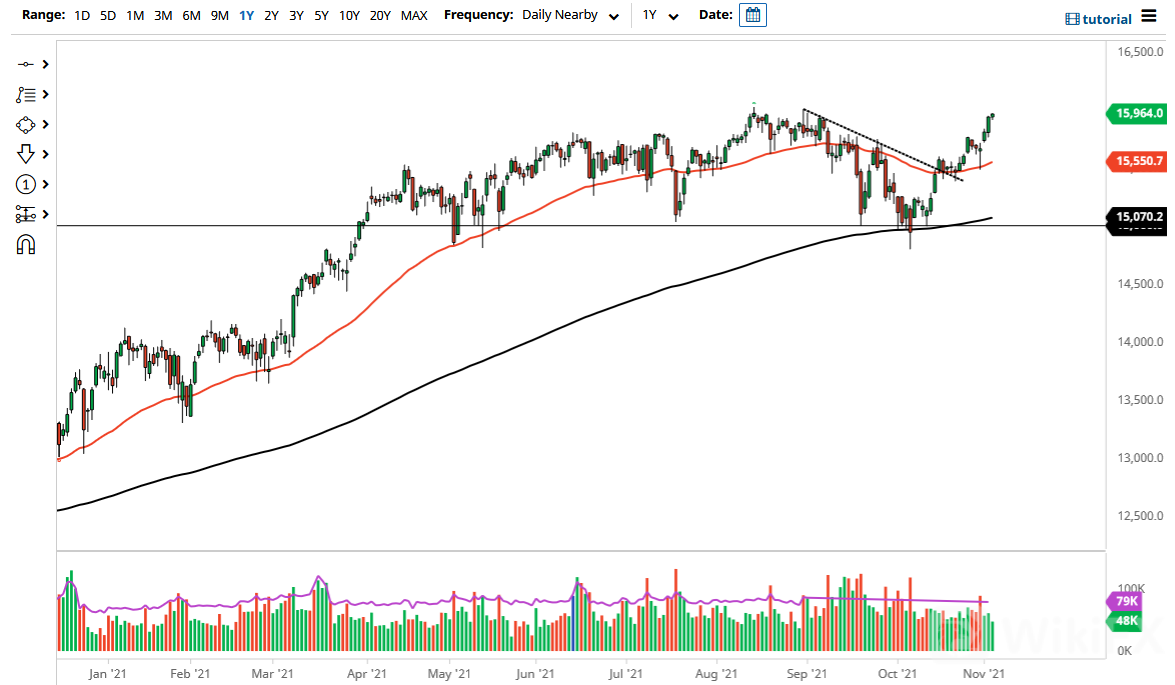

The German market was a bit quiet on Wednesday, but it is obvious that we still are very bullish, so think it is only a matter of time before we continue to go higher. I think short-term pullbacks at this point in time are good and healthy, because to blast right through this resistance would have the risk of it turning into a “blow off top,” which is not desirable because it would turn things back around. However, when you look at the totality of the markets around the world, it is obvious that we have quite a bit of momentum.

The hammer from last week that bounced off the 50-day EMA now acts as the “floor in the market”, which means that the 15,500 level should continue to be a major support level. The 50-day EMA is curling higher, so at this point it is very likely that we will not even get that far. If we were to break down below there, then it could change a lot of things, but the absolute “bottom of the market” is probably closer to the 15,000 level. The 15,000 level also includes the 200-day EMA, and it is likely that we will see a lot of pressure in that region.

To the upside, if we can break above the all-time high, then I think it opens up a move towards the 17,000 level. The market continues to be very noisy, but ultimately the DAX is the first place that people put money to work when it comes to the European Union. It is highly levered to the reopening trade, as the DAX is driven quite a bit by major industrial companies, so it is a great way to play the reopening trade in the European Union, as well as several Asian countries, as Germany is such a major exporter. The euro is cheap currently, so that helps as well, and I think it is only a matter of time before people start to play the export trade to the upside. I anticipate that a lot of noisy behavior is ahead, but I do not have any interest in shorting this market and fighting the trend.

Advertisement

Leave a Reply