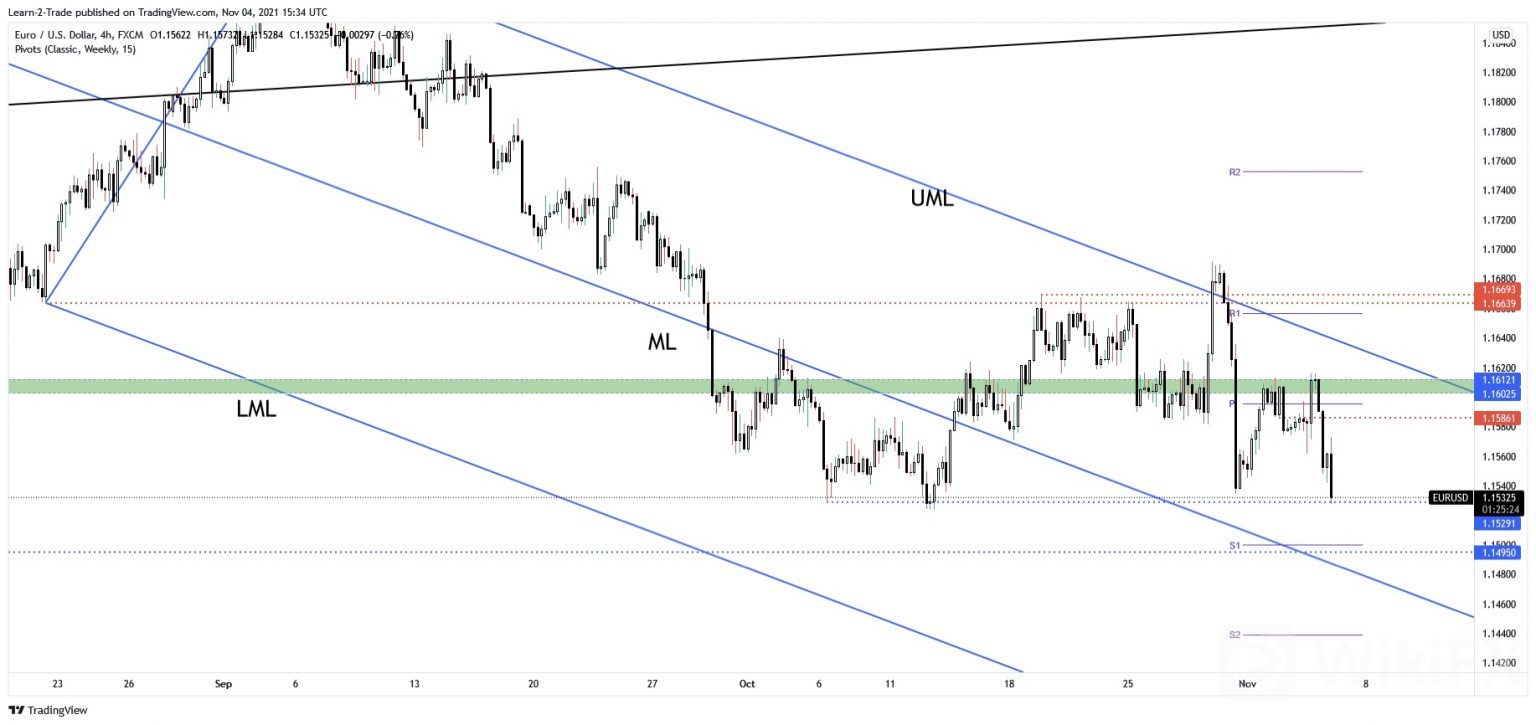

The EUR/USD forecast sees the pair registering a massive drop to as low as 1.1528 level. It has slipped below the 1.1529 downside obstacle.

Still, it remains to be seen if the rate will be able to confirm its breakdown. In the short term, the rate could rebound if the Dollar Index fails to resume its growth. The DXY is located within a resistance zone, a bearish pattern could send the index down.

The USD is strongly bullish after some better than expected US data reported these days. Yesterday, the greenback received a helping hand from the Unemployment Claims, which dropped unexpectedly lower from 283K to 269K, even if the specialists expected a potential drop only to 273K in the previous week.

On the other hand, the Euro was punished by some poor Euro-zone data. The Final Services PMI dropped from 54.7 to 54.6, below 54.7 expected, while the German Factory Orders registered only a 1.3% growth even if the specialists expected a 1.7% growth.

The EUR/USD plunged after making a new false breakout above the 1.1612 static resistance (support turned into resistance). As you can see on the h4, the rate has finally reached the 1.1529 static support.

It remains to see how the rate will react here around this downside obstacle. A bullish pattern could announce potential bounce back, while making a new lower low, a bearish closure below 1.1535 and under 1.1529.

From the technical point of view, the EUR/USD stands in a major support zone. Its trapped within a potential range between 1.1663 and 1.1529. Escaping from this pattern could bring good opportunities and a clear direction. A reversal pattern could signal potential movement in the opposite direction.

2021 EA WORLD CUP FIRST GLOBAL TRADING CHAMPIONSHIP REGISTERATION IS OFFICIALLY OPEN NOW! PARTICIPATE TO WIN A GRAND PRIZE.

Leave a Reply