What is CORE SPREADS?

The CORE SPREADS as a brokerage company has been established in the UK with the goal to offer the best of possibilities for active traders.

The strategy defined by Core Spreads is built to bring the best value in the industry while minimizing costs by reducing not the “first need” extensions. Their developed proprietary platform brings an honest low pricing as a standard to all clients.

Getting closer to the offering itself, Core Spreads combined years of experience in the market while offering spread betting and CFD trading through the essentials done by tight and fixed spreads, that helping to maximize returns.

Core Spreads Pros and Cons

Core Spreads trusted broker since regulated by high secure FCA in the UK. There is an easy account opening process, spreads are among lowest in industry with fixed or floating proposal.

From the Cons side Core Spreads instrument range is rather limited, and there is no 24/7 support.

Is Core Spreads safe or a scam

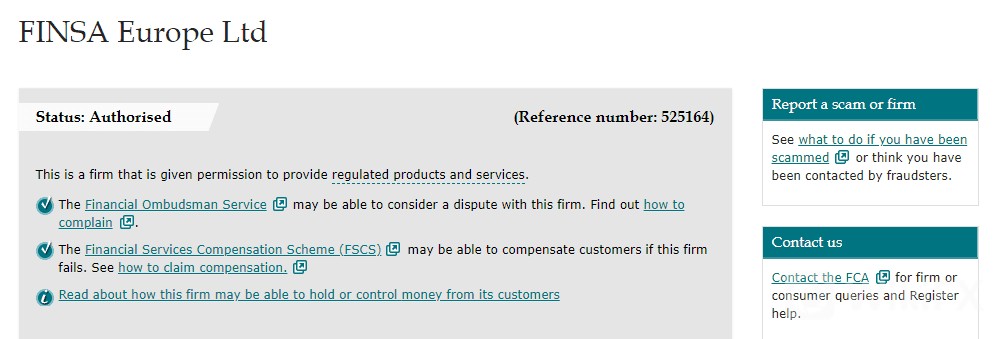

No, Core Spreads is not a scam, it is a trading name of Finsa Europe Ltd, a registered company in the UK considered low risk trading company due to regulation.

The broker is subject to the Financial Conduct Authority (FCA) regulation in the UK, which performs some of the strictest rules in the financial market respected worldwide. Under the rules of the Financial Conduct Authority, Finsa Europe Ltd. has a duty to conduct all business with an honest, fair and professional manner and to act in the clients best interests.

How are you protected?

What is more, each customer covered by the Financial Services Compensation Scheme (FSCS) under FCA rules of operation that guarantees clients‘ funds up to 50,000 GBP in the unlikely event. Also, funds are always kept separately from the company’s actives, means cannot be used for operational purposes, and are kept in segregated bank accounts at Barclays that secures your account.

Trading Instruments

The market offerings covers the most important instruments bringing availability to trade 30 popular currency pairs at Forex (including Spread Betting for UK residents), vast of Shares, Indices, Commodities and Cryptocurrencies

Leverage

As for the trading leverage conditions, Core Spreads chooses the optimal path to maximize the offering through the leverage which also complies to FCA regulation. In fact, European authorities strictly restrict leverage to a maximum of

-

1:30 for major currency pairs,

-

1:20 for minor currencies

-

1:10 for commodities.

As well, newly presented by Core Spreads possibility to trade cryptocurrencies brings an opportunity to speculate cryptos with leverage 2.5:1, yet available to only professional traders.

Account types

Core Spreads has one account type. The company sticks not to divide their clients and to offer every client excellent conditions, while the only slight different may occur on various platforms Core Spreads operate.

Fees

Core Spreads pricing and MT4 offers variable spreads and low commission charges. All clients at Core Spreads are treated as retail clients, however, there is an option to obtain a professional status, which requires experience and significant size of transactions. In reverse you will get a special status with numerous attractive conditions, lower costs and participation into programs.

Deposits and Withdrawals

Core Spreads offer for your convenience the most common payment methods while supporting options to fund and withdraw money through Cards payments, wire bank transfers and through e-wallet Skrill.

Minimum deposit

There is no minimum deposit requirement for Core Spreads account opening. To make a trade, you just need to deposit ‘margin’, which is effectively money cover in case you lost money on the trade instead of gain. The margin needed on the account is a percentage of the notional value of the trade, sometimes this can be less than 1%.

Core Spreads minimum deposit vs other brokers

| Core Spreads | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

WIthdrawals

Core Spreads withdrawal similar to deposits are Bank Wire and Card payments, the transaction fees involving card deposits and transfers do not incur any charges from the company for both deposits and withdrawals. Yet, you should always check with your payment provider in case any fees are waived from your side.

Conclusion

Our final thoughts about Core Spreads, one of the main attractive features of Core Spreads is their spreads offering, which they have managed to provide on a competitive basis along with an option to choose either fixed or floating spreads. The company does not offer learning materials or didnt include sophisticated tools, but brings clear and transparent trade processing. So, the conclusion is the same as company positioning – no noise, just tight spreads on thousands of markets.

Leave a Reply