just energy in general has been an issue. Economies needs energy to run, so obviously something needs to be figured out and quickly.

Leave a Reply