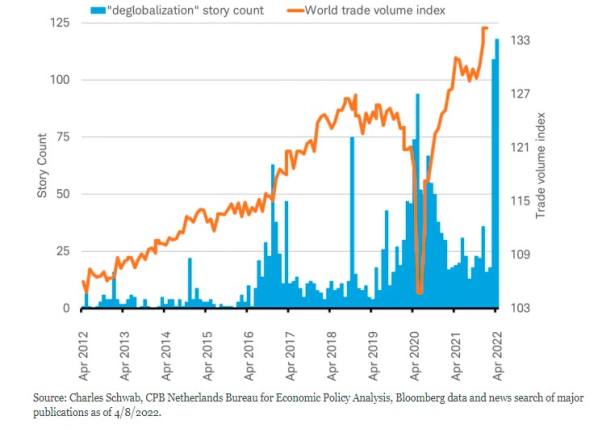

The “end of globalization” is a phrase that has come up a lot lately. Stories written about deglobalization have hit a fevered pitch with the war in Ukraine. But they began to heat up six years ago as that summer's Brexit referendum resulted in the British voting to leave the European Union. As you can see in the chart of “deglobalization” appearing in major news stories below, authors have attributed the potential end of world trade growth to:

-

Brexit in 2016;

-

President Trump's trade policy in 2017;

-

The rise of Nationalism in 2018;

-

The pandemic in 2020;

-

The war in Ukraine in 2022.

Yet, none of these have led to a decline in world trade. In fact, global trade hit a new all-time high this year after climbing steadily throughout the past six years despite the brief “V”-shaped disruption in response to the pandemic lockdowns.

Hot topic

Politics vs. economics

For decades, globalization described an economic concept, but more recently it has become blurred with a political concept. Separating the two ideas is important to understand the impact on investors.

Now, making such a distinction may not apply to Russia, since the country has decoupled from the rest of the world both politically and economically. But that is the exception. The U.S. and China, who have seen significant political decoupling, remain tightly intertwined economically. Brexit was primarily a political decoupling of the U.K. from the EU, not an economic one—as highlighted by U.K. imports from the EU recently hit their second-highest-ever level in January 2022 (the latest data point available). Even though the pandemic prompted politicians in major economies to tout new sources of domestic supplies of goods deemed essential, the trends in cross-border trade in vaccines, personal protection equipment, and ventilators remain largely unaltered.

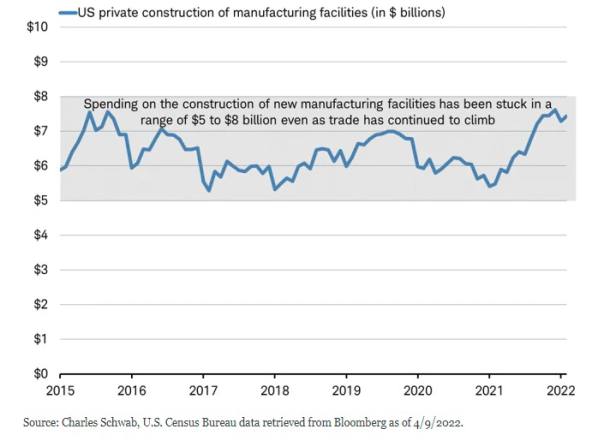

Despite the political deglobalization, we've seen no pickup in new construction of domestic manufacturing facilities to allow for economic deglobalization. The U.S. has seen no growth in such spending in either dollars or as a percentage of GDP even as the stories of the end of globalization piled up in recent years. As you can see in the chart below, spending on the construction of new manufacturing facilities has remained rangebound between $5 and $8 billion since 2015.

How would more domestically made goods be produced?

Measuring trade

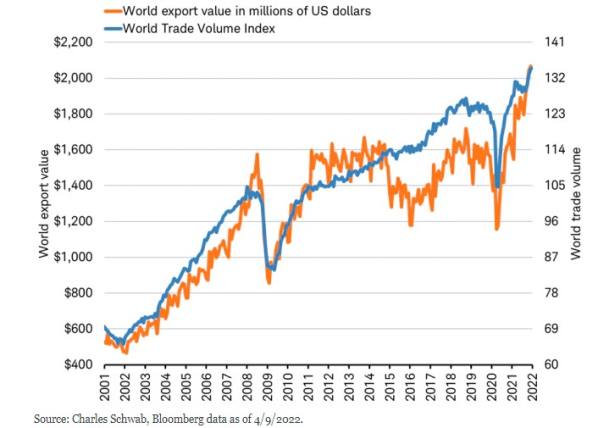

Some would argue that the value of world trade was stalling prior to the pandemic. When focusing on the economics of globalization it is important to look at the volume of global trade, since the value of trade can be impacted by many factors that can be misleading. The chart below shows that world trade momentum measured in dollars appeared to stall from 2008 through 2020, even as the volume of trade advanced steadily.

World trade volume vs. value

We don't believe that politics stalled the dollar value of trade. Overall, tariffs and non-tariff barriers to global trade were lowered, not raised, according to actions tracked by the World Trade Organization. In fact, the dollar amount of world trade rose 21% during the Trump administration from January 2017 to January 2021, rebounding from the oil-related downturn in 2015-16, and then surged during the pandemic.

Leave a Reply